What would happen if your business faced a liability claim? Would you be prepared to handle the situation effectively? Having a solid incident response plan can be the key to minimizing the impact of such incidents, allowing you to maintain your reputation and ensure business continuity. In this discussion, we’ll look at the vital components involved in developing comprehensive incident response plans specific to liability claims, touching on aspects of professional liability insurance, common misconceptions, and much more.

Understanding Liability Claims

Liability claims can arise in various contexts, depending on the nature of your business. Whether you’re in healthcare, legal services, or the tech industry, being equipped to handle liability claims effectively can save you both time and money.

What are Liability Claims?

A liability claim occurs when one party seeks compensation from another for damages or losses believed to be caused by the latter. This can include various situations, such as professional negligence, injury, or misrepresentation. Understanding the nuances of these claims is your first step toward preparedness.

Types of Liability Insurance

Liability insurance varies widely depending on the profession and potential risks involved. Here are the primary types you might consider:

| Type of Liability Insurance | Description |

|---|---|

| General Liability Insurance | Covers basic liabilities arising from accidents, injuries, or damage. |

| Professional Liability Insurance | Covers negligence, errors, or omissions in professional services provided. |

| Product Liability Insurance | Protects against claims related to product defects that harm users. |

Each type serves a distinct purpose, and understanding these can help you prioritize your coverage needs.

The Evolution of Professional Liability Insurance

While liability claims have been around for centuries, professional liability insurance has evolved significantly over time. Initially designed to protect professionals from lawsuits, it now encompasses a broader range of coverage that addresses unique risks posed by technological advancements and industry-specific challenges.

The Need for Professional Liability Insurance

Given the complexity of modern businesses, the need for professional liability insurance becomes more apparent. As industries evolve, so too do the potential risks associated with them. Utilizing this insurance can help protect your business against claims of negligence that may arise from routine operations.

The Expansion of Coverage Scope

In recent years, this insurance has expanded to cover cyber liabilities and other risks associated with technological advancements. Stay informed about your policy to ensure you are adequately covered against emerging threats.

How Professional Liability Insurance Differs from General Liability

The distinction between these two types of insurance is crucial for businesses. Whereas general liability typically covers physical injuries or property damage, professional liability insurance protects against claims of negligence or failure to deliver services as promised.

Coverage Specificities

Understanding these specifics can better prepare you for potential claims and inform your choice of coverage. It’s paramount that you identify which type of insurance best matches your business activities and the associated risks.

The Role of Professional Liability in Business Continuity

Business continuity planning is crucial for minimizing disruption in the event of a liability claim. Incorporating professional liability coverage into your business continuity strategies can enhance your preparedness for unforeseen incidents.

Enhancing Risk Management

Incorporating professional liability into your broader risk management strategy can mitigate the financial implications of claims. It’s about aligning your coverage with your operational realities.

Scenario Planning

Consider conducting scenario planning to imagine potential claims and how they could affect your business operations. This preparation can inform adjustments to both your incident response plan and your insurance coverage.

How to Evaluate Your Need for Professional Liability Coverage

Determining whether you need professional liability coverage requires a careful assessment of your business operations, potential risks, and industry standards.

Conduct a Risk Assessment

Start by evaluating your business activities and identifying areas of risk. Engaging with a risk management professional can provide valuable insight and help you tailor your insurance needs.

Regulations and Standards

Stay informed about industry regulations and standards that may require specific types of liability coverage. This knowledge will help you stay compliant and better protect your business.

Tailoring Liability Insurance for the Tech Industry

In the fast-paced tech industry, the risks are evolving. Data breaches, software errors, and other technological vulnerabilities can pose significant liabilities.

Specific Risks in Technology

Consider the nature of your tech solutions and the potential liabilities that can arise from them. Cybersecurity threats, for example, demand particular attention in your insurance coverage.

Coverage Recommendations

Investing in specialized coverage tailored to the tech industry can improve your risk management strategy. Consider including cyber liability insurance as part of your overall professional liability policy for comprehensive protection.

Professional Liability Needs for Healthcare Providers

Healthcare providers face unique challenges regarding liability claims, given the high stakes involved in patient care.

Medical Malpractice

Malpractice claims can be devastating for your practice—both financially and reputationally. Adequate insurance is a must to mitigate these risks.

Compliance with Regulations

Healthcare professionals must comply with various regulations governing liability insurance. Staying updated on these requirements will ensure your practice remains compliant.

Insurance Challenges in the Construction Sector

The construction industry faces a myriad of risks that necessitate thorough insurance coverage. Delays, accidents, and defects can lead to significant claims.

Unique Risks in Construction

Understand the specific risks associated with construction, including project delays and safety violations. Tailor your insurance coverage to mitigate these issues effectively.

Importance of Comprehensive Coverage

Opting for comprehensive liability coverage—one that includes both general and professional liability—can shield your business from various legal threats stemming from construction projects.

Legal Professionals: Unique Insurance Considerations

For legal practitioners, professional liability coverage is often mandatory. However, understanding the intricacies of what’s covered is paramount.

Legal Malpractice Insurance

Legal malpractice insurance protects against claims arising from negligence or errors in legal representation. These claims can be significant and damaging to your practice’s reputation.

Risk Management Strategies

Establishing a robust risk management strategy that includes regular training and client communication can help reduce liability exposure in your practice.

In the financial services sector, the risks associated with providing advice or services are magnified.

Maintaining Client Trust

Having adequate insurance helps maintain trust with your clients. It demonstrates your commitment to protecting their interests and your own.

The Impact of AI on Professional Liability Policies

As artificial intelligence becomes more prevalent in various industries, the implications for professional liability insurance are significant.

New Risks from AI

AI can introduce new risks that traditional liability insurance may not cover. This facet underscores the need for reviewing and likely updating your policies.

Adapting Insurance Coverage

Insurance providers are beginning to adapt their policies to include considerations for AI-related risks. Understanding this evolving landscape can inform your insurance strategy.

Cybersecurity Threats and Their Influence on Insurance Needs

In today’s digital age, cybersecurity threats pose a serious risk to businesses across industries.

Growing Importance of Cyber Liability Insurance

Cyber liability insurance can be an essential component of your liability coverage, as data breaches and other cyber threats can lead to substantial financial losses.

