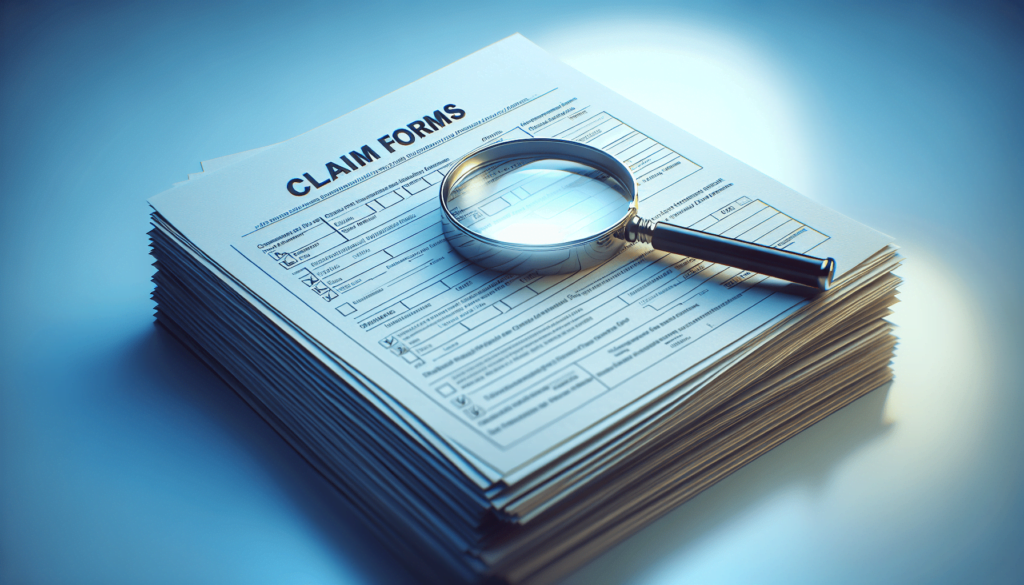

Have you ever wondered what happens when a claim is made against you or your business? Understanding the claims notification process is crucial for avoiding surprises during stressful times. It ensures that you know what to expect and how to effectively manage the situation.

The Importance of the Claims Notification Process

What You Need to Know About Claims Notification

A claims notification is essentially a formal announcement from you or a representative that a claim is pending against you. It begins the claims management process and provides the insurance company with a heads-up that they may need to step in.

-

Timing Matters: Reporting a claim promptly is often a requirement within your policy. Failing to notify your insurer in a timely manner might leave you vulnerable to hefty personal financial liability.

-

Documentation is Key: Providing comprehensive information about the claim is important. Detailed documentation helps your insurer understand the situation better and respond more effectively.

-

Legal Counsel: Involving legal counsel early on can provide you with guidance on how best to present your claim. They can also assist in navigating the complex legal landscape that may arise during the claims process.

The Evolution of Professional Liability Insurance

Professional liability insurance has evolved to meet the changing needs of various industries. Initially designed for specific professions, the rise of digital technology and new business models has broadening its scope.

How Professional Liability Coverage Has Changed

Professional liability coverage now encompasses a wide range of professions, from healthcare to technology, reflecting the growing complexity of service delivery. These changes often result in more specialized policies to meet the unique needs of different sectors.

-

Emerging Professions

-

Increasing Claims: With an uptick in claims across various industries, professionals are recognizing the importance of these policies as a critical component of operational stability.

Understanding professional liability insurance is filled with myths that can lead to misinformed choices about coverage.

Debunking Myths about Errors and Omissions Insurance

-

It’s Only for Certain Professions

-

General Liability is Enough: Some may believe general liability insurance covers all business risks. While it covers bodily injury and property damage, it does not address professional mistakes or neglected duties.

How Professional Liability Insurance Differs from General Liability

Recognizing the differences between professional and general liability insurance is crucial for your business’s risk management strategy.

Key Differences

| Feature | Professional Liability Insurance | General Liability Insurance |

|---|---|---|

| Coverage Focus | Negligence, errors, and omissions in professional services | Bodily injury and property damage |

| Claims Process | Claims are made based on professional mistakes | Generally covers injury or damage claims against your business |

| Industry-Specific | Tailored to particular professions | Broad coverage suitable for all types of businesses |

Understanding these distinctions will help you ensure you have the right type of coverage for your needs. It’s not just about being insured; it’s about being adequately protected against the appropriate risks.

The Role of Professional Liability in Business Continuity

Professional liability insurance plays a significant role in maintaining business continuity, especially when faced with unforeseen events.

