The Evolution of Professional Liability Insurance

Professional liability insurance has come a long way since its inception. Initially designed to protect professionals from claims of negligence, it now covers a broader range of offenses, including everything from misrepresentation to breach of contract. The evolved landscape reflects the complexities of modern professions, making it essential for you to understand how these changes could impact you.

It Only Covers Negligence

Personal Liability is Covered

How Professional Liability Insurance Differs from General Liability

It’s essential to differentiate between professional liability insurance and general liability insurance, as confusion often arises here.

Scope of Coverage

| Coverage Type | Professional Liability Insurance | General Liability Insurance |

|---|---|---|

| Protects against negligence | Yes | No |

| Protects against bodily injury | No | Yes |

| Protects against property damage | No | Yes |

| Covers contractual obligations | Yes | No |

Professional liability focuses on the services you provide, while general liability covers physical risks like property damage and bodily injuries. So, if you work in fields like consulting, healthcare, or finance, professional liability will be particularly relevant to your risk.

The Role of Professional Liability in Business Continuity

Having professional liability insurance plays a critical role in ensuring the continuity of your business. Imagine a scenario where a client brings a claim against you for negligence or inadequate services. Without appropriate insurance coverage, you may face litigation costs, settlement payouts, and damage to your reputation.

How to Evaluate Your Need for Professional Liability Coverage

Assess Your Industry Risks

The first step in evaluating whether you need professional liability coverage is to assess the risks specifically associated with your industry. For example, if you’re an architect or engineer, the stakes are higher due to the complex nature of your work, which could lead to significant claims if anything goes wrong.

Consider Your Client Base

Think About Your Services

What kind of services do you offer? Even seemingly low-risk professions can face claims. For instance, a financial advisor offering advice on retirement savings could face significant claims if a client feels they lost money due to that advice. Always consider the full scope of your services before deciding on coverage needs.

Get Professional Advice

Consulting with an insurance professional can offer valuable insights tailored to your specific situation. They can help you understand risks particular to your profession and industry while navigating the various policy options.

Tailoring Liability Insurance for the Tech Industry

Cybersecurity Risks

As a tech professional, cybersecurity is a huge concern. Errors in software code can lead to data breaches, and claims arising from these incidents can be costly. Thus, ensuring that your policy includes coverage for cyber-related claims can save you significant headaches in the long run.

Intellectual Property Issues

Rapid Industry Changes

Technology changes happen rapidly, and so do the associated risks. Having a flexible policy that allows you to adjust your coverage as your services evolve is crucial. Regular reviews of your policy can help align it with your current business model.

Professional Liability Needs for Healthcare Providers

Healthcare providers have a unique set of risks due to the nature of their work. Here are some key considerations:

Malpractice Claims

Regulatory Compliance

The healthcare industry is highly regulated, and failing to comply with laws can result in fines and lawsuits. Professional liability insurance can cover some regulatory issues, so maintaining comprehensive coverage is critical.

Insurance Challenges in the Construction Sector

In the construction industry, the complexities of projects can lead to a multitude of risks. Here are some challenges you may face:

Project Delays

Contractual Obligations

Legal Professionals: Unique Insurance Considerations

Confidentiality Breaches

Errors in Advice

Investment Losses

Regulatory Environment

The financial services industry is under constant regulatory scrutiny. Non-compliance can lead to charges against you, making it crucial to have insurance that covers disputes originating from regulatory actions.

The Impact of AI on Professional Liability Policies

As artificial intelligence continues to transform various industries, it’s essential to understand how these developments affect your professional liability coverage.

Emerging Risks

Innovation and Evolving Policies

Insurance providers are expected to evolve their policies to account for AI-related risks. Understanding these changes can help you select a robust coverage plan that encompasses potential AI-related claims.

Cybersecurity Threats and Their Influence on Insurance Needs

Data Breaches

Social Engineering Attacks

Social engineering tactics can target your business and lead to significant financial repercussions. Ensuring your insurance adequately covers these types of scams can help navigate the sometimes-overwhelming landscape of cybersecurity threats.

How Climate Change Affects Liability Risk Assessments

Climate change can also impact liability risk assessments across industries. Understanding how this trend affects your coverage can help mitigate potential risks.

Increasing Liability

As natural disasters become more frequent, the potential for liability claims increases. For professionals in sectors such as construction or event planning, considering how climate-related incidents could impact your work is crucial for maintaining a comprehensive insurance policy.

Sustainable Practices

Social Engineering: A Growing Concern for Insurers

Creating Vulnerabilities

Linked to cybersecurity, social engineering schemes can exploit human error, leading to significant financial losses for your clients. If you’re not covered against these tactics, your insurance may not provide adequate protection.

Training and Awareness

An essential part of managing social engineering risks is educating your team. Ensuring proper training can reduce exposure and, consequently, insurance costs, making this aspect crucial for fostering an alert organizational culture.

Navigating the Hard Market in Professional Liability

The insurance market sometimes faces hard conditions, leading to increased costs or reduced availability of coverage. Here are some tips on how to maneuver through this situation:

Shopping Around

In a hard market, it’s crucial to compare multiple insurance providers to find the best coverage terms. Utilize brokers who have access to a breadth of companies, as they can offer invaluable guidance based on changing market conditions.

Bundling Policies

Lessons from High-Profile Professional Liability Lawsuits

Examining high-profile professional liability cases can provide critical insights. Here’s what you can learn:

Understanding Risk Management

Studying cases where professionals faced significant losses can provide valuable lessons on risk management. Identifying recurring themes can help you preemptively avoid potential pitfalls that might otherwise expose you to similar threats.

Reevaluation of Insurance Policies

How Large Corporations Manage Their Liability Risks

Larger corporations often have more sophisticated systems in place than smaller businesses when managing liability risks. Here are some practices you can adapt:

Comprehensive Risk Management Teams

Consider establishing a risk management team within your organization. Teams dedicated to identifying and managing risks can elevate your coverage options and develop strategies for navigating liability challenges more efficiently.

Regular Policy Reviews

Corporations frequently conduct policy reviews to ensure coverage aligns with changing operational realities. Adopting a similar strategy in your business can keep your insurance up to date and relevant.

Case Study: Successful Claims Mitigation Strategies

Let’s look at a hypothetical example that illustrates successful claims mitigation strategies:

Scenario Summary

Mitigation Strategies

- Thorough Documentation: Maintaining detailed records of all client communications helps in defending against potential claims.

- Clear Agreements: Ensuring clients understand the risks associated with their investments can mitigate misunderstanding and claims.