Assessing Cyber Risks

Conducting a thorough risk assessment of your cybersecurity posture can help determine the level of coverage you need. Make sure to account for potential liabilities associated with data breaches.

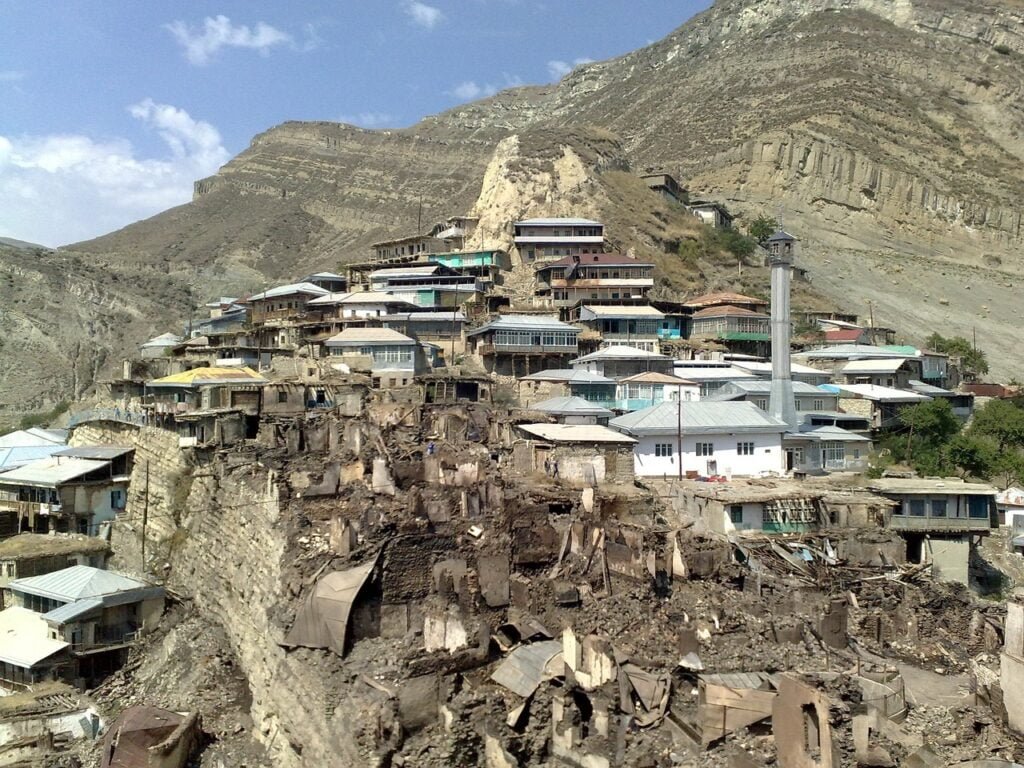

How Climate Change Affects Liability Risk Assessments

Climate change adds layers of complexity to liability risks. Businesses may be held accountable for environmental damages or contribute to climate change due to their practices.

Environmental Liability

Liability for environmental damage is becoming a critical consideration in many industries. Understanding your role and potential liabilities can ensure proper coverage.

Adapting Insurance Coverage

Insurance companies are beginning to factor climate-related risks into their assessments. Adjusting your coverage to reflect these emerging concerns will be beneficial.

Social Engineering: A Growing Concern for Insurers

Social engineering is an increasingly common threat leading to significant financial fallout for businesses.

Understanding Social Engineering Risks

Social engineering involves manipulating individuals to disclose confidential information. This risk is not only a cybersecurity concern but can also lead to liability claims.

Elevating Your Security Measures

Investing in employee training to recognize social engineering tactics can be beneficial. Enhanced security measures can mitigate risks associated with these types of claims.

Navigating the Hard Market in Professional Liability

Market fluctuations can significantly impact insurance availability and pricing.

Understanding the Hard Market

A “hard market” arises when insurance capacity drops, leading to increased premiums and limited coverage. Understanding this cycle is essential for managing your insurance strategy.

Securing Coverage

In a hard market, building strong relationships with insurers can help you secure the coverage necessary for your business. Engaging a knowledgeable broker can also provide valuable insights.

Lessons from High-Profile Professional Liability Lawsuits

Learning from the experiences of others can provide valuable insights into managing liability risks effectively.

Analyzing High-Profile Cases

Study high-profile professional liability lawsuits to identify common pitfalls and better understand how companies navigated their challenges. Use this information to inform your own risk management strategies.

Implementing Recommendations

Implementing best practices drawn from these lessons can strengthen your internal policies and procedures, preparing you for potential claims.

How Large Corporations Manage Their Liability Risks

Large corporations often maintain sophisticated risk management strategies due to their unique challenges and risks.

Comprehensive Risk Management Strategies

These organizations typically engage in extensive risk management planning that includes legal consultations, thorough training programs, and dedicated claims teams.

Learning from Corporations

Despite the scale of large corporations, smaller businesses can still learn from their strategies. Understanding how they navigate liability challenges can help tailor your own risk management efforts.

Case Study: Successful Claims Mitigation Strategies

Investigating case studies can highlight strategies that effectively mitigate claims.

A Closer Look at Mitigation

Examine real-world examples where companies successfully navigated claims. Identifying the practices and procedures they implemented can crystallize strategies for your own business.

Documentation and Communication

Effective documentation and clear communication lines have emerged as critical factors in successfully managing claims. Incorporating these elements into your strategy can significantly improve outcomes.

The Financial Impact of Negligence Claims on Small Businesses

Negligence claims can wreak havoc on small businesses. Understanding this impact helps you grasp the importance of solid liability coverage.

Real-World Financial Consequences

Small businesses often lack the resources to withstand significant financial setbacks. Claims may lead to dramatic losses and could even threaten your company’s survival.

The Importance of Proactive Measures

Private businesses can benefit from being proactive in risk management to avoid negligence claims altogether. Understanding potential pitfalls allows you to navigate your operations more safely.

Studying real-world examples of Errors and Omissions claims can provide valuable lessons.

Learning from Resolutions

Understanding how other businesses have resolved their claims can inform your approach. This can reveal potential gaps in your own policies or areas for improvement in your operations.

