Have you ever stopped to think about how the rise of cybersecurity threats could influence the insurance landscape for your business? In today’s rapidly evolving digital world, cybersecurity is more critical than ever, not just for protection but also in determining the type of insurance you might need. Understanding this intersection of cybersecurity and insurance can help safeguard your business from potential vulnerabilities and financial losses.

The Evolution of Professional Liability Insurance

How Professional Liability Insurance Keeps You Protected

By having professional liability insurance, you protect yourself against claims made by clients or third parties. This coverage ensures that, if an error occurs that leads to a financial loss, you’re not left to pay the costs out of pocket. With the landscape of business changing due to technological advancement and the constant threat of cyber risks, this coverage is not just an option; it’s becoming a necessity.

Many people believe that having general liability insurance is enough to cover all their business risks. This is a common misconception that can lead to significant financial trouble later on. General liability insurance protects you from bodily injury and property damage claims, but it does not cover errors in professional services or advice.

Understanding the Distinct Coverage Needs

It’s essential to recognize that your liability coverage needs to be tailored to your specific industry and business model. For instance, tech companies face unique cybersecurity threats that general liability insurance wouldn’t cover. Educating yourself and your team about these distinctions can prevent costly oversight.

How Professional Liability Insurance Differs from General Liability

While both forms of coverage serve to protect your business, they do so in fundamentally different ways.

| Aspect | Professional Liability Insurance | General Liability Insurance |

|---|---|---|

| Coverage Scope | Errors and omissions, negligence | Bodily injury, property damage |

| Industry Focus | Professionals (consultants, lawyers) | All businesses |

| Defense Costs | Covered until the claim is resolved | Covered if liability is established |

| Claims Made | Often requires proof of negligence | Covers accidents regardless of fault |

The Importance of Comprehensive Coverage

Understanding these differences is crucial in ensuring your business has comprehensive coverage that addresses all potential risks. In increasingly complex environments, this knowledge can be empowering.

The Role of Professional Liability in Business Continuity

For many businesses, especially in high-stakes professions, having professional liability insurance is essential for ensuring continuity. If a claim is made against you, having this insurance can be the difference between weathering a financial storm or compromising your business’s future.

Ensuring Resilience Against Claims

Having robust professional liability insurance means that you can focus on running your business without the worry of potentially devastating claims derailing your operations. This resilience is especially critical in industries where trust and reputation are paramount.

How to Evaluate Your Need for Professional Liability Coverage

Evaluating your need for professional liability coverage starts with understanding the nature of your business and the risks associated with it. Consider the following questions:

-

What services do you provide?

High-stakes services often require more extensive coverage. -

What is your exposure to negligence claims?

If your work has a higher probability of errors, having insurance is advisable. -

How do clients perceive your business?

A strong reputation may lead to more clients, but it also increases exposure to claims.

Conducting a Thorough Risk Assessment

By answering these questions and conducting a risk assessment, you gain invaluable insight into your insurance needs. It’s an integral part of ensuring the safety of your business and peace of mind for your professional operations.

Tailoring Liability Insurance for the Tech Industry

The technology sector has rapidly expanded and evolved, bringing unique challenges and insurance needs. Cybersecurity is now a top concern, making tailored liability coverage essential.

Addressing Emerging Risks in Technology

Tech companies often deal with sensitive data and complex systems. Identifying specific risks, such as data breaches or project failures, can help in choosing the right coverage that protects against losses that may arise from these incidents.

Professional Liability Needs for Healthcare Providers

Healthcare professionals face particular challenges regarding liability. With the increasing dependence on technology and electronic health records, the need for tailored professional liability insurance grows.

Protecting Against Medical Malpractice Claims

In a field where human lives are at stake, having comprehensive malpractice insurance is essential for healthcare providers. This coverage not only protects against lawsuits related to medical negligence but also addresses the growing risks associated with digital patient records and telemedicine.

Insurance Challenges in the Construction Sector

The construction industry has unique liability concerns, especially with its blend of on-site work and contractual obligations. These challenges are compounded by the potential for physical injury claims and the increasing complexity of construction projects.

Navigating Risks Associated with Construction

Having the right insurance allows you to focus on project completion and safety without the constant threat of liability claims. Ensure your coverage addresses issues such as contractor negligence, design flaws, and even workplace injuries.

Legal Professionals: Unique Insurance Considerations

It’s no secret that the legal industry is fraught with liability risks. From potential malpractice claims to issues of confidentiality breaches, attorneys must navigate a complex maze of liability challenges.