By cultivating these strategies, you can significantly reduce the likelihood of claims while fostering strong client relationships.

The Financial Impact of Negligence Claims on Small Businesses

Negligence claims can have a devastating impact on small businesses. When you consider the likelihood of a claim, it’s worth realizing how these situations can jeopardize your financial health:

High Legal Fees

Legal costs can be exorbitant when responding to claims. These expenses can quickly drain resources, especially for smaller businesses, making strong insurance coverage essential.

Potential Settlements or Judgments

Beyond legal fees, you may also face substantial settlement costs. These financial strains can threaten the viability of your business, further emphasizing the need for professional liability coverage.

Graphic Designer Claim

Successful Resolution

A Step-by-Step Guide to Filing a Professional Liability Claim

Filing a claim can feel overwhelming, but understanding the process can ease your concerns. Here’s a straightforward guide:

Step 1: Notify Your Insurer

As soon as you’re aware of a potential claim, notify your insurer promptly. Delays could complicate your situation or lead to complications in the claims process.

Step 2: Gather Evidence

Collect any relevant documents, emails, or contracts related to the potential claim. This evidence will be crucial in forming your case.

Step 3: Detailed Report

Submit a detailed report outlining the context and nature of the claim. The more clarity you provide, the easier it will be for your insurer to assist you.

Step 4: Follow Up

Keep lines of communication open with your insurer, following up as necessary to ensure your claim is moving forward.

Assess Your Risks

Identify the specific risks associated with your profession. Understanding your unique challenges will help guide your selection of coverage limits and policy specifics.

Evaluate Insurer Reputation

Research insurers to confirm their reliability in handling claims. Consider client testimonials and reviews to gauge their responsiveness and customer service.

Seek Expert Guidance

Engaging with an insurance broker with industry knowledge can ease your decision-making process. They can offer valuable insights and align your policy with your unique needs.

Policy Limits

Watch out for the limits of your coverage, which determine the maximum amount your insurer will pay for a claim. Evaluating your risks can provide you with a clearer vision of what limits you need.

Deductibles

The deductible is the amount you must pay out of pocket before insurance coverage kicks in. Choosing a deductible you can comfortably manage is critical for avoiding financial strain in the event of a claim.

Tips for Negotiating Better Terms with Your Insurer

Being proactive in negotiations can help you secure a more favorable policy. Here are some tips to consider:

Highlight Your Risk Management Practices

Demonstrating robust risk management practices can encourage an insurer to offer better terms. Highlight safety protocols, client education efforts, or regular training initiatives to illustrate your commitment to minimizing claims.

Compare Quotes

Never settle for the first quote you receive. By comparing multiple options, you are better positioned to negotiate terms that meet your needs without unnecessary costs.

Understand Market Trends

Staying informed about trends in the insurance market can bolster your negotiation tactics. Knowledgeable clients often secure better terms due to their understanding of current issues and changes impacting their industry.

How to Educate Employees About Liability Risks

Your employees play a crucial role in preventing liability risks. Here are ways to foster a culture of awareness within your organization:

Conduct Training Sessions

Regular training sessions can help employees understand the types of liability risks they might encounter and how to avoid them. Tailoring sessions to your specific industry challenges makes the information more relevant.

Provide Written Resources

Offering easy-to-understand documents or guides can reinforce what employees learn during training. Providing checklists and best practices can ensure they have ongoing access to essential information.

Encourage Open Communication

Create an environment where employees feel comfortable discussing liability concerns. Open lines of communication can encourage reporting of potential risks before they escalate into claims.

Exploring Niche Markets for Professional Liability Coverage

In today’s economy, niche markets are evolving quickly, and so are their insurance needs. Here are ways to adapt coverage for these emerging sectors:

Identify Industry-Specific Risks

Those in niche markets often face unique situations needing specialized coverage. Understanding these specific risks can ensure you prepare appropriately.

Seek Tailored Coverage Options

Many insurers now offer customizable policies designed for niche markets. Engaging with your broker can help you determine the ideal coverage tailored to your specific needs, better protecting you and your clients.

Customizing Policies for Emerging Industries

Emerging industries often introduce new risks not accounted for in traditional policies. Here’s how you can tailor your coverage:

Understand the Landscape

Get a clear picture of the emerging trends and risks in your industry. This knowledge will help you engage with insurers on how best to adapt your policy.

Flexibility is Key

Many insurers offer flexible coverage options that allow you to adjust your policies as your industry matures. Building a relationship with your insurer can facilitate these conversations over time.

The Role of Professional Associations in Shaping Coverage Needs

Professional associations play a significant role in advocating for relevant insurance needs across industries. Here are ways you can engage:

Join Relevant Associations

Becoming a member can offer insights into industry challenges and networking opportunities. Many associations also provide industry-specific insurance resources that can help you make informed decisions.

Participate in Workshops and Training

Associations often conduct workshops that delve into government regulations and best practices. Engaging in these opportunities can enhance your understanding and help shape your insurance coverage.

Leveraging Industry-Specific Insights to Enhance Coverage Options

Industry-first insights can empower you to negotiate better terms. Here are steps to harness these benefits:

Stay Informed

Familiarize yourself with trends and data impacting your sector. This knowledge will enable you to speak confidently during negotiations, enhancing your understanding of your needs.

Utilize Industry Publications

Having a well-defined risk management plan can help you minimize the likelihood of liability claims. Here’s how you can go about it:

Identify Risks

Begin by identifying all potential risks that your business may face in providing your services. A thorough risk assessment is a foundational step in developing a strong plan.

Create Actionable Strategies

Once your risks are identified, create actionable strategies to mitigate them. This may involve further employee training, regularly updating protocols, or even adjusting your services.

Regularly Review Plans

Risk management is not a one-time task but an ongoing process. Make it a point to regularly review and adapt your plans to account for new risks as they arise.

Professional Liability Insurance 101: A Beginner’s Guide

What is Professional Liability Insurance?

It’s designed to protect professionals against claims resulting from errors, negligence, or omissions while providing services. Coverage can include legal fees, settlements, and damages.

Who Needs It?

How Do You Get It?

Start by assessing your specific needs and engage with an insurance broker who specializes in your industry. They can analyze your situation and guide you in selecting the most appropriate policy.

A – Awareness of Risks

Being aware of the potential risks inherent in your profession is the first step in protecting yourself.

B – Building Relationships

Establish relationships with both your insurer and broker to ensure you are receiving comprehensive advice and coverage options.

C – Coverage Reviews

Regularly review your coverage to remain compliant and ensure you have appropriate protection for your evolving risks.