Identifying Best Practices

Analyze the best practices highlighted in these cases to enhance your incident response strategy. Each lessons-learned highlights actionable insights that may strengthen your approach to liability.

A Step-by-Step Guide to Filing a Professional Liability Claim

If faced with a liability claim, knowing how to proceed can alleviate some of the stress involved.

Understanding the Claims Process

A clear understanding of the claims process can help you navigate it more efficiently. Prompt action can often mitigate damages and improve the chances of a favorable resolution.

Reporting Procedures

Ensure you familiarize yourself with your insurance policy’s specific reporting requirements. Missing deadlines can drastically affect the outcome of your claim.

Choosing the right Errors and Omissions policy requires careful consideration and research.

Evaluating Your Options

Begin by assessing your specific business needs and the types of risks you encounter. Comparing various policies can unveil the best fit for your organization.

Engaging with Experts

Consulting with professional liability insurance specialists can provide valuable insights. They can help clarify your needs and identify suitable coverage options.

Appropriately understanding your policy limits and deductibles is crucial for effective coverage.

What is a Policy Limit?

Your policy limit defines the maximum amount your insurer will pay for a covered claim. Be sure to consider potential claims when selecting limits.

Deciding on Deductibles

The amount you’re willing to pay out of pocket before coverage kicks in varies significantly. Your deductible choice should balance affordability with risk tolerance.

Tips for Negotiating Better Terms with Your Insurer

Negotiation is key in securing the best possible terms with your insurance provider.

Building Strong Relationships

Developing a solid relationship with your insurer can enhance your negotiating position. Feel free to communicate your operational realities and the unique risks you face.

Leverage Industry Standards

Stay informed about industry standards in coverage and pricing. Knowledgeable negotiation can lead to more favorable terms.

How to Educate Employees About Liability Risks

Engaging your employees in understanding liability risks is an essential part of your incident response plan.

Training Initiatives

Conducting regular training sessions can enhance awareness of potential liabilities and ensure everyone on your team understands their roles in mitigating risks.

Creating a Culture of Awareness

Promoting a culture of risk awareness can further enhance your company’s resilience. Encourage open dialogue about potential liabilities and risks.

Exploring Niche Markets for Professional Liability Coverage

Identifying niche markets for liability coverage can provide unique opportunities and protect against specialized risks.

Specific Needs by Industry

Certain industries—such as technology, healthcare, and legal services—often require specialized coverage due to unique liability risks. Exploring these niches can uncover opportunities to better protect your business.

Tailored Solutions

Engaging insurance providers with expertise in specific fields can lead to customized solutions that meet your niche market needs.

Customizing Policies for Emerging Industries

Every industry has unique characteristics that can influence your liability needs.

Recognizing the Need for Customization

Emerging industries like biotechnology and renewable energy may require tailored liability solutions. Be open to adapting your insurance as industries evolve.

Collaborate with Insurers

Building relationships with insurance providers familiar with your emerging industry can facilitate innovative coverage solutions.

The Role of Professional Associations in Shaping Coverage Needs

Professional associations play a crucial role in outlining the insurance standards and coverage needs for various industries.

Engaging with Associations

Stay connected with professional associations relevant to your industry to gain insights into the evolving insurance landscape.

Utilizing Resources

Many associations provide resources and guidelines regarding liability coverage. Leverage these tools to stay informed and secure the right insurance.

Leveraging Industry-Specific Insights to Enhance Coverage Options

Understanding trends within your industry can enhance your approach to liability coverage.

Insights into Emerging Risks

Stay attuned to industry-specific risks and incorporate this knowledge into your insurance evaluation process.

Connecting with Experts

Engage with industry experts who can provide valuable insights and help shape your risk management strategies.

Developing thorough risk management plans enables you to minimize potential exposure to liability claims.

Analyzing Current Practices

Assess current practices and identify gaps in your current plan. Keep an eye on emerging trends that may influence future liabilities.

Setting Goals and Objectives

Establish clear goals regarding your risk management strategy to effectively guide your insurance decisions.

Professional Liability Insurance 101: A Beginner’s Guide

Understanding the basics of professional liability insurance can provide a solid foundation for further exploration.

Key Concepts

Familiarize yourself with essential terms like coverage limits, exclusions, and endorsements relevant to professional liability.

A Strong Foundation

Knowing these basics can empower you to make informed decisions about your coverage and negotiate effectively with insurers.

This coverage specifically offers shield against claims alleging negligence, misrepresentation, or inadequate services—common threats for professionals.

Choosing the Right Coverage

Why Every Professional Needs Liability Coverage

No matter your profession, the risk of liability claims exists.

The Universal Need

Whether you’re a healthcare provider or a tech entrepreneur, liability insurance serves as a necessary protective measure against potential claims.

Peace of Mind

Having liability insurance grants peace of mind, allowing you to focus on your work without constantly worrying about potential threats.

Understanding the Claims Process: What to Expect

Filing a claim can be daunting, but being prepared will help ease some of the stress.

The Claims Journey

The claims process involves reporting the incident, providing details for investigation, and cooperating with your insurer. Understanding each step can lead to smoother resolutions.

Maintaining Communication

Keeping lines of communication open with your insurer can enhance the claims process. Be forthcoming with the necessary information and updates regarding the situation.

Key Terms and Definitions in Professional Liability Insurance

Familiarity with terms related to professional liability insurance can enhance your understanding.

Essential Definitions

Key terms such as “coverage limit,” “deductible,” and “exclusion” can influence your insurance strategy.

Building Knowledge

Understanding these terms equips you to navigate the complex landscape of liability insurance more effectively.

Be aware of the common exclusions within professional liability insurance policies.

Types of Exclusions

Evaluating Your Needs

Understanding common exclusions allows you to assess your insurance plan critically and adjust it to better suit your operational risks.

The Role of Risk Management in Mitigating Liability

Incorporating a solid risk management framework can significantly minimize liability.

Effective Risk Assessment

By identifying potential risks in your operations, you enable proactive measures to lessen exposure and safeguard against potential claims.

Developing Preventative Measures

Creating clear policies and training staff on risk mitigation can further the effectiveness of your risk management initiatives.

Factors Affecting Professional Liability Premiums

Understanding how premiums are calculated is essential to managing your insurance costs effectively.