Maintaining Stability and Reputation

When a claim arises, the financial implications can jeopardize your operations. Having effective coverage minimizes disruption and helps maintain your company’s reputation.

-

Financial Protection: Insurance can cover legal fees and compensation, alleviating the financial burden on your operations.

-

Reputation Management: With the right coverage, you can manage claims more effectively, which is crucial in maintaining client trust.

How to Evaluate Your Need for Professional Liability Coverage

Deciding if you need professional liability insurance involves assessing your unique business situation.

Steps to Evaluate Coverage Needs

-

Industry Considerations: Consider the common risks associated with your profession. High-risk industries often benefit from more comprehensive policies.

-

Client Expectations: Understand client expectations and industry standards; having the right coverage may not only protect you but also enhance client trust.

-

Assess Past Claims: Review any past claims or potential issues related to your services. This can provide insights into your coverage needs.

Tailoring Liability Insurance for the Tech Industry

Technology businesses face unique challenges and risks that require tailored coverage.

Specific Risks for Tech Companies

-

Data Breaches: With the rise in cyber threats, tech companies must often ensure that their liability policies address data breaches adequately.

-

Intellectual Property Claims: The risk of IP disputes is prominent; thus, having coverage that addresses these responsibilities is vital.

-

Consulting Errors: For consultants, understanding how advice is interpreted can lead to coverage tailored to protect against professional mistakes.

Professional Liability Needs for Healthcare Providers

Healthcare professionals face specific risks that necessitate specialized coverage.

Understanding Unique Healthcare Risks

-

Malpractice Claims: Healthcare providers are particularly vulnerable to malpractice suits. It’s essential they have coverage that addresses this risk comprehensively.

-

Regulatory Compliance: Coverage must also align with the ever-evolving regulatory requirements in healthcare, ensuring you remain compliant while providing necessary patient care.

Insurance Challenges in the Construction Sector

The construction industry presents a unique set of challenges when it comes to professional liability insurance.

Typical Liability Risks in Construction

-

Construction Defects: These can lead to claims based on negligence. Proper coverage can help mitigate these potential losses.

-

Contractual Obligations

-

Operations and Safety: A focus on risk management is vital in the construction sector, positioning professional liability insurance as a crucial safeguard.

Legal Professionals: Unique Insurance Considerations

For legal professionals, the stakes are often incredibly high when it comes to claims against them.

-

Client Trust

-

Risk of Malpractice Cases: Lawyers face various risks, from clerical errors to claims of neglect, making tailored coverage non-negotiable.

Financial services professionals face immense pressure and potential liability.

Key Considerations for Financial Advisors

-

Client Risks: Financial advice can sometimes lead to significant losses for clients, increasing exposure to professional liability claims for advisors.

-

Professional Reputation: The impact on reputation can be daunting. Coverage protects both the advisor and their clients, ensuring financial security.

The Impact of AI on Professional Liability Policies

Emerging technologies, such as AI, are reshaping professional liability landscapes.

Navigating New Risks

-

Algorithmic Accountability:

As AI solutions are increasingly adopted, questions of accountability may arise. Insurers are adapting policies to address liabilities related to AI. -

Data Security:

With AI comes significant data usage, leading to challenges around data protection and breach responsibilities in your policy.

Cybersecurity Threats and Their Influence on Insurance Needs

As businesses become more digital, the growing threat of cybersecurity risks must be addressed in liability policies.

Coverage for Cyber Attacks

-

Cyber Liability Insurance:

Understanding how cyber liability insurance fits into your overall liability strategy can provide an added layer of protection. -

Evolving Threat Landscape:

As the threat landscape shifts, reviewing and adapting your professional liability coverage to encompass these risks is critical.

How Climate Change Affects Liability Risk Assessments

Climate change is a relatively new factor influencing liability risk assessments across many industries.

Assessing Evolving Risks

-

Increased Natural Disasters:

The increasing number of natural disasters is leading to heightened liability risks. Professionals may need to consider their exposure related to climate events. -

Sustainability Practices:

Businesses embracing sustainable practices may find their liability needs evolve, requiring updates to current coverage.

Social Engineering: A Growing Concern for Insurers

Social engineering poses unique risks that can lead to liability claims.

Addressing Human-Centric Threats

-

Employee Training:

Ensuring your employees are trained to recognize social engineering attempts can mitigate risks, providing an extra layer of defense. -

Policy Adaptation:

Insurers must adjust policies to account for these new types of threats, ensuring that businesses are adequately protected.

Navigating the Hard Market in Professional Liability

The insurance market can undergo cycles that affect your coverage options. Understanding how to navigate a hard market can be crucial.