Why Every Professional Needs Liability Coverage

Financial Protection

Professional Reputation

Holding appropriate liability insurance shows clients that you take your responsibilities seriously. It enhances your credibility, making it easier to form trusting relationships.

Understanding the Claims Process: What to Expect

Navigating the claims process can be daunting, but being prepared can ease your mind. Here’s a breakdown of what to expect:

Initial Notification

Upon receiving a claim, your first step should be to notify your insurer. It’s essential to act quickly to ensure you receive support.

Investigation Phase

After notification, your insurer will begin their investigation, gathering facts surrounding the claim. The faster and more accurate your response, the better.

Resolution

The resolution phase can involve settlement negotiations, litigation, or even dismissal. Understanding your policy will guide you on what options you can consider as the process unfolds.

Key Terms and Definitions in Professional Liability Insurance

| Term | Definition |

|---|---|

| Deductible | The amount you pay out of pocket before insurance kicks in |

| Policy Limit | The maximum amount your insurer will pay for a claim |

| Exclusions | Specific situations not covered by your policy |

| Premium | The cost of your insurance coverage |

By familiarizing yourself with these terms, you can communicate more effectively about your coverage.

Understanding exclusions is critical when selecting a policy. Some common exclusions include:

Intentional Acts

Most policies won’t cover damages stemming from dishonest or fraudulent actions. Insurance is meant for honest mistakes—not wrongful conduct.

Employment Practices

Claims related to employment practices, such as wrongful termination, are often excluded. Separate coverage may be necessary for these situations.

Environmental Liability

The Role of Risk Management in Mitigating Liability

Implementing robust risk management practices can significantly reduce the chances of facing claims. Here’s how you can start:

Identify Operational Risks

Begin by evaluating your operations and pinpointing areas where potential claims could arise. Proactive identification can mitigate risks before they escalate.

Implement Best Practices

Establishing best practices and following industry standards can reduce your likelihood of making mistakes that could lead to claims.

Continuous Improvement

Make risk assessment and management a regular process as your business evolves. Constantly improving your practices will create a safer environment for both employees and clients.

Factors Affecting Professional Liability Premiums

Understanding what factors impact your insurance premiums can help you make informed decisions. These often include:

| Factor | Explanation |

|---|---|

| Industry Type | Different professions carry varying risk levels. |

| Business Size | Larger businesses may face higher exposure levels. |

| Claims History | A history of previous claims often leads to increased premiums. |

| Coverage Limits | Higher coverage limits generally lead to higher premiums. |

By understanding these factors, you can better negotiate your coverage to fit your budget.

Comparing Claims-Made vs. Occurrence Policies

Choosing between claims-made and occurrence policies can be tricky. Here’s a breakdown to help you decide:

Claims-Made Policies

With claims-made policies, coverage applies only if the claim is made while the policy is in effect. This can create risks if you don’t keep the policy active during all years of your practice.

Occurrence Policies

Occurrence policies cover claims regardless of when they are made, as long as the incident occurred during the time the policy was active. This type usually offers broader protection, which can come at a higher cost.

The Importance of Adequate Coverage Limits

Selecting appropriate coverage limits ensures you’re protected against worst-case scenarios. Here’s why limits matter:

Potential Claim Costs

If a claim exceeds your policy limits, you could face significant out-of-pocket expenses. It’s crucial to assess your potential risks and select limits that provide sufficient protection.

Legal and Settlement Costs

Litigation and settlements can be exorbitantly high. Having adequate coverage in place allows for more peace of mind when serving your clients.

How to Choose the Right Deductible for Your Business

Choosing a deductible involves balancing premium costs with your financial circumstances. Here are considerations:

Financial Comfort Zone

Select a deductible that you can comfortably afford in the event of a claim. Avoid excessively high deductibles that could undermine your financial stability.

Premium Savings

Higher deductibles often mean lower premiums. You should weigh your comfort with potential out-of-pocket costs against the savings on your overall policy.

The Impact of Prior Claims on Future Insurability

Past claims can affect your insurability over time, potentially influencing your premiums or coverage options. Here’s what to keep in mind:

Underwriting Considerations

Insurers may scrutinize your claim history during underwriting. If you have several claims, they might perceive you as a higher risk, leading to increased premiums.

Challenging Future Coverage

When to Review and Update Your Liability Coverage

Regularly reviewing your liability coverage keeps you aligned with your current risk exposure. Here’s a timeline to consider:

Annually

A yearly review allows you to assess changes in your business that could affect your needs. Regular engagement with your broker can ensure you’re adequately covered.

After Major Projects or Contracts

Take time to reevaluate your coverage after completing major projects or entering significant contracts. New risks may arise that require additional coverage.

When Expanding Services

If you introduce new services or products, review your liability coverage to ensure it accommodates these changes. Understanding how your offerings impact risk exposure can be crucial for maintaining comprehensive protection.

The Role of Brokers and Agents in the Insurance Process

Brokers and agents can streamline your insurance needs and mitigate risks. Here’s why they matter:

Expert Knowledge

Whether navigating the options or understanding the nuances of coverage, brokers and agents are invaluable resources. Their expertise allows you to focus on your business’s daily operations while ensuring protection.

Advocacy

Brokers can act as your advocate, negotiating on your behalf with insurers and helping you secure the best premiums and terms available.

Tips for Communicating with Your Insurer

Clear communication with your insurer is crucial for ensuring seamless coverage. Here are some tips:

Be Transparent

When discussing your business and practices, transparency will promote stronger relationships with your insurer. Providing accurate and thorough information can enhance your opportunity to secure a better policy.

Document All Correspondence

Always document communications with your insurer. A clear record can facilitate smoother interactions, especially in claims scenarios.

Ask Questions

Don’t hesitate to ask questions about your policy or coverage options. This openness can lead to a better understanding of your insurance and how it protects you.

Professional Liability for Accountants: Beyond the Numbers

Audit Risks

Confidentiality Issues

Accountants also deal with sensitive client information. Having coverage against data breaches or confidentiality violations is critical.

Architects and Engineers: Building a Strong Insurance Foundation

In the realms of architecture and engineering, professional liability insurance is vital to managing risk.

Project-Based Risks

Contracts and Scope of Work

Contracts in these professions often classify the scope of work explicitly, so you’ll want coverage that aligns with this specificity to avoid possible disputes.