Key Influencing Factors

Factors such as claims history, industry type, and the size of your business can influence your premiums. Be prepared to consider these when discussing coverage options.

Strategies for Cost Management

Prioritizing risk management initiatives can positively impact your premiums by presenting your business as lower risk to insurers.

Comparing Claims-Made vs. Occurrence Policies

Choosing between claims-made and occurrence policies is critical for liability coverage.

Understanding the Differences

Claims-made policies provide coverage for claims filed during the policy term, while occurrence policies cover incidents that happen during the policy period, regardless of when the claim is filed.

Choosing the Right Policy

Understanding your business’s needs and the timeline for potential claims will inform your decision on which type of policy suits you best.

The Importance of Adequate Coverage Limits

Determining suitable coverage limits for your professional liability insurance is crucial.

Assessing Your Needs

Evaluate the potential risks and financial implications that could arise from claims to set adequate coverage limits.

Balancing Cost and Risk

While higher coverage limits offer better protection, they can also drive up premiums. Striking the right balance is key to effective liability coverage.

How to Choose the Right Deductible for Your Business

Deciding on the right deductible is an integral aspect of your professional liability insurance.

Understanding Deductibles

Your deductible is the out-of-pocket amount you pay for coverage before the insurance starts paying. Selecting a deductible proportionate to your financial capacity is vital.

Balancing Costs

Choosing a higher deductible may reduce your premium but could create financial strain in the event of a claim. Assess your risk tolerance carefully.

The Impact of Prior Claims on Future Insurability

Having a history of claims can significantly impact your future insurability.

Navigating Claims History

If your business has faced liability claims in the past, this history might affect your premiums and willingness from insurers to cover your business.

Strategies for Mitigation

Engaging in robust risk management tactics can reduce the chances of future claims and positively influence your insurability.

When to Review and Update Your Liability Coverage

Regularly reviewing and updating your liability insurance is crucial in responding to evolving business needs.

Key Triggers for Review

You may want to reassess your coverage in response to changing regulations, shifts in your business operations, or after significant incidents.

Establishing a Routine

Consider establishing a routine review process to ensure your liability coverage remains relevant and adequate.

The Role of Brokers and Agents in the Insurance Process

Brokers and agents play an essential role in securing the right insurance for your needs.

Recognizing Their Expertise

Engaging with knowledgeable brokers can provide valuable insights and clarity on the options available to you.

Developing Effective Relationships

Building strong relationships with your brokers can lead to personalized solutions that fit your unique operational demands.

Tips for Communicating with Your Insurer

Effective communication with your insurer can lead to improved outcomes when navigating liability claims.

Building Communication Lines

Establish clear lines of communication with your insurance providers. Make sure they know the details of your business and any ongoing risks.

Documenting Communications

Consider documenting your interactions with insurers. This practice can ensure clarity and accountability throughout the claims process.

Professional Liability for Accountants: Beyond the Numbers

Accountants face unique liability challenges, including potential errors in financial reporting.

Having Errors and Omissions coverage is paramount for accountants. It can protect against claims arising from inaccurate financial statements or misrepresentation.

Understanding Regulatory Requirements

Stay vigilant regarding applicable regulations and standards relevant to accounting practices, ensuring you meet compliance expectations.

Architects and Engineers: Building a Strong Insurance Foundation

In the construction and design sectors, architects and engineers must safeguard against inherent risks.

Errors and omissions coverage becomes vital, especially in a profession where mistakes can lead to significant financial implications.

Managing Risks Effectively

By implementing proactive risk management strategies, professionals in these fields can better shield themselves against claims.

Attorneys at Law: Protecting Your Practice from Malpractice Claims

Lawyers must take proactive steps to safeguard their practices from malpractice claims.

Understanding Risks in Legal Practice

Recognizing potential risks—especially concerning client relationships—can better inform your insurance needs.

Creating Client Trust

Establishing clear communication and transparency with clients can foster trust and mitigate liability risks.

Unique Risks Faced by Consultants

Consultants may face liability for failing to deliver results or providing inadequate recommendations. Understanding these risks informs insurance needs.

Risk Management Strategies

Implementing effective client communication standards and setting clear project expectations can help reduce potential claims.

Dentists: Navigating the Complexities of Liability Insurance

Dental professionals encounter unique liability risks, making appropriate insurance essential.

Malpractice Insurance Necessity

Malpractice claims in the dental field are prevalent, emphasizing the need for robust liability coverage to protect against potential lawsuits.

Assessing Coverage Needs

Regularly reviewing your specific risks can inform your coverage choices, helping ensure adequate protection.

Financial Advisors: Shielding Your Clients’ Investments

Financial advisors face significant exposure to liability claims, especially regarding investment advice.

The Importance of Professional Coverage

Having professional liability coverage safeguards against claims that may arise from perceived negligence in investment strategies.

Risk Management Practices

Sharpening your risk management strategies can build client trust, thereby helping to avoid future claims.

Healthcare Professionals: The Importance of Malpractice Insurance

Malpractice insurance is a cornerstone for healthcare professionals facing potential liability claims.

Understanding Malpractice Risks

Awareness of potential claims regarding negligent patient care fosters a proactive approach to liability insurance.

Comprehensive Coverage Strategy

Implement a comprehensive coverage strategy tailored to the unique requirements of your practice to safeguard against threats.

IT Professionals: Mitigating Cyber Risks and Data Breaches

As technology becomes increasingly central in business operations, cyber risks are a top concern for IT professionals.

Cyber Liability Insurance

Cyber liability insurance can help mitigate damages stemming from data breaches and cyber incidents.

Implementing Security Protocols

Fostering stringent cybersecurity measures can help minimize exposure and enhance your insurance coverage profile.

Insurance agents also face liability claims stemming from errors or omissions in recommendations or coverage provided.

Solid Coverage Essential

Client Communication Standards

Establishing consistent client communication practices is invaluable in cultivating trust and reducing misunderstandings that may lead to claims.

Real Estate Agents: Avoiding Liability in Property Transactions

Real estate transactions carry inherent risks that necessitate effective insurance coverage.

Understanding Liability Risks

Liability risks can stem from misrepresentation, negligence, or undisclosed defects in property sales.

Liability Insurance Strategies

Robust liability insurance protects against potential claims while promoting transparency and ethical practices in transactions.