Strategies for Securing Coverage

-

Focus on Relationships:

Building strong relationships with your insurance broker can help navigate challenging market conditions. -

Be Proactive:

Reviewing your risk management strategies well ahead of policy renewal can yield more favorable coverage terms.

Lessons from High-Profile Professional Liability Lawsuits

High-profile lawsuits can provide valuable lessons.

Analyzing Case Studies

-

Pitfalls to Avoid:

Reviewing previous high-profile cases can help identify common mistakes that led to liability issues, allowing you to refine your practices. -

Best Practices:

Drawing insights from successful cases can guide your risk management strategies moving forward.

How Large Corporations Manage Their Liability Risks

Large corporations have structured processes to manage liability risks effectively.

Comprehensive Risk Management Frameworks

-

Dedicated Risk Management Teams:

Corporations often have specialized teams focused on risk assessment and insurance alignment. -

Use of Data Analytics:

Employing data analytics in risk management strategies helps in identifying emerging trends and informs proactive decision-making.

Case Study: Successful Claims Mitigation Strategies

Real-world examples can provide a roadmap for success.

Learnings from Successful Mitigation

-

Timely Reporting:

Quick claims reporting has proven pivotal in mitigating longer-term consequences of claims. -

Collaborative Approach:

Engaging stakeholders during the claims process creates a more streamlined response and resolution.

The Financial Impact of Negligence Claims on Small Businesses

Negligence claims can cripple small businesses financially.

Preparing for Potential Claims

-

Budgeting for Legal Fees:

Setting aside financial resources for potential claims can safeguard against unexpected expenses. -

Insurance Limits:

Understanding your policy limits helps in evaluating the adequacy of your coverage relative to your business risks.

Concrete examples can better illustrate the claims process and outcomes.

Notable Case Studies

-

Financial Misadvisement:

Several financial advisors faced significant legal costs due to negligent misadvisement. Reviewing these cases can help you build safeguards in your practice. -

Contractual Breaches:

Construction professionals frequently encounter claims stemming from contractual breaches, emphasizing the importance of clear agreements and adequate coverage.

A Step-by-Step Guide to Filing a Professional Liability Claim

Filing a claim can be overwhelming, but knowing the process can make it more manageable.

Understanding the Claims Process

-

Initial Notification:

Start by notifying your insurer as soon as a claim arises, providing all pertinent information. -

Gather Documentation:

Compile all relevant documentation, including contracts, communications, and records related to the claim. -

Cooperate with Insurer:

Work collaboratively with your insurer during the claims investigation, providing them with the necessary information.

Factors to Consider

-

Coverage Types:

Understand the different types of coverage available, ensuring they align with your business operations and exposure. -

Policy Limits and Deductibles:

Evaluate how policy limits and deductible amounts will affect your overall financial risk profile.

Recognizing how limits and deductibles work will empower you during the claims process.

Key Concepts to Grasp

-

Policy Limits:

The maximum amount the insurer will cover in the event of a claim. Adequate limits safeguard against significant financial losses. -

Deductibles:

The amount you must pay out of pocket before the insurance kicks in. Choosing an appropriate deductible can balance premiums with potential financial exposure.

Tips for Negotiating Better Terms with Your Insurer

Negotiating with insurers can sometimes feel intimidating, but with the right strategy, you can secure favorable terms.

Strategies for Effective Negotiation

-

Research Insurer History:

Understanding your insurer’s history with claims can help you negotiate better terms based on their responsiveness and support. -

Highlight Risk Management Practices:

Demonstrating robust risk management practices may prompt your insurer to offer more competitive rates or terms.

How to Educate Employees About Liability Risks

Employee awareness is key in minimizing liability exposure.

Creating a Culture of Risk Awareness

-

Regular Training Sessions:

Conducting ongoing training on liability risks and safety protocols empowers your employees to recognize and mitigate exposure. -

Open Communication:

Fostering an environment where employees can discuss concerns will encourage proactive risk management.

Exploring Niche Markets for Professional Liability Coverage

Niche markets present unique coverage opportunities that can benefit specialized professionals.

Identifying Niche Needs

-

Industry-Specific Risks:

Specialized professions often encounter distinctive risks that require customized insurance solutions. -

Emerging Trends:

Keeping an eye on emerging trends can help you identify new opportunities for coverage within niche markets.

Customizing Policies for Emerging Industries

Emerging industries present new risks that could require tailored insurance coverage.

Flexibility in Coverage

-

Adaptability:

Policies should be adaptable to changing market demands, allowing businesses to adjust coverage as they grow. -

Integration with Risk Management:

Customization ensures that coverage aligns with broader risk management strategies, safeguarding the business’s future.