Attorneys at Law: Protecting Your Practice from Malpractice Claims

Lawyers face distinct risks tied to negligence claims. Here’s what to consider:

Representation Failures

Fee Disputes

As a consultant, you provide expertise that can have significant consequences for your clients. Here’s how to best protect yourself:

Diversified Risks

Clear Deliverables

Dentists: Navigating the Complexities of Liability Insurance

For dentists, the stakes of professional liability begin with the care provided to patients. Here’s what you need to know:

Malpractice Claims and Patient Relations

Regulatory Compliance

Financial Advisors: Shielding Your Clients’ Investments

Investment Losses

Clear Documentation

Healthcare Professionals: The Importance of Malpractice Insurance

Healthcare professionals often find themselves in precarious situations that demand robust insurance coverage. Here’s why:

Patient Care Risks

With healthcare comes the potential for error. Malpractice insurance covers claims arising from patient care incidents, providing vital financial protection.

Lawsuits

IT Professionals: Mitigating Cyber Risks and Data Breaches

In the digital age, IT professionals need to be keenly aware of the risks they face. Here’s how to manage these situations:

Data Management Errors

Breach of Confidentiality

Due to the nature of your work, ensuring you have the right coverage for data breaches and confidentiality issues is crucial in today’s digital landscape.

Errors in Policy Design

Client Consultations

Real Estate Agents: Avoiding Liability in Property Transactions

In real estate, the risks are high. Here’s how to manage liability:

Transaction Errors

Disclosure Obligations

Tech Startups: Tailoring Coverage for Emerging Risks

Agile Policies

Understanding Specific Risks

Identify industry-specific challenges your startup may encounter. Establishing connections with your insurer ensures that your policy evolves alongside your business.

Nonprofits: Addressing Unique Liability Concerns

Public Perception

Regulatory Scrutiny

Many nonprofits are subject to strict regulations. Working with an insurer at the forefront of nonprofit requirements can ensure you’re adequately covered against potential claims.

Media and Entertainment: Managing Risks in a Creative Field

Copyright and Intellectual Property Claims

Defamation Risks

As media outputs fluctuate, defamation claims can arise quickly. Comprehensively understanding your coverage against these claims can safeguard your reputation as a creative professional.

Hospitality Industry: Protecting Your Guests and Reputation

Guest Safety

Regulatory Compliance

Educational Institutions: Liability Concerns in Academia

For those in academia, the stakes can be high regarding liability claims. Let’s explore:

Faculty Errors

Regulatory Issues

The Rise of Cyber Liability: Protecting Against Digital Threats

As digital threats become a growing concern, understanding your needs is crucial. Here’s what to know:

Cybersecurity Risks

Data Breach Consequences

The Impact of AI on Professional Liability: New Risks and Opportunities

AI is transforming the landscape of various industries. Understanding how this affects your liability coverage is crucial.

Emerging Scenarios

With AI comes new risks that could lead to claims, requiring a reevaluation of existing policies. Understanding these scenarios will ensure your coverage remains relevant.

Innovations in Policy Design

Insurance companies are beginning to develop policies that encompass AI-related risks. Engage with your insurer to determine how best to align your coverage with future developments in your industry.

Climate Change and Liability: Assessing Evolving Risks

In a world increasingly impacted by climate change, addressing risks related to this issue is essential. Here’s how it affects liability:

Increased Liability Effects

With more frequent natural disasters, risks related to liability can grow. Understanding how these changes impact your coverage can better prepare you for potential claims.

Sustainable Practices

Social Engineering: The Human Factor in Liability Claims

Social engineering tactics often rely on human elements, making education and training crucial. Here’s what you can do:

Training and Awareness Initiatives

Implementing training around social engineering tactics can significantly reduce risks. Educating employees about susceptibility can empower them to avoid traps laid by scammers.

Implementing Security Protocols

Strong security measures often serve as deterrents for social engineering coders. Assuring employees follow robust security protocols can enhance your overall risk management strategy.

Navigating the Hard Market: Strategies for Securing Coverage

A tough insurance market can create challenges around securing coverage. Here are some tips to navigate these times:

Engage with Multiple Brokers

Working with several brokers can broaden your options. Different brokers may have relationships with numerous insurers, increasing your chances of securing favorable terms.

Consider Higher Deductibles

Willingness to take on higher deductibles can lead to lower premiums. This could create opportunities for securing coverage options during difficult market periods.

The Gig Economy: Liability Considerations for Freelancers and Contractors

For those in the gig economy, liability insurance can often feel elusive. Here’s how to secure protection in this unique environment:

Comprehensive Coverage

Clarity in Contracts

Being clear in contract negotiations can mitigate risks. Documentation outlining the scope of services and responsibilities protects both parties and can deter claims.

Telemedicine: Addressing Liability Concerns in Remote Healthcare

As telemedicine grows, understanding its liability risks becomes necessary. Here are key considerations for coverage in this area:

Remote Consultations

Regulatory Changes

The evolving regulatory environment around telemedicine necessitates regular reviews of insurance policies to ensure continued compliance and protection against potential claims.

Remote Work: The Impact on Professional Liability Risks

The shift toward remote work changes professional dynamics. Here’s how it could alter your liability exposure:

Cybersecurity Changes

Isolation Consequences

Employee isolation can lead to mistakes driven by stress. Addressing mental health in liability mitigation plans can help reduce associated risks.

Evolving Regulatory Landscape: Staying Compliant with Insurance Requirements

With regular changes in regulations, staying informed about your duties is essential. Here’s how you can manage this:

Regularly Review State and Federal Requirements

Engage with Legal Counsel

Working alongside your legal counsel provides peace of mind. They can help ensure that your policy aligns with legalities, minimizing liability risks.

The Role of Data Privacy in Liability Insurance

Data privacy laws are increasingly influential in shaping your insurance coverage. Here’s what to note:

Compliance Requirements

Claims Related to Breaches

Mental Health Professionals: Addressing Unique Liability Concerns

For mental health professionals, emotional and mental consequences of their work lead to unique liability risks that require coverage:

Openness to Claims

Confidentiality Obligations

The Impact of Social Media on Reputation and Liability

Social media can fuel claims against professionals if mishandled. Understanding its implications is essential:

Monitoring Online Presence

Maintaining an understanding of your social media presence is crucial. Regular monitoring helps reduce the likelihood of negative encounters that might lead to liability claims.

Equipping Employees

Educating employees regarding your organization’s social media policies can help prevent reputational risks. Ensuring staff understands your digital guidelines reduces the chance of errors leading to claims.

Professional Liability in the Age of Globalization

As globalization increases connectivity, understanding its implications for professional liability is essential. Here’s how you can navigate these changes:

Cross-Border Risks

Compliance Challenges

Navigating multiple regulatory requirements across countries can be daunting. Therefore, it’s crucial to maintain robust coverage that addresses potential liabilities arising from diverse laws.