Tech Startups: Tailoring Coverage for Emerging Risks

Tech startups face unique risks as they navigate the rapidly changing technological landscape.

Comprehensive Coverage Adaptation

Understanding the evolving nature of technology-related risks informs your liability coverage choices.

Continual Assessment

Regular assessments of your operations can help you identify necessary adjustments to stay protected in an ever-changing environment.

Nonprofits: Addressing Unique Liability Concerns

Nonprofit organizations encounter specific challenges that warrant attention in terms of liability coverage.

Volunteer Liability

Understanding the liability risks associated with volunteers increases the need for tailored insurance solutions.

Strategic Coverage Planning

Establishing a strategic coverage plan that addresses your unique risks can enhance risk management capabilities.

Media and Entertainment: Managing Risks in a Creative Field

In the media and entertainment industry, inherent risks require specialized coverage and strategies.

Reputation and Defamation Risks

Liability claims such as defamation or copyright infringement in creative work are critical concerns.

Forging Comprehensive Risk Management

Create robust risk management protocols to protect against potential claims while fostering creativity and innovation within your projects.

Hospitality Industry: Protecting Your Guests and Reputation

The hospitality sector demands vigilant attention to liability issues as guests commonly encounter accidents on premises.

Guest Safety and Liability

Understanding the responsibilities associated with guest safety is crucial in managing liability risks effectively.

Insurance Strategies

Employing tailored liability insurance and proactive safety measures can protect both guests and the reputation of your establishment.

Educational Institutions: Liability Concerns in Academia

Educational institutions navigate a complex landscape of potential liabilities, from student safety to faculty conduct.

Comprehensive Coverage Needs

Ensuring robust liability coverage that addresses the unique risks faced by educational institutions is vital for operational continuity.

Risk Awareness Training

Fostering a culture of risk awareness can help mitigate claims related to potential issues within the institution.

The Rise of Cyber Liability: Protecting Against Digital Threats

Cybersecurity threats are increasingly relevant, leading many businesses to consider cyber liability policies.

Addressing Digital Risks

The risks posed by digital data breaches require an informed approach to liability coverage.

Developing Data Protection Strategies

Establishing strict data protection protocols can act as a buffer against potential claims and facilitate claims management.

The Impact of AI on Professional Liability: New Risks and Opportunities

As AI systems become more integrated across sectors, understanding their implications for professional liability is paramount.

Adapting to Emerging Threats

Navigating the evolving landscape of AI involves contributing to risk assessment and understanding AI-driven claims.

Future-Proofing Your Insurance

Engaging with insurance providers familiar with AI technology and its risks can help tailor comprehensive coverage for future developments.

Climate Change and Liability: Assessing Evolving Risks

Climate change shifts liability risks, creating the need for businesses to adapt their insurance strategies.

Understanding Climate-Related Risks

Assessing how climate change may impact your operations can better prepare your liability responses.

Integrating Environmental Considerations

Adapting your risk management strategy to account for environmental factors and integrating sustainable practices may prove beneficial.

Social Engineering: The Human Factor in Liability Claims

Human elements play a crucial role in many claims stemming from social engineering tactics.

Educating Staff

Staff training in recognizing social engineering attempts can help minimize risks.

Assessing Procedures

Conducting reviews of internal procedures may help expose vulnerabilities due to human factors in your operations.

Navigating the Hard Market: Strategies for Securing Coverage

When navigating through insurance market challenges, knowing how to adjust your strategies is essential.

Understanding Market Dynamics

Be informed about the current market conditions that may affect insurance pricing and availability.

Diversifying Insurers

By diversifying your insurers, you may improve your chances of securing essential coverage despite market fluctuations.

The Gig Economy: Liability Considerations for Freelancers and Contractors

Freelancers and contractors operate in a unique intersection of risks that necessitate specific insurance considerations.

Risks in the Gig Economy

Understanding the liability risks associated with independent contracts or projects can help protect your work and finances effectively.

Tailored Coverage Solutions

Investing in tailored insurance solutions can address specific risks related to freelance work engagements.

Telemedicine: Addressing Liability Concerns in Remote Healthcare

With the rise of telemedicine, understanding the associated liability risks is paramount for healthcare providers.

Remote Care Challenges

Telemedicine presents unique challenges, particularly concerning malpractice and patient confidentiality.

Evolving Coverage Needs

Conducting a review of current coverage to ensure protection against emerging telemedicine-related claims is vital.

Remote Work: The Impact on Professional Liability Risks

The shift to remote work creates new liability risks that necessitate a review of your insurance needs.

Assessing Remote Operations

Evaluate how remote work impacts your operations and potential liabilities.

Supporting Employees

Providing employees with guidance and resources to understand their responsibilities can mitigate associated risks.

Evolving Regulatory Landscape: Staying Compliant with Insurance Requirements

The regulatory landscape surrounding liability insurance is continually changing.

Adapting to Regulations

Stay updated on compliance requirements, as these can vary widely depending on your industry.

Regular Updates

Consider regular reviews with legal counsel to ensure your operations and liability insurance align with current regulations.

The Role of Data Privacy in Liability Insurance

Data privacy considerations increasingly influence the landscape of liability insurance.

Legislation Implications

Emerging legislation regarding data privacy can shape your insurance needs and potential liabilities.

Compliance Awareness

Ensure your understanding of relevant data privacy regulations aligns with your insurance strategy to maintain compliance.

Mental Health Professionals: Addressing Unique Liability Concerns

Mental health professionals face unique liability challenges that require specialized insurance solutions.

Specific Risk Considerations

Understanding the risks of malpractice in mental health care reinforces the need for solid liability coverage.

Risk Management Awareness

Promote awareness of legal and ethical responsibilities within your practice to enhance risk management.

The Impact of Social Media on Reputation and Liability

Social media can play a significant role in shaping liability claims, especially regarding reputational risks.

Managing Online Presence

Protecting your reputation online can bolster your defenses against potential claims. The proactive management of your social media presence is essential.

Establishing Guidelines

Creating clear guidelines for employee social media use can minimize risks associated with reputational damage.

Professional Liability in the Age of Globalization

Globalization opens new avenues for liability risks, requiring enhanced insurance awareness.