The Role of Professional Associations in Shaping Coverage Needs

Professional associations often provide resources and guidance in selecting adequate coverage.

Building Industry Standards

-

Guidelines for Members:

Many associations publish best practice guidelines that inform members about their insurance needs based on industry-specific risks. -

Negotiated Group Rates:

Joining professional associations can often provide access to better group insurance deals, making coverage more affordable.

Leveraging Industry-Specific Insights to Enhance Coverage Options

Industry insights can guide you in enhancing your coverage options.

The Benefits of Industry Knowledge

-

Understanding Trends:

Keeping abreast of industry trends will enable you to revise your insurance coverage accordingly. -

Networking with Peers:

Engaging with peers in your industry can provide valuable insights into effective insurance strategies.

An effective risk management plan works in unison with your professional liability coverage.

Components of a Strong Risk Management Plan

-

Identification of Risks:

Clearly identifying potential risks will allow you to develop strategies to mitigate them. -

Training and Awareness Programs:

Implementing training programs ensures that employees understand operational risks and their roles in managing them.

Professional Liability Insurance 101: A Beginner’s Guide

Understanding professional liability insurance starts with the basics.

Breaking Down the Fundamentals

-

:

It’s designed to protect professionals against claims of negligence or oversight in their professional services. -

Who Needs It?:

Essential Terms to Know

-

Coverage Types:

-

Claims Process:

Knowing the claims process can alleviate stress during potentially difficult situations.

Why Every Professional Needs Liability Coverage

Liability coverage serves as a critical line of defense for professionals in any industry.

Safeguarding Your Business

-

Financial Protection:

It protects you from substantial financial loss due to claims against your professional actions. -

Credibility:

Having coverage enhances your professional credibility and can instill confidence in your clients.

Understanding the Claims Process: What to Expect

Understanding the claims process beforehand can provide clarity and reduce anxiety if you ever need to file a claim.

Navigating Through the Claims Process

-

Initial Notification:

Inform your insurer immediately upon becoming aware of a claim; this will set in motion the claims process. -

Investigation:

Your insurance company will conduct a thorough investigation, which may involve reviewing information and possibly hiring legal counsel. -

Resolution:

Once the investigation concludes, your insurer will determine liability and provide necessary support throughout the resolution process.

Key Terms and Definitions in Professional Liability Insurance

Familiarizing yourself with key terms can facilitate better communication with your insurer.

Common Terminologies

-

Exclusions:

Specific scenarios that are excluded from coverage under your policy. -

Indemnification:

The act of compensating for damages or loss, typically involving an obligation to pay or reimburse.

Understanding the exclusions in your policy is essential to avoiding unpleasant surprises.

Typical Exclusions to Be Aware Of

| Exclusion | Description |

|---|---|

| Intentional Acts | Claims arising from intentional wrongdoing |

| Professional Services Not Covered | Services explicitly mentioned as excluded in policy |

| Prior Knowledge | Claims related to events you were aware of before insurance was purchased |

Being aware of these exclusions helps you set realistic expectations regarding your coverage.

The Role of Risk Management in Mitigating Liability

Proactive risk management plays a crucial role in maintaining your professional liability insurance.

Building a Risk Management Framework

-

Regular Assessments:

Conduct frequent assessments to identify vulnerabilities within your operations. -

Implementing Best Practices:

Adopting industry best practices mitigates exposure to potential claims.

Factors Affecting Professional Liability Premiums

Various factors impact professional liability premiums, and understanding them can help you prepare ahead.

Key Determinants of Premium Costs

| Factor | Impact on Premium |

|---|---|

| Business Size | Larger businesses may face higher premiums due to increased exposure |

| Claims History | A history of prior claims typically leads to higher premiums as it suggests higher risk |

| Industry Risk Profile | Higher risk industries often have elevated premiums because of more frequent claims |

Being aware of these factors will enable you to seek favorable rates when discussing policy options.

Comparing Claims-Made vs. Occurrence Policies

Understanding these two policy types can guide your selection of coverage.

What You Need to Know

| Policy Type | Description |

|---|---|

| Claims-Made | Coverage is provided only if the policy is active when the claim is made |

| Occurrence | Covers incidents that occur during the policy term, regardless of when claims are made |

Each type has its advantages and choosing the right one aligns with your specific business needs.

The Importance of Adequate Coverage Limits

Having adequate coverage limits ensures you are protected against financial losses.

Evaluating Coverage Needs

-

Current Risk Exposure:

Assess your current business landscape to determine necessary coverage limits. -

Future Growth:

As your business grows, periodically reevaluate your policy limits to ensure continued protection.