Drones and Autonomous Vehicles: New Liability Frontiers

With emerging technologies come new liability challenges. Here’s how to navigate these risks:

Understanding Operational Risks

Professionals engaging in drone operations need to understand the associated risks. Tailoring insurance to address these unique liability considerations is critical for protection.

Automating Coverage

The Future of Professional Liability Insurance: Predictions and Trends

As we look ahead, understanding the evolving landscape of professional liability insurance will be vital. Here are some predictions:

Technological Influence

The rise of technology will create complex liability issues that require specialized coverage. Staying informed of technological trends will help you adapt your risk management approach.

Regulatory Developments

Creating a Culture of Risk Awareness: Employee Training and Education

Building a culture of risk awareness is vital for minimizing liability exposure. Here’s how you can implement robust training:

Regular Education Initiatives

Conduct training sessions that discuss potential liabilities. Engaging employees in these conversations fosters awareness and proactively reduces risk.

Foster Supportive Dialogue

Encouraging open dialogue about liabilities among employees creates an environment where they feel comfortable discussing risks. This can help prevent claims before they become problematic.

Implementing Effective Risk Management Strategies

To effectively mitigate risks, you need solid strategies. Here are ways to establish a comprehensive risk management plan:

Engage Stakeholders

Involve stakeholders in risk assessments. Collaborating with your team creates a broader understanding of the risks you might face.

Establish Strong Protocols

Implementing clear protocols across your organization can reduce vulnerabilities. Documenting these processes ensures everyone is on the same page about practices.

Developing Comprehensive Incident Response Plans

An efficient incident response plan can help you navigate crises smoothly. Here’s what to include:

Clear Roles and Responsibilities

Everybody should understand their responsibilities in the event of a claim. Assigning specific duties can minimize confusion and streamline responses.

Communication Channels

Establish secure and efficient communication channels. Clearly communicating during incidents will ensure that everyone involved is updated and informed, reducing potential confusion.

The Importance of Documentation in Liability Claims

Effective documentation during claims can greatly influence outcomes. Here are steps for maintaining proper records:

Keep Detailed Records

Maintain comprehensive records of client interactions and decisions. These can provide critical evidence during claims investigations.

Regular Updates

Periodically update your documentation process to ensure compliance. Regular assessments can minimize risks associated with negligence claims.

Best Practices for Client Communication and Engagement

Clear communication with clients is essential for successful engagement. Here’s how to foster good relationships:

Regular Check-Ins

Maintain open lines of communication through regular check-ins. Engaging clients in ongoing discussions helps prevent misunderstandings and builds trust.

Clear Expectations

Set clear expectations at the onset of any engagement. Clients understanding what they can expect will reduce claims stemming from miscommunication.

Managing Conflicts of Interest to Minimize Risk

Conflicts of interest can complicate professional relationships. Here’s how to manage these:

Transparency is Crucial

Being honest about potential conflicts can go a long way in minimizing fallout. Openly communicating with clients regarding conflicts can enhance trust.

Document Agreements

Documenting any agreements surrounding conflicts of interest can protect you. Clear documentation reinforces understanding, substantially minimizing claims.

Utilizing Technology to Enhance Risk Management

Incorporating technology can vastly improve how you approach risk management. Here are ways to leverage innovation:

Data Analytics

Utilizing data analytics can give insights into your risk exposure. Understanding emerging patterns helps you take proactive measures to mitigate exposure.

Effective Communication Tools

Employing communication tools can improve clarity in client conversations. Adopting technology can foster professionalism and accountability.

The Role of Internal Audits in Loss Prevention

Conducting regular internal audits is crucial for loss prevention. Here’s what to consider:

Identify Weaknesses

Internal audits can help you uncover weaknesses in your operations that might expose you to liability. Addressing these issues promptly protects your organization.

Establish Safety Protocols

After identifying potential vulnerabilities, implementing new protocols can improve overall safety. Audits help ensure you keep compliance in check and mitigate risks effectively.

Case Studies: Lessons Learned from Liability Claims

Examining real-world claim scenarios can provide essential lessons for your practice. Here are takeaways from hypothetical cases:

Take a Business Approach

How businesses approached and resolved claims can offer valuable insights. Focus on preventative measures they implemented to avoid similar situations.

Implement Best Practices

Identifying best practices of others can enhance your own operations significantly. Learning from the experiences of others ensures that your team is better prepared for potential claims.

Expert Insights: Interviews with Risk Management Professionals

Conduct Regular Discussions

Having regular discussions with risk management professionals helps you stay informed about industry trends. Take advantage of these opportunities whenever they arise.

Implement Expert Recommendations

Applying advice from seasoned professionals can improve your own practices. Consider adopting their suggestions concerning documentation or communication strategies.

Avoiding Common Pitfalls: Tips for Reducing Liability Exposure

Reducing liability exposure can sometimes feel overwhelming. Here’s how to avoid common pitfalls:

Educate Your Team

Fostering education around liability risks can help employees understand issues they might face. Workshops and training sessions can provide practical examples and solutions.

Implement Comprehensive Protocols

Invest time in developing thorough protocols for your operations. Procedures that minimize risks will set your organization up for success, helping you prevent claims.

The Importance of Continuous Improvement in Risk Management

Risk management is never a one-and-done task. Here’s why ongoing improvement is vital:

Evolving Regulations

As regulations change, you should adjust your risk management accordingly. Keeping your insurance in sync with evolving guidelines protects your business.

Learn from Experiences

Reviewing previous incidents can help you identify areas for improvement. Building a culture of continuous learning ensures that incidents become invaluable training ground for future endeavors.

Creating a Safe and Secure Work Environment

Fostering a physically and emotionally safe workplace can mitigate liabilities. Here are key considerations:

Safety Training

Regular safety training ensures employees are aware of essential protocols, reducing workplace accidents that could lead to claims.

Open Communication Channels

Creating an environment where employees feel comfortable voicing concerns cultivates a safe space. This can enhance overall morale while minimizing risks associated with workplace conditions.

Managing Third-Party Risks: Vendors and Contractors

Hiring external vendors or contractors can expose you to additional liabilities. Here’s how to navigate these relationships:

Vetting Process

Before engaging third-party services, conduct thorough background checks. Understanding a vendor’s track record for managing liabilities can enhance your protections.

Clear Agreements

Establish clear agreements outlining expectations and responsibilities associated with contractors. Written agreements can serve as collateral in case disputes arise.

The Role of Professional Associations in Risk Management

Professional associations often serve as advocates for industry standards and practices. Here’s how to engage effectively with them:

Membership Benefits

Joining a professional association can offer essential resources for risk management, including educational materials and networking opportunities.