Understanding Global Risks

Assessing the potential liability risks associated with global operations will inform your insurance choices.

Coverage Adjustments

Engaging with insurers knowledgeable about international markets can help you navigate the complexities of global liability coverage.

Drones and Autonomous Vehicles: New Liability Frontiers

The integration of drones and autonomous vehicles introduces new complexities in liability.

Navigating Emerging Risks

Understanding the risks associated with using these technologies can prompt a review of your insurance policies.

Educating Yourself

Be proactive in researching how these technologies might impact liability and engage with expert insurers.

The Future of Professional Liability Insurance: Predictions and Trends

Predicting how professional liability insurance will evolve can be beneficial for strategic planning.

Anticipating Changes

Keeping abreast of emerging trends—such as technological advancements and new regulatory frameworks—can prepare you for future developments.

Engaging Technology

Engaging with insurance technologies may foster innovative approaches to understanding and managing liability risks.

Creating a Culture of Risk Awareness: Employee Training and Education

Fostering a culture of risk awareness is essential to minimizing liability claims.

Regular Training Programs

Implement ongoing training and risk management programs to keep employees informed about updates and protocols.

Encouraging Open Dialogue

Create channels for encouraging employee feedback and discussions about risks in your operations.

Implementing Effective Risk Management Strategies

Your business can benefit from the implementation of effective risk management strategies tailored to reduce liability.

Proactive Measures

Identifying potential risks will allow you to establish contingencies to minimize exposure effectively.

Routine Evaluation

Conduct regular evaluations of your risk management practices to adapt to changing conditions and potential challenges.

Developing Comprehensive Incident Response Plans

Designing a comprehensive incident response plan can ensure that your business is prepared to address liability claims.

Key Components of an Effective Plan

Include clear communication protocols, guidelines for documentation, and procedures for engaging with legal counsel as essential components of your plan.

Continuous Improvement

Regularly review and refine your incident response plan to ensure it evolves alongside your business and the risks involved.

The Importance of Documentation in Liability Claims

Effective documentation practices can dramatically impact your response to liability claims.

Importance of Records

Accurate and timely documentation can serve as crucial evidence during claims processing, helping to protect your business interests.

Establishing Protocols

Implementing clear documentation protocols can streamline claims management while reducing potential risks.

Best Practices for Client Communication and Engagement

Effective communication helps mitigate liability risks and fosters strong client relationships.

Establishing Clear Channels

Set up clear communication protocols to ensure your clients are kept informed throughout your working relationships.

Regular Check-Ins

Engage in routine follow-ups with clients to help identify potential issues and strengthen relationship ties.

Managing Conflicts of Interest to Minimize Risk

Conflicts of interest can lead to potential liability claims, which can be avoided with proactive measures.

Establishing Policies

Having clear policies in place to manage conflicts of interest will protect both your business and clients.

Open Communication

Engaging in honest discussions with clients regarding potential conflicts reinforces transparency and trust.

Utilizing Technology to Enhance Risk Management

Technology can play an important role in enhancing your risk management strategies.

Implementing Risk Management Software

Utilizing software can help you monitor and assess risks effectively, aiding in proactive decision-making.

Staying Updated

Keep abreast of technological advancements that can enhance your understanding of liability risks.

The Role of Internal Audits in Loss Prevention

Conducting regular internal audits is a valuable practice in loss prevention and identifying potential liability risks.

Evaluating Procedures

Internal audits can help highlight gaps in procedures that may expose you to risk, allowing you to take corrective action.

Continuous Improvement

Use the findings from audits to inform risk management strategies and enhance your overall approach to liability coverage.

Case Studies: Lessons Learned from Liability Claims

Analyzing case studies provides insights into the complexities of liability claims.

Identifying Best Practices

Learning from previous claims can pinpoint effective risk management strategies and illustrate potential pitfalls.

Continuous Growth

Implement the lessons learned into your incident response strategy to enhance your capabilities continually.

Expert Insights: Interviews with Risk Management Professionals

Engaging with risk management professionals can shed light on effective strategies for managing liability.

Seeking Expert Opinions

Interviews with experienced professionals can reveal insights and offer best practices tailored to your industry.

Building a Network

Develop relationships with thought leaders that can guide you through challenges and enhance your understanding of liability.

Avoiding Common Pitfalls: Tips for Reducing Liability Exposure

Understanding common pitfalls enables you to take proactive measures to protect your business.

Focused Training Programs

Implement targeted training programs that address industry-specific risks that lead to liability claims.

Implementation of Best Practices

Staying aware of and implementing industry best practices can minimize exposure to potential liabilities.

The Importance of Continuous Improvement in Risk Management

Adopting a framework of continuous improvement enhances your risk management capabilities.

Regular Evaluation

Conduct regular evaluations of your risk management practices to ensure effectiveness and to address emerging challenges.

Adapting Strategies

Be prepared to adapt your strategies based on new insights, technologies, and changing regulatory environments.

Creating a Safe and Secure Work Environment

A safe work environment reduces the likelihood of incidents that could result in liability claims.

Prioritizing Staff Safety

Ensure employee safety is a primary focus, implementing health and safety protocols as necessary.

Continuous Improvements

Regularly assessing workplace conditions ensures they foster a safe and secure work environment.

Managing Third-Party Risks: Vendors and Contractors

Third-party relationships can introduce risks unique to your organization.

Assessing Third-Party Exposure

Evaluate the potential liabilities associated with your third-party vendors and contractors to minimize risks.

Establishing Safe Practices

Creating policies and practices for managing third-party relationships can help mitigate potential liabilities.

The Role of Professional Associations in Risk Management

Professional associations can be invaluable resources for risk management best practices.

Utilizing Association Resources

Most associations provide guidelines and resources for navigating liability risks within specific industries.

Networking Opportunities

Engaging with peers in your industry can foster relationships that provide insights into risk management strategies.

Understanding the Claims Notification Process

Familiarizing yourself with the claims notification process is essential for a smooth claims experience.

Step-by-Step Procedures

Be aware of the steps needed for notifying your insurer to ensure a proper claims process is followed.

Importance of Timeliness

Communication regarding claims must be timely to ensure compliance with policy terms and avoid complications.

Working with Claims Adjusters: Tips for a Smooth Experience

Building strong relationships with claims adjusters can enhance your claims process.