How to Choose the Right Deductible for Your Business

The right deductible can significantly influence your premiums and overall financial exposure.

Factors to Consider

-

Cash Flow:

Review your business’s cash flow situation to determine how much out of pocket you can afford in the event of a claim. -

Risk Tolerance:

Consider your comfort level with out-of-pocket expenses versus premium costs when evaluating deductible options.

The Impact of Prior Claims on Future Insurability

Your history of claims can affect your future insurability and costs.

Managing Past Claims

-

Addressing Previous Claims:

Be proactive in addressing and resolving past claims to ensure a smoother renewal process. -

Maintaining a Clean Record:

Implement risk management strategies to minimize future claims and maintain a good standing in the eyes of insurers.

When to Review and Update Your Liability Coverage

Regular reviews of your liability coverage are essential to adapt to changing conditions.

Identifying Key Review Points

-

Business Changes:

Significant changes in your business structure or operations warrant a reevaluation of coverage. -

Legal Landscape Changes:

Regulatory changes in your industry may necessitate updates to your existing policies.

The Role of Brokers and Agents in the Insurance Process

Brokers and agents provide invaluable support in navigating the insurance landscape.

How They Can Help

-

Expert Guidance:

Brokers and agents can provide expert insights tailored to your specific business needs. -

Comparative Shopping:

They simplify the process of comparing policies across multiple insurers, ensuring you find the right coverage at the best rate.

Tips for Communicating with Your Insurer

Maintaining open lines of communication with your insurer is key to a successful claims process.

Effective Communication Strategies

-

Clear and Concise:

When communicating, being clear and concise helps avoid misunderstandings. -

Documentation:

Keep thorough records of all communications with your insurer, aiding in clarity during the claims process.

Professional Liability for Accountants: Beyond the Numbers

Accountants must consider unique liability risks in their profession.

Key Risks and Coverage Needs

-

Financial Mismanagement:

-

Regulatory Compliance:

Maintaining compliance with evolving regulations is crucial, and coverage should reflect these responsibilities.

Architects and Engineers: Building a Strong Insurance Foundation

Professionals in architecture and engineering face distinctive liability challenges requiring comprehensive coverage.

Addressing Specific Risks

-

Design Errors:

Coverage for design errors can be significant, ensuring that your firm is protected against potential claims stemming from oversights. -

Contractual Liabilities:

Be aware of the contractual obligations involved in your projects, and negotiate coverage that accommodates these agreements.

Attorneys at Law: Protecting Your Practice from Malpractice Claims

Malpractice claims present unique challenges to legal professionals requiring tailored coverage.

Understanding Legal Risks

-

Client Claims:

The nature of legal work can expose firms to various claims, making it essential to have adequate malpractice coverage. -

Risk Management Strategies:

Developing comprehensive risk management practices specific to your firm can aid in minimizing exposure to malpractice claims.

Consultants must protect their services to avoid potential liability pitfalls.

The Value of Coverage

-

Client Expectations and Trust:

-

Effective Communication:

Managing client relationships effectively can minimize misunderstandings and reduce the likelihood of claims.

Dentists: Navigating the Complexities of Liability Insurance

Dentists face specific risks, making tailored liability coverage essential.

Understanding Liability Risks

-

Malpractice Claims:

The nature of dental care invites claims due to accusations of negligence, making ample coverage necessary. -

Patient Safety:

Patient safety must remain a priority alongside liability coverage, ensuring a holistic approach to professional practice.

Financial Advisors: Shielding Your Clients’ Investments

Financial advisors must navigate unique liability considerations to protect their clients.

Key Coverage Considerations

-

Investment Risks:

Advisors face significant risks stemming from client investments; comprehensive coverage is essential. -

Client Trust:

Having adequate insurance reassures clients that their advisors are prepared for unforeseen circumstances.

Healthcare Professionals: The Importance of Malpractice Insurance

Healthcare professionals have specialized insurance needs.

The Necessity of Coverage

-

Risk of Litigation:

Malpractice claims can have devastating impacts on practitioners, underlining the importance of adequate coverage. -

Compliance and Standards:

Coverage must align with industry standards and regulations to ensure compliance and safety in practice.

IT Professionals: Mitigating Cyber Risks and Data Breaches

The IT industry faces unique liability risks stemming from cybersecurity.

Addressing Digital Threats

-

Data Breach Coverage:

Having coverage that addresses cyber breaches protects IT professionals against claims related to data security failures. -

Contractual Obligations:

Many IT contracts can expose professionals to various liabilities; tailored policies would help mitigate these risks.