Securing Coverage for Legal Professionals

Professional liability coverage for attorneys protects against claims of improper advice, errors in legal representation, and breaches of duty. It’s about safeguarding your practice and ensuring continuation even in the face of potential claims.

The financial sector operates under strict regulations, and ensuring the right professional liability insurance is even more vital. Errors and omissions insurance provides a safety net against claims that can arise from your professional services.

Building Trust Through Insurance

The Impact of AI on Professional Liability Policies

Artificial intelligence has become an integral part of many businesses, but it also brings about new liability challenges. As more companies rely on AI for decision-making, the implications for professional liability insurance are significant.

Understanding AI’s Role in Liability

AI can influence decisions in various industries, meaning errors can occur without direct human involvement. This has prompted insurers to rethink their policies and develop coverage that considers AI-driven risks.

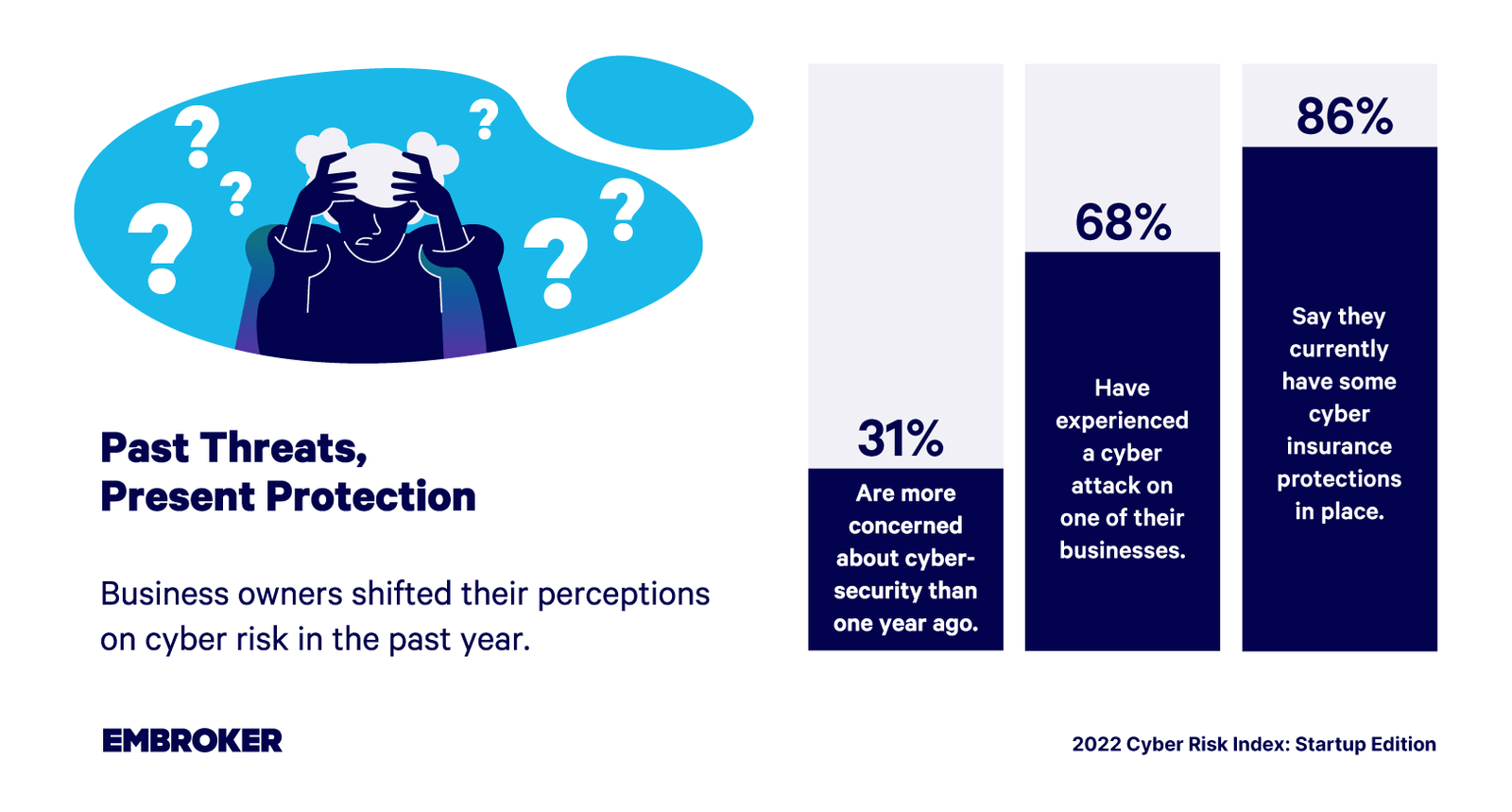

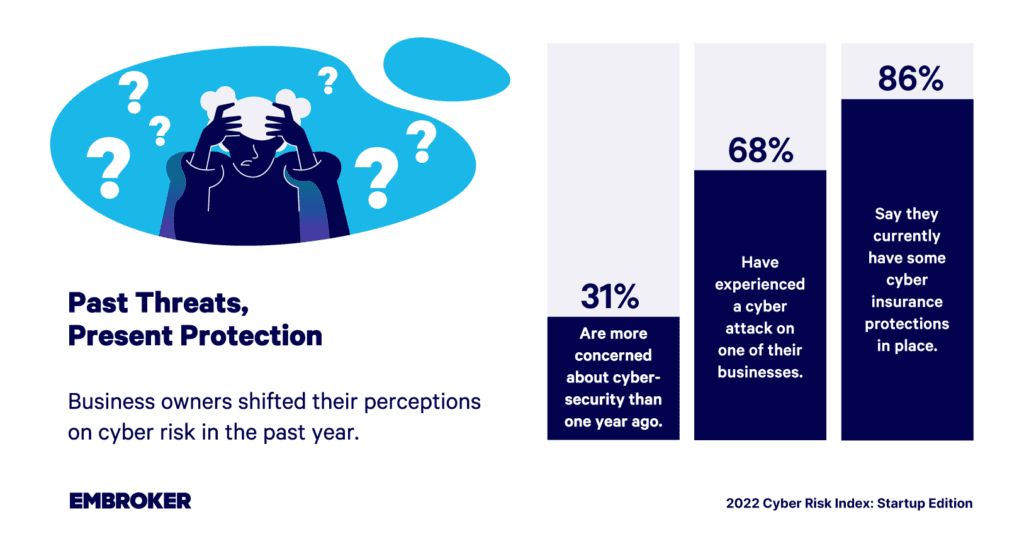

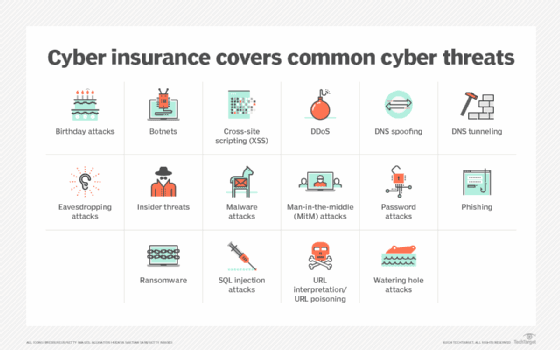

Cybersecurity Threats and Their Influence on Insurance Needs

As cyber threats become increasingly sophisticated, businesses must understand how these challenges shape their insurance needs. Cyberattacks can result in substantial financial losses and reputational damage.

Evaluating the Vulnerability of Your Business

Understanding how susceptible your business is to cyber risks is the first step in addressing potential liabilities. Whether you’re a small business or a large corporation, assessing vulnerabilities can help determine the necessary coverage.

The Impact of Social Engineering on Insurance

Social engineering attacks, where hackers manipulate individuals into divulging confidential information, are on the rise. This growing risk necessitates careful consideration when evaluating your insurance needs.

Protecting Against Human Error

Training your staff to recognize social engineering attempts and having the right insurance policy can mitigate risks associated with these attacks. It’s essential to remember that coverage should address both technological and human factors contributing to security breaches.

Navigating the Hard Market in Professional Liability

The insurance market can be as volatile as the risks businesses face. During hard market conditions, obtaining coverage can become challenging and more expensive.

Strategies for Securing Necessary Coverage

Being proactive, shopping around for various policies, and understanding what underwriters are looking for can help navigate these difficult times. Sometimes, it may even require adjusting your coverage needs based on the ever-changing market landscape.

Lessons from High-Profile Professional Liability Lawsuits

High-profile lawsuits often provide invaluable lessons for businesses regarding the importance of liability insurance. Analyzing these case studies can yield insights into what can go wrong and how to protect your organization.