Effective Communication

Maintain open lines of communication with claims adjusters to clarify your specific situation and expedite progress.

Providing Thorough Documentation

Comprehensive documentation can facilitate a smoother claims process and potentially lead to better outcomes.

The Role of Legal Counsel in Liability Claims

Legal counsel plays a critical role in navigating liability claims effectively.

Engaging Legal Expertise

Involving legal counsel early in the process enhances your response capabilities and provides insight into potential outcomes.

Understanding the Legal Landscape

Staying connected to legal developments can improve your insurance strategy and claims management.

Preparing for Litigation: Key Considerations

Litigation can be a daunting reality in the realm of liability claims.

Establish Clear Protocols

Establishing clear protocols for engaging in litigation can help guide your response.

Evaluating Outcomes

Conduct regular assessments of potential case outcomes to inform your claims management strategy.

Mediation and Alternative Dispute Resolution: Options for Resolving Claims

Mediation can often present a more amicable resolution to disputes than traditional litigation.

Understanding Mediation

Ensure you understand the arbitration and mediation processes that could offer viable alternatives to litigation.

Evaluating Effectiveness

Consider the pros and cons of mediation and other dispute resolution methods to determine when they might be suitable for your situation.

Expert Witnesses: Their Role in Liability Cases

Expert witnesses can provide valuable insights in liability cases, aiding both plaintiffs and defendants.

Engaging Experts

Consider the advantages of involving expert witnesses to bolster your case’s credibility and effectiveness.

Building a Strong Case

Utilizing expert testimony wisely can enhance your overall claims management strategy.

Managing the Emotional Impact of a Liability Claim

Liability claims often lead to heightened stress and emotional turmoil.

Acknowledging Emotions

Recognizing the emotional impact a claim can have on personnel can facilitate better responses from your team.

Providing Support

Offering support services, such as counseling or resources, can help employees manage stress during the claims process.

Case Studies: Analyzing Real-World Claim Scenarios

Case studies provide an avenue for understanding how claims are navigated in practice.

Examining Claims Outcomes

Reviewing the resolutions in these scenarios can highlight effective strategies, methods, and common pitfalls.

Extracting Lessons

Learning from others can inform improvements in your risk management procedures and insurance coverage.

The Impact of Litigation on Reputation and Brand Image

Litigation can have long-lasting repercussions on your reputation.

Managing Public Relations

Be proactive in your public relations strategies to mitigate reputational harm during litigation.

Building Brand Resilience

Develop strategies that bolster brand resilience, even facing adverse legal situations.

Protecting Your Business During a Claim: Continuity Strategies

Developing business continuity strategies during claims enhances your organization’s resilience.

Establishing a Plan

A strong continuity plan can ensure your business remains operational while navigating claims.

Fostering Adaptability

Adaptability is key, ensuring your business can pivot in response to ongoing developments.

The Role of Public Relations in Managing Liability Crises

Proactive public relations can be essential in managing perceptions during liability claims.

Crisis Communication Strategies

Prepare tailored crisis communication strategies to help preserve your reputation amid liability challenges.

Engaging Stakeholders

Effectively engaging stakeholders during crises can facilitate smoother claims management.

Lessons Learned from High-Profile Liability Lawsuits

High-profile lawsuits can reveal significant lessons for professionals in all industries.

Analyzing Outcomes

Consider the resolutions and strategies implemented in these notable cases.

Implementing Lessons

Incorporate learnings into your risk management practices and claims handling strategies.

Understanding the Financial Costs of Litigation

Litigation can lead to substantial financial repercussions, making understanding associated costs crucial.

Calculating Costs

Review the potential costs of litigation—beyond attorney fees—and assess how they may affect your business strategy.

Prioritizing Budgeting

Establishing a dedicated budget for litigation-related expenses can bolster your claims preparedness.

Strategies for Negotiating Favorable Settlements

Settlement negotiations can vary widely, impacting your claims’ outcomes.

Effective Negotiation Practice

Establish negotiation practices that serve the best interests of your business while striving for equitable outcomes.

Drawing on Expertise

Consider utilizing legal counsel experienced in claims negotiation to guide your conversations.

The Importance of Post-Claim Analysis and Improvement

Once claims are resolved, post-claim analysis serves as a valuable opportunity for improvement.

Evaluating Responses

Reviewing how your incident response plan fared during claims can identify areas for enhancement.

Continuous Growth

Integrate findings from your analysis into your overall risk management strategy for future resilience.

The History of Professional Liability Insurance

Understanding the historical context of professional liability insurance can help navigate modern challenges.

Evolution Over Time

Evaluate how professional liability has developed over time to meet the evolving needs of businesses.

Learning from Histories

Learning from historical experiences can inform your contemporary risk management strategies.

The Role of Insurance in Economic Growth and Stability

Insurance plays a vital role in promoting economic growth, serving as a safeguard for businesses.

Support for Businesses

By mitigating risks, insurance fosters a stable environment for investment and development.

Enhancing Markets

Understanding the critical role of insurance in the marketplace can guide your strategic planning and risk management efforts.

Professional Liability Around the World: International Perspectives

Liability standards and practices can vary significantly across countries.

Comparative Understanding

Engaging with international perspectives on professional liability can provide insight into best practices.

Adapting Strategies

Understanding global perspectives can enhance your own strategies and insure you against international risks.

The Ethics of Professional Liability Insurance

Ethical considerations often arise in the context of professional liability, informing both practices and policies.

Professional Principles

Assessing the ethics underpinning liability insurance can determine operational integrity and reputation.

Navigating Ethical Challenges

Understanding and navigating ethical challenges can strengthen the profession and improve risk management practices.

The Impact of Technology on the Insurance Industry

Technological advancements are drastically reshaping the insurance industry, presenting both challenges and opportunities.

Embracing Innovation

Exploring and adapting to new technologies can improve efficiency in claims management and risk assessment.

Preparing for Change

Staying attuned to technological shifts will help secure your insurance solutions for the future.

Careers in Professional Liability Insurance

The field of professional liability insurance offers diverse career opportunities across industries.

Exploring Opportunities

Understanding the various roles and responsibilities available enables informed career choices.

Building Expertise

Professional development in this dynamic field can enhance your skill set and foster growth.