Insurance agents require tailored coverage to navigate their unique risks.

Key Insurance Needs

-

Client Trust:

Having adequate coverage reassures clients and bolsters your agency’s credibility. -

Claims Management:

Efficiently managing potential claims related to errors can enhance your agency’s operational efficiency.

Real Estate Agents: Avoiding Liability in Property Transactions

Real estate agents face unique liability concerns within their transactions.

Protecting Yourself

-

Transaction-Related Claims:

Claims may arise from transactional oversights; comprehensive coverage mitigates these risks comprehensively. -

Client Education:

Educating clients on potential pitfalls can enhance relationships and reduce potential liability.

Tech Startups: Tailoring Coverage for Emerging Risks

Tech startups face rapidly evolving risks requiring specialized coverage.

Understanding Startup Needs

-

Rapid Growth:

As startups grow, refining coverage will be essential to adequately address evolving risks. -

Innovation-Related Claims:

New product innovations can expose startups to unforeseen claims; adapting coverage to these changes will be paramount.

Nonprofits: Addressing Unique Liability Concerns

Nonprofits have unique risks that differ from traditional businesses.

Tailored Coverage for Nonprofits

-

Volunteer Activities:

Coverage is essential for protecting against claims arising from volunteer actions. -

Fundraising Activities:

Protecting your organization from potential liabilities associated with various fundraising efforts is crucial.

Media and Entertainment: Managing Risks in a Creative Field

Professionals in media and entertainment face distinctive liability risks.

Importance of Coverage

-

Copyright and Licensing:

These areas present significant risks, requiring comprehensive insurance policies to protect creative works. -

Public Relations:

Effectively managing media risks can reduce liabilities and maintain a positive public image.

Hospitality Industry: Protecting Your Guests and Reputation

The hospitality industry faces unique liability concerns that require strategic coverage.

Guest Safety and Liability

-

Accidents and Injuries:

Insuring against potential claims related to guest injuries can safeguard your property and personnel. -

Reputation Management:

Maintaining robust coverage can help manage reputational risk in times of crisis.

Educational Institutions: Liability Concerns in Academia

Educational institutions must consider specialized liability risks.

Navigating New Risks

-

Student Safety:

Protecting against liability claims related to student incidents is essential for institutions. -

Compliance Issues:

Educational institutions must align their coverage with regulatory requirements to maintain compliance.

The Rise of Cyber Liability: Protecting Against Digital Threats

The increase in digital threats necessitates a rise in cyber liability coverage.

Adapting to New Cyber Risks

-

Comprehensive Cyber Policies:

Ensuring you have appropriate coverage can protect against the increasing frequency of cyberattacks. -

Employee Training and Awareness:

Regularly training employees on cyber risks and security protocols minimizes exposure to liability.

The Impact of AI on Professional Liability: New Risks and Opportunities

The emergence of AI technologies introduces both risks and opportunities for professional liability.

Navigating the Future

-

Evolving Coverage Needs:

As the market evolves, so too will coverage needs surrounding AI technologies; staying current with industry advancements is essential. -

Regulatory Considerations:

Understanding the regulatory implications of using AI technologies will inform your insurance needs moving forward.

Climate Change and Liability: Assessing Evolving Risks

The evolution of climate change presents new liabilities for many industries.

Future-Proofing Your Coverage

-

Impact Assessment:

Conducting regular assessments of how climate change impacts your business can guide necessary updates to coverage. -

Sustainability Initiatives:

Embracing sustainability practices can not only protect your business but also enhance liability protections.

Social Engineering: The Human Factor in Liability Claims

Social engineering remains a growing concern in an increasingly digital landscape.

Educating Employees

-

Awareness Programs:

Implementing robust training programs empowers employees to recognize and mitigate risks related to social engineering. -

Policy Updates:

Revisiting and updating policies to cover these emerging challenges can proactively safeguard against claims.

Navigating the Hard Market: Strategies for Securing Coverage

Navigating a tough insurance market can be challenging, requiring thoughtful strategies.

Effective Negotiation Tactics

-

Strong Relationships:

Nurturing relationships with your insurance broker can help facilitate better terms during challenging market conditions. -

Documentation:

Providing solid documentation of your risk management practices can bolster your negotiation position.

The Gig Economy: Liability Considerations for Freelancers and Contractors

Freelancers and contractors face unique liability challenges within the gig economy.

Understanding Coverage Needs

-

Independent Contractor Risks:

Tailored coverage is essential for protecting against unique risks independent contractors face in securing work. -

Client Agreements:

Clearly defining expectations and securing proper contracts can mitigate potential liability.