Learning from Mistakes

Failure to mitigate risks can lead to lawsuits that damage not only finances but also reputation. Proactive measures, such as maintaining insurance and training employees, can significantly reduce the risk of such situations.

How Large Corporations Manage Their Liability Risks

For large corporations, the stakes are even higher. With numerous departments and a diverse range of services, understanding the full scope of liability is critical.

Comprehensive Risk Management Strategies

Large organizations often employ dedicated risk management teams that focus on identifying potential liabilities and mitigating risks effectively. This comprehensive approach helps protect the company’s assets and ensures continued operation amidst potential liabilities.

Case Study: Successful Claims Mitigation Strategies

Learning from organizations that have successfully navigated liability claims can provide a roadmap for your own risk management strategies. Gathering real-world examples of effective claims mitigation can pave the way toward establishing best practices.

Implementing Effective Strategies

Whether it’s through thorough employee training or investment in advanced cybersecurity measures, understanding successful techniques from others can inspire you to implement similar strategies in your organization.

The Financial Impact of Negligence Claims on Small Businesses

For small businesses, the ramifications of negligence claims can be devastating. The costs associated with litigation and settlements can exceed what many companies can afford.

Prioritizing Protection for Small Businesses

Understanding the potential financial impact can encourage small business owners to invest in adequate insurance coverage. This essential financial safety net ensures that you’re not left vulnerable to overwhelming costs.

Gaining Insight from Case Studies

Identifying trends in claims and resolutions can empower you to strategize more effectively in your operations. Knowing the common pitfalls other businesses have faced can guide your decision-making and risk management efforts.

A Step-by-Step Guide to Filing a Professional Liability Claim

Filing a claim can be a daunting process, especially if you’re unfamiliar with the intricacies involved. Understanding the steps can ease this burden and prepare you for what to expect.

Streamlining the Claims Process

- Review Your Policy: Understanding your coverage is crucial.

- Gather Documentation: Compile all relevant documentation and evidence.

- Notify Your Insurer Promptly: Time-sensitive claims require immediate action.

- Consult with Legal Counsel: Depending on your situation, legal advice can be invaluable.

Setting Realistic Expectations

Having a clear understanding of these steps can help you prepare for the process and alleviate some stress associated with filing a claim.

Evaluating Your Options

Consider factors such as policy limits, exclusions, and the complaints history of potential insurers. Getting multiple quotes can give you a better understanding of what’s available.

It’s essential to know your policy limits and deductibles as they play a significant role in your coverage. These decisions can impact your overall financial exposure in the event of a claim.

Balancing Coverage with Affordability

You’ll want to balance a higher deductible with manageable premiums. Understanding these intricacies ensures you make informed decisions that align with your business goals.

Tips for Negotiating Better Terms with Your Insurer

Negotiation is key when it comes to obtaining the best coverage terms. Knowing how to approach your insurer can significantly benefit your business.

Strategies for Successful Negotiation

- Do Your Research: Familiarize yourself with market rates and trends.

- Prepare to Discuss Your Business: Articulating your needs and risks can garner better terms.

- Be Open to Compromise: Flexibility can often lead to mutually beneficial agreements.

Building a Relationship with Your Insurer

Ensuring you maintain a good relationship with your insurer can lead to better service, quicker resolutions, and improved terms over time.

How to Educate Employees About Liability Risks

Employee education is crucial in mitigating potential liability risks. Ensuring that your team understands their responsibilities promotes a culture of accountability.

Creating an Engaging Training Program

- Regular Workshops: Conduct periodic training on company policies and legal obligations.

- Interactive Learning Modules: Use technology to make learning engaging.

- Open Discussions: Encourage employees to voice concerns and ask questions.

The Importance of Communication

Clear communication about expectations and responsibilities reduces the likelihood of errors that could lead to liability claims.

Exploring Niche Markets for Professional Liability Coverage

As industries evolve, so do the types of professional liability coverage needed. Exploring niche markets can provide opportunities for tailored insurance solutions.

Identifying Emerging Industries

Emerging markets, such as biotechnology or remote work services, may face different risks than established industries. Understanding these needs can help you tailor coverage appropriately.

Customizing Policies for Emerging Industries

Adjusting your insurance policies to meet the demands of emerging industries ensures your coverage remains relevant and effective.

Adapting to New Risks

Whether through new technologies or market shifts, being proactive in customizing your policies keeps your business protected against unforeseen liabilities.

The Role of Professional Associations in Shaping Coverage Needs

Professional associations can play a significant role in shaping the insurance landscape for their members.