Active Involvement

Participating in workshops and events can keep you informed about industry best practices, so make an effort to attend.

Understanding the Claims Notification Process

Notifying your insurer promptly is important when faced with a claim. Here’s how to navigate this process:

Immediate Communication

As soon as you’re aware of a claim, communicate with your insurer. Timeliness is crucial in ensuring protection against potential claims.

Follow Up Regularly

After initial notification, be proactive in following up to ensure your claims process remains on track. Open dialogue can promote clarity around the steps needed.

Working with Claims Adjusters: Tips for a Smooth Experience

Navigating claims can feel daunting, but understanding your claims adjuster’s role can help. Here are some tips for effective collaboration:

Provide Necessary Documentation

Ensure your claims adjuster receives all relevant documentation promptly. This can help expedite the claims process.

Be Transparent

Transparency during the claims process fosters trust with your adjuster, making the process smoother and more efficient.

The Role of Legal Counsel in Liability Claims

Legal counsel can often play a key role if a claim arises. Here’s how to navigate this relationship:

Seek Legal Guidance Early

Don’t hesitate to seek legal counsel as soon as you believe a claim might arise. Legal professionalism can better prepare you for navigating the claims process.

Open Communication

Maintain an open line of communication with your legal counsel, providing them with all necessary information and documentation aiding your case.

Preparing for Litigation: Key Considerations

When faced with potential litigation, preparation is essential. Here are some things to consider:

Review Records

Evaluate all relevant records associated with the case. A thorough understanding of events will help when formulating your legal strategy.

Engage Experts

Consider involving experts who can testify on your behalf. Engaging witnesses can bolster your position during courtroom proceedings.

Mediation and Alternative Dispute Resolution: Options for Resolving Claims

Mediation or alternative dispute resolutions can often provide a smoother path for resolving claims. Here’s how it works:

Explore Pre-Litigation Options

Before entering into litigation, consider mediation or negotiations as a viable option. Many disputes can be resolved amicably, saving time and resources.

Document Agreements

Ensure that any resolutions are documented clearly to maintain a record of agreements. This documentation can serve as a reference for both parties.

Expert Witnesses: Their Role in Liability Cases

Expert witnesses can significantly bolster your position during a claim. Here’s what you should know:

Qualifications Matter

When selecting an expert witness, their qualifications matter. Ensure they have established credibility in your industry to fortify your case.

Clear Expectations

Clearly outline expectations with your expert witnesses regarding their roles in the process. Setting these guidelines promotes a smoother collaboration and positive outcomes.

Managing the Emotional Impact of a Liability Claim

Facing a liability claim can be emotionally taxing. Here are ways to manage stress effectively:

Establish a Support System

Having a support system during stressful periods can provide vital relief. Engaging with colleagues and family can create a healthier environment as you navigate the claims process.

Mindfulness Practices

Consider implementing mindfulness or stress-relief practices to manage anxiety levels. Keeping yourself centered and focused can facilitate better decision-making throughout the process.

Case Studies: Analyzing Real-World Claim Scenarios

Delving into real-world examples can provide vital lessons. Here’s how:

Review Outcomes

Analyzing the outcomes of various claims can illuminate changing practices in your industry. Studying these examples can enhance your understanding of risk management.

Identify Patterns

Recognizing common patterns from previous claims can contribute to a more proactive approach in your practice. Utilize these insights to fortify your own risk management strategy.

The Impact of Litigation on Reputation and Brand Image

Litigation can significantly impact your professional reputation. Here’s how to manage your image during trying times:

Communication Strategies

Develop communication strategies addressing the litigation while managing public perceptions. Transparency in messaging can minimize negative fallout.

Minimize Further Damage

Engaging with clients transparently can help alleviate reputational damage. The more informed your clients are, the better equipped they will be to continue supporting you through tough periods.

Protecting Your Business During a Claim: Continuity Strategies

Ensure you’re thinking ahead during a claim scenario. Here are some strategies for continuity:

Business Continuity Plans

Implementing thorough plans for business interruptions promotes stability. Preparing for the unexpected fosters a seamless transition through potential hurdles.

Engage Employees

Keeping lines of communication open with your employees during claims will boost morale and help ensure a sense of support. Encourage staff to voice concerns or questions during challenging times.

The Role of Public Relations in Managing Liability Crises

Effective public relations are essential for navigating litigation. Here’s how PR can bolster your strategy:

Crafting the Narrative

Strategically crafting communication that accurately reflects your stance helps establish control in media conversations. Clear messaging can guide public perception during crises.

Transparency Matters

Being transparent in your communications fosters trust among clients and stakeholders. Open dialogue minimizes speculation and alleviates potential concerns.

Lessons Learned from High-Profile Liability Lawsuits

Drawing lessons from high-profile cases can help shape your strategies. Here are some examples:

Understand Industry Evolution

Examining how high-profile cases have unfolded can illustrate overall transformations within your sector. Changes in practices post-case often reflect shifts in industry standards.

Evaluate Impacts

Assess the impact of significant lawsuits on your profession. Understanding the consequences can inspire you to rethink your own practices and policies proactively.

Understanding the Financial Costs of Litigation

Litigation entails considerable financial implications. Here’s a look at what you might anticipate:

Legal Fees

Legal representation is often among the highest costs associated with claims. Familiarizing yourself with potential fees helps prepare you for possible expenses.

Settlement Costs

Strategies for Negotiating Favorable Settlements

If a claim arises, understanding strategies for achieving favorable settlements is crucial. Here are some tips:

Focus on Strengths

Highlight strengths in your case during negotiations. Presenting a compelling and fact-based argument can lead to a more favorable outcome.

Be Open to Compromise

Being willing to negotiate while remaining firm on non-negotiables fosters goodwill in discussions. Flexibility can open doors for mutually beneficial settlements.

The Importance of Post-Claim Analysis and Improvement

Even after a claim is resolved, learning from the experience is essential. Here’s why:

Identify Lessons

Post-claim analysis reveals critical lessons learned during the process. Understanding what went wrong helps you improve future practices.

Update Policies

After resolving a claim, revisiting your policies to address any identified gaps will fortify your protections.

The History of Professional Liability Insurance

Understanding the roots of professional liability insurance will inform your perspectives. Here’s a brief history:

Evolution Over Time

Professional liability insurance originated to cover professionals against negligence. The rise in consumer expectations has encouraged greater growth and sophistication in policies.

Regulatory Influences

Changes in regulations and standards have shaped how insurance evolves. Keeping abreast of these developments is vital for choosing the right coverage.