Telemedicine: Addressing Liability Concerns in Remote Healthcare

The rise of telemedicine requires medical professionals to address new liability challenges.

Remote Care Considerations

-

Technological Risks:

Ensuring that telemedicine platforms meet security standards is vital in mitigating associated risks. -

Documentation and Compliance:

Comprehensive documentation aids in compliance and provides evidence in the event of a claims investigation.

Remote Work: The Impact on Professional Liability Risks

The shift to remote work has altered professional liability landscapes.

Addressing New Exposure

-

Technology Reliance:

Increased reliance on technology can create new risks; ensuring proper cybersecurity coverage is paramount. -

Workplace Safety:

Adapting your liability policies to address remote workplace safety issues can mitigate exposure.

Evolving Regulatory Landscape: Staying Compliant with Insurance Requirements

The regulatory landscape is constantly changing, impacting insurance requirements across various sectors.

Proactive Compliance

-

Monitoring Changes:

Staying informed about regulatory changes is crucial to ensuring your coverage remains compliant. -

Regular Audits:

Conducting regular audits of your policies will help ensure you meet evolving compliance standards.

The Role of Data Privacy in Liability Insurance

Data privacy is an essential consideration for professional liability insurance.

Safeguarding Client Information

-

Compliance with Regulations:

Ensuring compliance with data privacy regulations protects both you and your clients from potential liabilities. -

Training Employees:

Conducting regular training on data privacy helps minimize exposure to data-related claims.

Mental Health Professionals: Addressing Unique Liability Concerns

Mental health professionals face specific liabilities linked to client treatment.

Navigating Risk

-

Confidentiality and Trust:

Maintaining strict confidentiality is essential in mitigating risks associated with malpractice claims. -

Insurance Needs:

Tailored coverage for unique risks in mental health is necessary to safeguard practitioners against potential claims.

The Impact of Social Media on Reputation and Liability

Social media can influence your liability risks in more ways than one.

Managing Your Online Presence

-

Monitoring Online Reputation:

Regularly monitoring your online reputation helps you manage potential risks associated with negative information. -

Client Communication:

Effective communication with clients about potential social media pitfalls safeguards against misunderstandings.

Professional Liability in the Age of Globalization

Globalization presents challenges that impact professional liability coverage.

Cross-Border Liabilities

-

Addressing Regional Variances:

Understanding how liability laws differ in various jurisdictions is crucial for professionals working globally. -

Customized Coverage:

Securing tailored coverage that accommodates global operations and risks can provide peace of mind.

Drones and Autonomous Vehicles: New Liability Frontiers

The rise of drones and autonomous vehicles introduces new liability challenges.

Evaluating Emerging Risks

-

Regulatory Compliance:

Ensuring compliance with evolving regulatory standards for drones and autonomous vehicles is essential for liability protection. -

Insurance Considerations:

Understanding the unique exposures these technologies bring is key to securing appropriate coverage.

The Future of Professional Liability Insurance: Predictions and Trends

Looking ahead, professional liability insurance will likely evolve to address emerging risks and market changes.

Anticipating Developments

-

Technology Integration:

The integration of technology in insurance processes will likely lead to more personalized coverage options. -

Regulatory Responses:

As industries evolve, regulatory responses shaping liability requirements will continue influencing insurance offerings.

Creating a Culture of Risk Awareness: Employee Training and Education

Building a culture of risk awareness begins with effective employee training and education.

Fostering Safety and Responsibility

-

Ongoing Training:

Regular training sessions ensure that employees stay updated on best practices and risk management strategies. -

Reporting Mechanisms:

Establishing clear reporting mechanisms encourages employees to take responsibility for identifying potential risks.

Implementing Effective Risk Management Strategies

Developing risk management strategies will bolster your professional liability protection.

Key Management Strategies

-

Risk Assessment Protocols:

Regular risk assessments will help identify potential vulnerabilities and guide necessary policy adjustments. -

Emergency Response Plans:

Implementing emergency response plans aids in swift resolution of claims, minimizing impact on your business.

Developing Comprehensive Incident Response Plans

Preparing for incidents should be a core component of your risk management strategy.

Structured Incident Response

-

Establishing Procedures:

Clearly defined procedures for incident response can streamline claims management, ensuring efficient handling of situations. -

Regular Drills and Reviews:

Conducting regular drills and reviews helps ensure that all employees are prepared to respond effectively in the event of a claim.

The Importance of Documentation in Liability Claims

Thorough documentation can make a significant difference during the claims process.

Keeping Detailed Records

-

Accurate Records:

Maintaining accurate records of all interactions and transactions reduces the likelihood of disputes. -

Claim Summary Documentation:

Summarizing claims-related documentation helps facilitate smoother communication with your insurer.