Advocating for Adequate Coverage

Associations often provide resources tailored to their specific profession, educating members about essential coverage options.

Leveraging Industry-Specific Insights to Enhance Coverage Options

Industry insights can help you understand evolving risks, allowing you to enhance your insurance policies in line with these changes.

Staying Ahead of Industry Trends

Regularly assessing trends in your industry ensures that your coverage remains effective and that you’re adequately protected against emerging threats.

Holistic Risk Management Strategies

A comprehensive risk management plan integrates insurance with operational practices, ensuring that your business is resilient against potential claims.

Professional Liability Insurance 101: A Beginner’s Guide

If you’re new to the realm of professional liability insurance, starting with the basics helps demystify coverage options.

Understanding Key Concepts

- Definition: Professional liability insurance protects against claims related to professional mistakes.

- Importance: It mitigates financial threats related to errors and omissions.

Recognizing Your Insurance Needs

Being mindful of your specific business model will help you choose appropriate coverage and help guide your decision-making process.

Key Terms and Definitions in Professional Liability Insurance

Understanding common terms goes a long way towards navigating the world of professional liability insurance.

Breaking Down Essential Concepts

- Professional Liability Insurance: Covers claims of negligence in professional services.

- Exclusions: Specific instances or situations not covered by the policy.

- Limits of Liability: The maximum amount an insurer agrees to pay under the policy terms.

Common Exclusions in E&O Policies

Even the best policies come with exclusions. Knowing what is not covered is essential in planning your coverage.

Preparing for the Unexpected

Reviewing your policy for common exclusions, such as intentional misconduct or illegal acts, helps you understand your limitations upfront.

The Role of Risk Management in Mitigating Liability

Effective risk management strategies are essential for reducing potential liability claims. By proactively managing risk, you can protect your business on multiple fronts.

Implementing Risk Management Practices

Incorporating risk management best practices into your business operations builds a strong defense against liability claims.

Factors Affecting Professional Liability Premiums

Your insurance premium can vary due to several factors. Understanding how these elements affect your coverage can lead to more informed decisions.

Key Considerations for Premium Calculation

- Business Type: Higher-risk professions often incur higher premiums.

- Claims History: A history of claims can lead to increased costs.

Negotiating Lower Premiums

By demonstrating strong risk management practices, you might negotiate better premiums and coverage conditions.

Comparing Claims-Made vs. Occurrence Policies

Understanding the difference between claims-made and occurrence policies can help you make informed decisions when selecting coverage.

Key Differences

- Claims-Made Policy: Covers claims made during the policy period, regardless of when the event occurred.

- Occurrence Policy: Covers incidents that occur during the policy term, regardless of when claims are made.

Choosing the Right Policy for Your Needs

Each type of policy has its pros and cons. Assessing your business operations will help you select the most suitable option.

Understanding the Claims Process: What to Expect

Filing an insurance claim can be an overwhelming experience. Knowing what to expect can ease the burden.

Steps in the Claims Process

- Notify the Insurer: Prompt communication is key.

- Investigate the Claim: Insurers may conduct their investigation.

- Resolution: Determine whether the claim is covered and agree on settlement terms.

Setting Realistic Expectations

Understanding this process ensures you remain informed and prepared for any claims that might arise.

The Importance of Documentation in Liability Claims

Proper documentation can make or break a liability claim. Keeping detailed records protects you legally and ensures smooth claim processing.

Best Practices for Documentation

- Maintain Records: Keep comprehensive records of business operations.

- Document Meetings: Record decisions and actions taken in meetings.

- Follow Up: Regularly check in on unresolved issues.

Best Practices for Client Communication and Engagement

Effective communication with clients is critical in handling potential liability issues. Maintaining transparency fosters trust and can mitigate misunderstandings.

Strategies for Engaging Clients

- Regular Updates: Keep clients informed about their project status and any changes.

- Prompt Responses: Encourage open lines of communication.

- Feedback Mechanisms: Solicit feedback to address concerns promptly.

Building Strong Client Relationships

An engaged client is less likely to pursue claims, making client relationship management a crucial aspect of professional liability risk management.

With the ever-changing landscape of cybersecurity threats and their implications for businesses, now is the time to take a proactive stance on your insurance needs. By understanding the nuances of professional liability insurance and considering the evolving nature of cyber risks, you can better prepare your business for the future. The right coverage not only protects your assets but also helps you build a strong foundation upon which your business can thrive amidst challenges.