The Role of Insurance in Economic Growth and Stability

As an integral component of economic stability, insurance plays a crucial role. Here’s how:

Business Confidence

By providing financial protection, insurance fosters confidence among professionals, allowing them to take calculated risks without fearing potential ruin.

Promoting Growth

With an effective insurance framework in place, businesses can expand, knowing that they have a safety net to absorb unexpected downturns.

Professional Liability Around the World: International Perspectives

Liability insurance standards differ globally. Here’s what to know about international perspectives on insurance:

Regulatory Variability

Different countries enforce various regulations regarding liability insurance. Understanding these disparities can inform decisions about conducting international business.

Coverage Expectations

The Ethics of Professional Liability Insurance

The ethical implications of liability insurance warrant consideration. Here’s why this matters:

Accountability to Clients

Having appropriate insurance coverage ensures a commitment to clients. It represents accountability and provides reassurance that you take your professional responsibilities seriously.

Transparency Expectations

Ethics in the insurance industry encourage clarity regarding coverages and exclusions. Engaging transparently with clients serves to build stronger relationships based on trust.

The Impact of Technology on the Insurance Industry

Technology is reshaping insurance every day. Here’s how to stay in the know:

Digital Innovations

The use of technology transforms how insurance operates. From underwriting to claims processing, technology makes the system more efficient and accessible.

Data Utilization

Insurers increasingly utilize data analytics for risk assessment. Understanding how data influences your policy can enhance your approach to finding the right coverage.

Careers in Professional Liability Insurance

With a growing field, exploring careers in liability insurance can be interesting. Here’s what to consider:

Diverse Opportunities

Working in insurance encompasses a multitude of roles, from underwriting to claims management. Exploring these avenues can open your career to new paths.

Necessary Skills

Knowledge of risk assessment, negotiation techniques, and legal principles can benefit those pursuing a career in professional liability insurance.

The Future of the Insurance Industry: Predictions and Trends

As the insurance industry continues to evolve, it’s essential to stay updated on future trends. Here are some predictions to consider:

Technological Integration

We can anticipate further integration of technology into the insurance process, improving efficiency and client experience. Embrace the changes as they come.

Focus on Client Experiences

Insurance providers will increasingly prioritize customer service and the client experience. Being responsive and accessible will distinguish successful providers.

Book Reviews: Must-Reads for Risk Management Professionals

For those interested in diving deeper into risk management, book reviews can provide valuable recommendations. Here are a few books to explore:

- “The Risk Management Handbook” – A must-read for anyone looking to deepen their understanding.

- “Stakeholder Risk Management” – Offers practical insights into managing liabilities.