Best Practices for Client Communication and Engagement

Effective client communication can help prevent liability issues from arising.

Improving Relationships

-

Transparency:

Clear, honest communication fosters trust and helps set realistic expectations. -

Regular Check-Ins:

Conducting regular check-ins with clients ensures that they feel supported and informed throughout your service delivery.

Managing Conflicts of Interest to Minimize Risk

Conflicts of interest can expose you to risks that may jeopardize your professional integrity.

Key Considerations

-

Disclosure Policies:

Having robust disclosure policies helps manage potential conflicts of interest with clients effectively. -

Regular Training:

Providing ongoing training on identifying and addressing conflicts can foster a more ethical business environment.

Utilizing Technology to Enhance Risk Management

Using technology can amplify your risk management strategies.

Key Technological Innovations

-

Data Analytics:

Employing data analytics tools assists in identifying trends, providing insights to inform your coverage needs. -

Risk Management Software:

Investing in risk management software can streamline the process of monitoring and assessing company risks.

The Role of Internal Audits in Loss Prevention

Internal audits offer valuable insights into loss prevention strategies.

Conducting Effective Audits

-

Regular Auditing Procedures:

Establishing regular auditing procedures helps ensure adherence to risk management protocols. -

Remediation Strategies:

Identifying and addressing areas of potential exposure strengthens your overall risk posture.

Case Studies: Lessons Learned from Liability Claims

Learning through real-world examples can inform your strategy moving forward.

Key Takeaways

-

Identifying Common Pitfalls:

Review case studies focused on claims to highlight common pitfalls professionals encounter. -

Implementing Learnings:

Integrating insights gained from documentation can enhance your risk management practices.

Expert Insights: Interviews with Risk Management Professionals

Consulting with experts can provide additional perspectives on best practices.

Gaining Insights

-

Real-World Applications:

Expert interviews often focus on practical strategies utilized by successful businesses, bridging theory with practice. -

Industry Knowledge Sharing:

Engaging with professionals across different sectors ensures a broader understanding of risk management landscapes.

Avoiding Common Pitfalls: Tips for Reducing Liability Exposure

Identifying and avoiding common pitfalls can provide ongoing protection against liability.

Effective Strategies

-

Regular Training and Awareness:

Ongoing employee training and awareness are essential for minimizing exposure to liability risks. -

Consistent Communication Protocols:

Establishing and maintaining clear communication protocols enhances operational effectiveness and reduces misunderstandings.

The Importance of Continuous Improvement in Risk Management

Continuous improvement should be at the core of your risk management strategy.

Evolving Strategies

-

Feedback Mechanisms:

Implementing feedback mechanisms encourages learning from mistakes and enhances operational efficiency. -

Adaptability:

Remaining adaptable and open to change will reflect in your long-term success.

Creating a Safe and Secure Work Environment

A safe and secure work environment is essential for minimizing liability risks.

Essential Safety Practices

-

Clear Protocols:

Establishing clear safety protocols helps reduce risks associated with workplace incidents. -

Employee Involvement:

Engaging employees in safety discussions creates a culture of awareness and responsibility.

Managing Third-Party Risks: Vendors and Contractors

Third-party risks from vendors or contractors may increase your liability concerns.

Key Management Strategies

-

Due Diligence:

Conduct thorough due diligence on vendors and contractors to minimize the risk of liability related to third-party actions. -

Contractual Safeguards:

Implementing contractual safeguards helps define responsibilities and mitigate risks associated with third parties.

The Role of Professional Associations in Risk Management

Professional associations often provide valuable resources for managing liability concerns.

Leveraging Association Resources

-

Access to Best Practices:

Many professional associations publish best practices and guidelines useful for members seeking to refine risk management strategies. -

Networking Opportunities:

Engaging with peers through associations offers insights into how others are managing their liability risks.

Understanding the Claims Notification Process in Detail

Understanding the claims notification process in detail can empower your decision-making during challenging situations.

Steps to Follow

-

Notify Your Insurer Promptly:

Always notify your insurer as soon as you become aware of a potential claim. -

Provide Comprehensive Information:

Share all relevant details with your insurer, including contracts, timelines, and any communications related to the claim. -

Follow Up:

After reporting, actively follow up to ensure your claim is moving forward and maintain open lines of communication with your insurer.

In summary, having a solid understanding of the claims notification process and professional liability insurance is vital for safeguarding your business. With thorough knowledge and proactive strategies, you can navigate potential claims more effectively, protecting your integrity, finances, and reputation.