The Future of the Insurance Industry: Predictions and Trends

Understanding future trends can inform strategic decisions for insurance providers and businesses.

Anticipating Market Shifts

Anticipating shifts, such as technological integration, may shape the future landscape of professional liability insurance.

Adapting to Innovations

Be prepared to integrate new trends into your business strategies, ensuring continuous adaptation.

Book Reviews: Must-Reads for Risk Management Professionals

Literature often provides crucial insights into refining risk management and liability practices.

Exploring Effective Resources

Evaluate recommended books that offer valuable perspectives on insurance and liability management.

Building Knowledge

Developing a habit of reading industry literature can bolster your understanding of professional liability.

Infographics and Visual Guides to Professional Liability

Visual resources can simplify complex information related to liability and insurance.

Using Visual Tools

Infographics can enhance understanding by presenting information clearly and effectively.

Supplementing Knowledge

Utilizing visual guides alongside traditional learning methods can enhance your overall knowledge retention.

Webinars and Online Courses: Continuing Education Resources

Online resources offer valuable opportunities for ongoing education in professional liability.

Engaging in Learning Opportunities

Participating in webinars and courses can deepen your understanding of liability management.

Networking Opportunities

These platforms can also foster relationships with industry professionals, enhancing your network.

Podcasts and Interviews with Industry Leaders

Podcasts serve as an engaging resource for insights from industry leaders regarding professional liability.

Learning from Experience

Listening to experienced professionals can unlock new strategies and perspectives relevant to your practice.

Continuous Development

Regularly consuming industry-related podcasts can support ongoing learning and professional growth.

Conferences and Events: Networking Opportunities

Engaging in industry events can provide unique insights into professional liability trends.

Building Connections

Networking opportunities can forge valuable connections with others in your field.

Exploring Strategies

Attend inclusion events that offer discussions on contemporary liability management subjects.

Glossaries and Resource Guides: Essential Tools for Professionals

Glossaries can aid understanding of complex terms related to professional liability insurance.

Developing Resources

Creating accessible reference materials helps address complexities and support learning.

Continuous Reference

Ensure ongoing access to valuable resources as you navigate the professional liability landscape.

Frequently Asked Questions About Professional Liability Insurance

Fostering a deeper knowledge of professional liability can help clarify common inquiries.

Addressing Concerns

Creating an FAQ guide can illuminate prevalent questions and enhance understanding.

Building Trust

Providing clear information helps clients and employees navigate risks with confidence.

Client Testimonials and Success Stories

Sharing successes can reinforce trust in your services while highlighting the importance of proper advice.

Showcasing Experiences

Highlighting client testimonials can bolster your credibility and inspire confidence in your capabilities.

Promoting Best Practices

Through success stories, you can showcase effective risk management practices leading to positive outcomes.

Humorous Takes on Liability Insurance: Cartoons and Jokes

Lightening the mood surrounding liability insurance can create engaging content.

Approaching with Humor

Using humor provides a fresh perspective on serious topics, making it relatable for audiences.

Enhancing Engagement

Integrating light-hearted content can facilitate engagement and broaden your reach.

Industry News and Updates: Stay Informed About the Latest Developments

Keeping abreast of industry developments is crucial for effective insurance management.

Engaging Resources

Utilize news resources to stay informed about changes within the liability landscape.

Adapting to Change

Implementing knowledge gained from current industry news can enhance your risk management efforts.

Regulatory Changes and Their Impact on Liability Coverage

Being aware of regulatory changes is crucial for effective liability management.

Tracking Changes

Engaging with resources that track changes ensures you stay compliant with new regulations.

Adjusting Strategies

Adjusting your strategies according to new regulations can strengthen your coverage and protect your operations.

Case Studies: Analyzing Landmark Court Decisions

Landmark decisions often shape how liability claims are navigated.

Evaluating Judicial Impact

Review these cases to assess their implications and inform your risk management strategies.

Learning from Outcomes

Implementing lessons learned from these landmark decisions can strengthen your claims management practices.

The Role of Insurance in Social Responsibility and Sustainability

Professionals in the liability field contribute to sustainable practices through responsible behavior.

Promoting Best Practices

Highlighting insurance’s role in promoting social responsibility enhances understanding and supports influential practices.

Driving Change

Consider how your business practices reflect ethical standards, promoting sustainability and responsible behavior.

Thought Leadership: Essays and Opinion Pieces from Experts

Contributing thought leadership can enhance industry discussions surrounding professional liability.

Sharing Perspectives

Writing essays or opinion pieces can foster engagement and demonstrate expertise within the field.

Building Community

Collaboration fosters industry community, enhancing knowledge sharing and best practices among professionals.

Debunking Myths and Misconceptions About Liability Insurance

Identifying and addressing myths surrounding liability insurance can enhance understanding.

Empowering Readers

Clarifying misinformation empowers your audience to make informed decisions regarding their insurance practices.

Strengthening Communication

Effective communication regarding liability insurance can improve overall comprehension and trust.

Interactive Quizzes and Assessments: Test Your Knowledge

Engaging quizzes can facilitate understanding of liability insurance principles and practices.

Enhancing Learning

Incorporating interactive elements helps reinforce knowledge and encourages participation.

Measuring Comprehension

Utilizing quizzes can also assess understanding and help identify knowledge gaps.

Tips for Marketing and Promoting Your Professional Services

Effective marketing strategies can enhance your professional visibility while addressing liability risks.

Building Brand Awareness

Engaging promotional strategies foster brand recognition and legitimacy.

Utilizing Social Media

Leverage social media platforms to expand your reach and share insightful content.

Building a Strong Online Presence: Websites and Social Media

A strong online presence is necessary for promoting your professional services effectively.

Establishing Authority

Creating a well-structured website can showcase your expertise and stand out within your field.

Enhancing Connectivity

Utilizing social media can help build connections and foster relationships with potential clients.

A comprehensive incident response plan for liability claims can significantly enhance your preparedness and your ability to navigate challenges should they arise. By understanding your specific risks, engaging with qualified professionals, and investing in tailored insurance solutions, you help secure the longevity of your operations in an increasingly complex landscape. Remember, staying informed and maintaining proactive approaches in your risk management practices is the key to resilience in the face of liability claims.