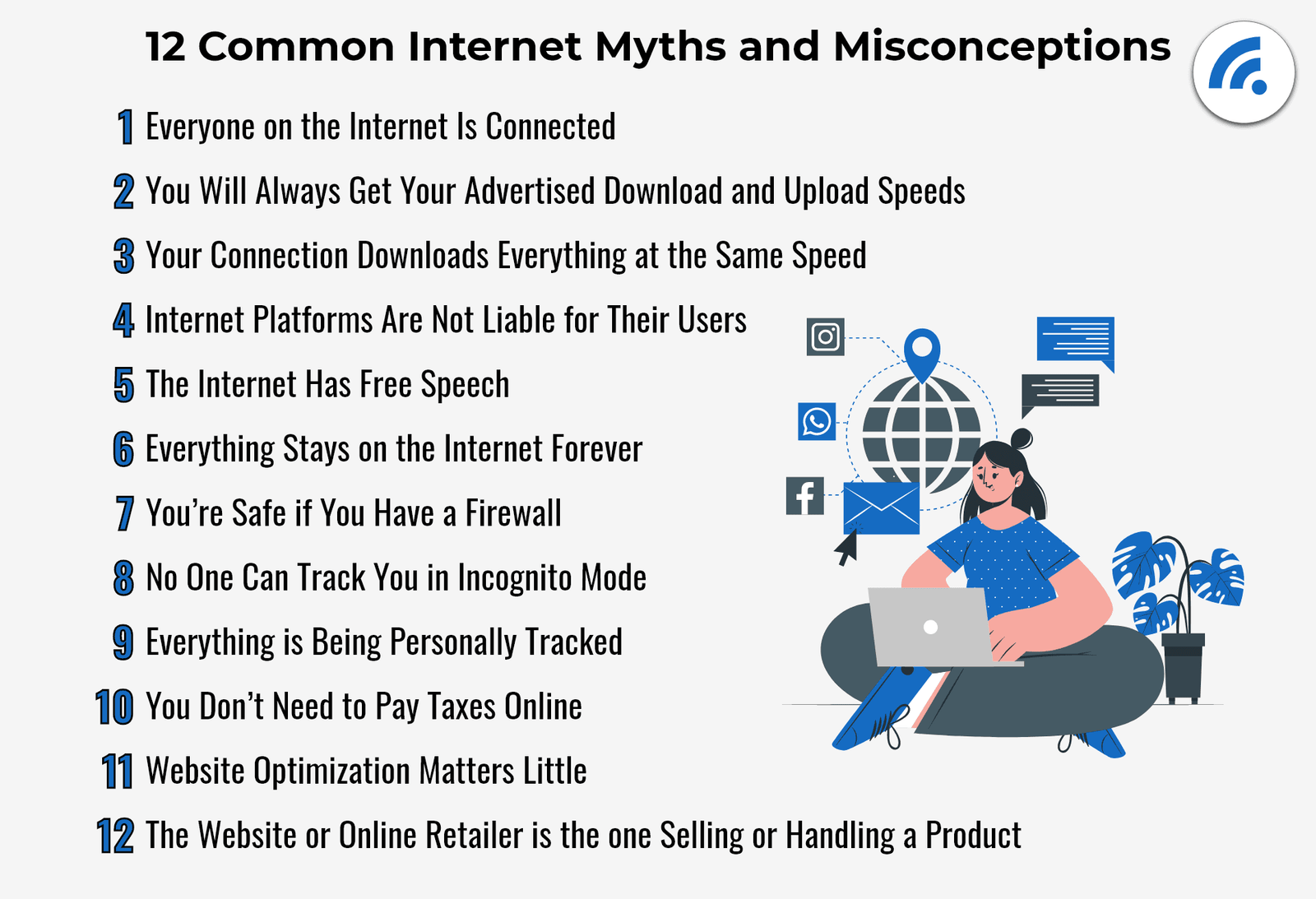

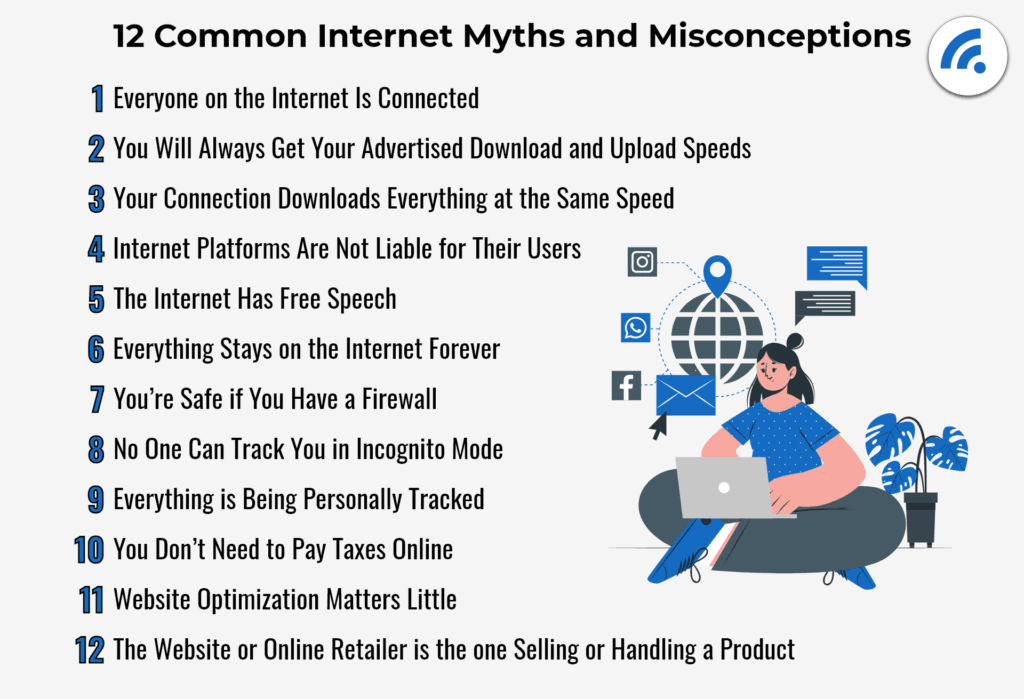

Infographics and Visual Guides to Professional Liability

Visual aids can enhance your learning. Here are ways to utilize infographics:

Simplified Information

Helpful Comparisons

Visuals can also assist in comparing different coverage options, helping you navigate policy differences at a glance.

Webinars and Online Courses: Continuing Education Resources

Engaging in webinars and online courses can keep you informed of developments in liability insurance. Stay actively engaged in your learning through various formats available.

Industry Experts

Many webinars feature industry experts providing valuable insights. Regularly attending these sessions keeps you updated on trends and potential adaptations in the insurance landscape.

Networking Opportunities

Online courses can also connect you with peers. Building relationships can create support systems while deepening your understanding of professional liability.

Podcasts and Interviews with Industry Leaders

Listening to industry-related podcasts can supply you with valuable perspectives. Consider searching for interviews with industry leaders to gain insights into their experiences, regulations, and challenges.

Conferences and Events: Networking Opportunities

Attending industry events can create valuable networking opportunities. Here’s how to maximize your participation:

Engage Actively

Be proactive in engaging with speakers and exhibitors, asking questions, and participating in discussions to enhance your learning experience.

Keep Records

Take notes during workshops and inevitably relate them to your business practices. Keeping a journal of events can help reinforce your learning.

Glossaries and Resource Guides: Essential Tools for Professionals

Having access to glossaries and resource guides can bolster your understanding. Here’s how to leverage this information:

Understand Key Terms

Valuable Reference Material

Maintain a list of essential resources at your fingertips. Having access to tools can streamline your efforts for ongoing improvement in risk management.

Frequently Asked Questions About Professional Liability Insurance

How do I choose the right policy?

Engage an insurance broker to help you evaluate your needs and compare various coverage options. It’s crucial to align your policy with your unique risks.

Client Testimonials and Success Stories

Learning from Experiences

Showcasing these stories can also serve as a reminder of the significance of proper coverage. Sharing experiences increases awareness regarding the essential nature of liability insurance.

Humorous Takes on Liability Insurance: Cartoons and Jokes

Inject some humor into the often-stressful world of liability coverage. Seeking out light-hearted representations of insurance-related scenarios can foster a more engaging atmosphere, making discussions surrounding liability a bit less daunting.

Stress Relief through Laughter

While liability insurance is a serious matter, allowing yourself opportunities to laugh can alleviate some tension. Sharing these humorous elements can build camaraderie in professional settings.

Industry News and Updates: Stay Informed About the Latest Developments

Subscribe to Newsletters

Consider subscribing to newsletters focusing on legal and insurance updates in your industry for ongoing insights.

Engage on Social Media

Follow relevant organizations and professionals on social media platforms. Engaging in conversations can deepen your understanding while connecting you with industry developments.

Regulatory Changes and Their Impact on Liability Coverage

Being aware of regulatory changes can shape your insurance decisions. Here’s how to stay on top of developments:

Regularly Review Guidelines

As regulations change, continuously assessing your coverage can ensure compliance, minimizing your exposure to potential liabilities.

Engaging with Experts

Consulting legal experts ensures you keep your policies in balance with existing guidelines while adapting to new requirements.

Case Studies: Analyzing Landmark Court Decisions

Understanding landmark court decisions can provide key insights into liability trends. Here’s how to glean value from these cases:

Review Context and Outcomes

Reviewing these decisions can help contextualize the evolution of liability insurance frameworks. Pay attention to outcomes to inform your strategies.

Adapt Practices Accordingly

Adjusting your policies based on lessons from landmark cases allows you to align with current standards, protecting your business while advancing your commitment to compliance.

The Role of Insurance in Social Responsibility and Sustainability

As societal awareness around social responsibility and sustainability grows, insurance approaches are evolving. Here’s how to engage responsibly:

Promote Sustainable Practices

Show a commitment to responsible practices within your insurance and professional services, aligning with client expectations.

Enhance Community Relationships

Establishing positive relationships with communities through social responsibility initiatives can build goodwill and strengthen your business reputation.

Thought Leadership: Essays and Opinion Pieces from Experts

Engaging with thought leaders in professional liability can deepen your understanding. Seek essays and opinion pieces from industry experts for invaluable insights.

Inviting Diverse Perspectives

Absorbing multiple viewpoints can enhance your comprehension of your own practices while demonstrating the breadth of opinions circulating in the industry.