The Evolution of Professional Liability Insurance

Professional Liability Insurance has come a long way since its inception. Originally tailored for professions like medicine and law, the scope has broadened to cover various industries where professional services are offered. The rise of technology and the gig economy has prompted a surge in demand for comprehensive coverage that addresses unique risks associated with modern professions.

You might be surprised to learn that the roots of professional liability insurance can be traced back to the late 20th century. As industries evolved and transformed, so did the need for more specialized insurance products that cater specifically to the risks of providing professional advice or services. This evolution continues as new industries emerge, necessitating tailored coverage options.

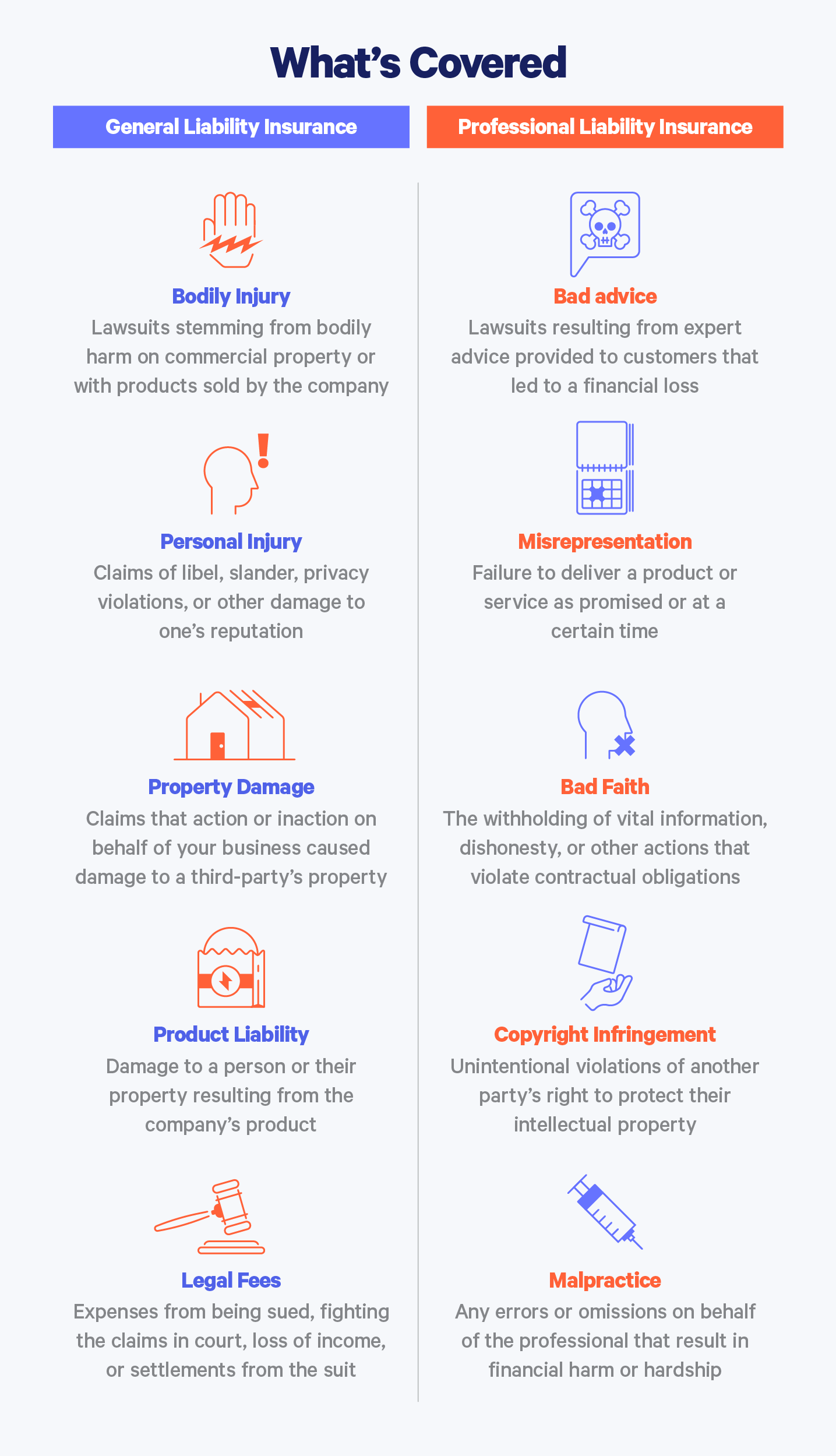

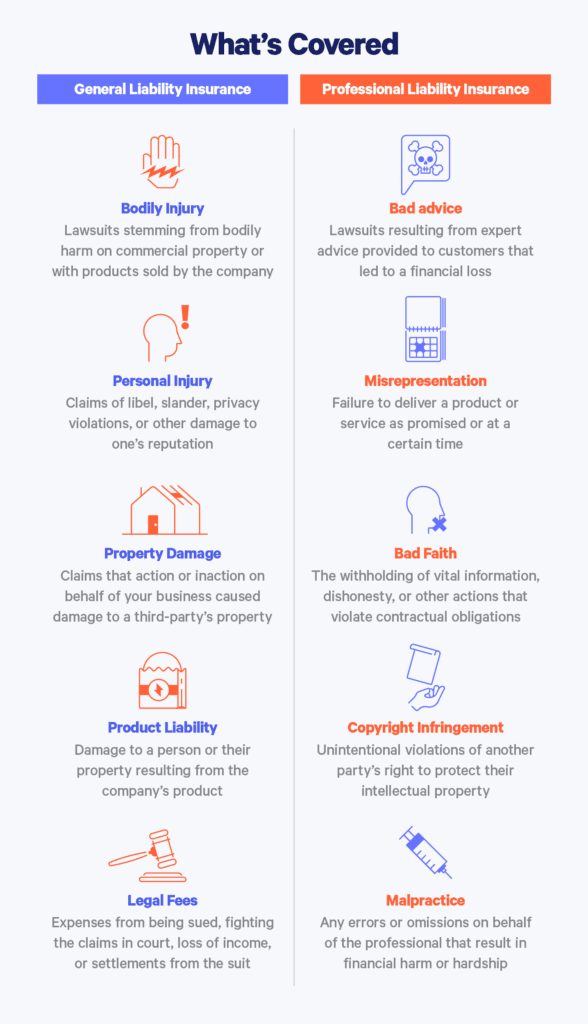

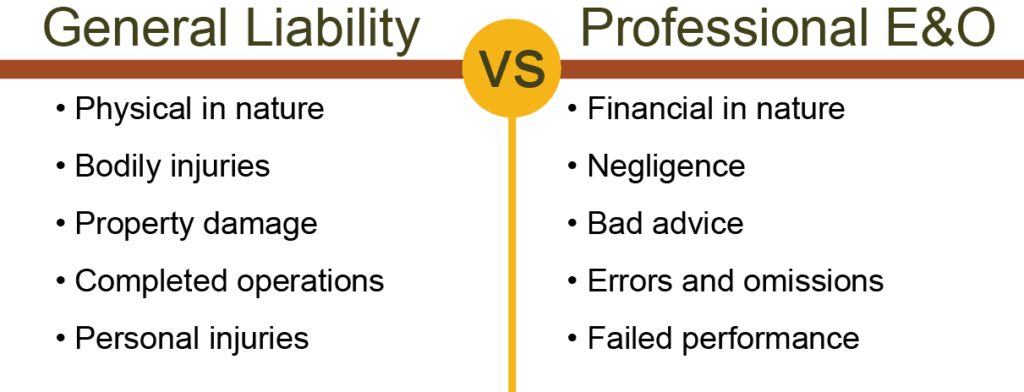

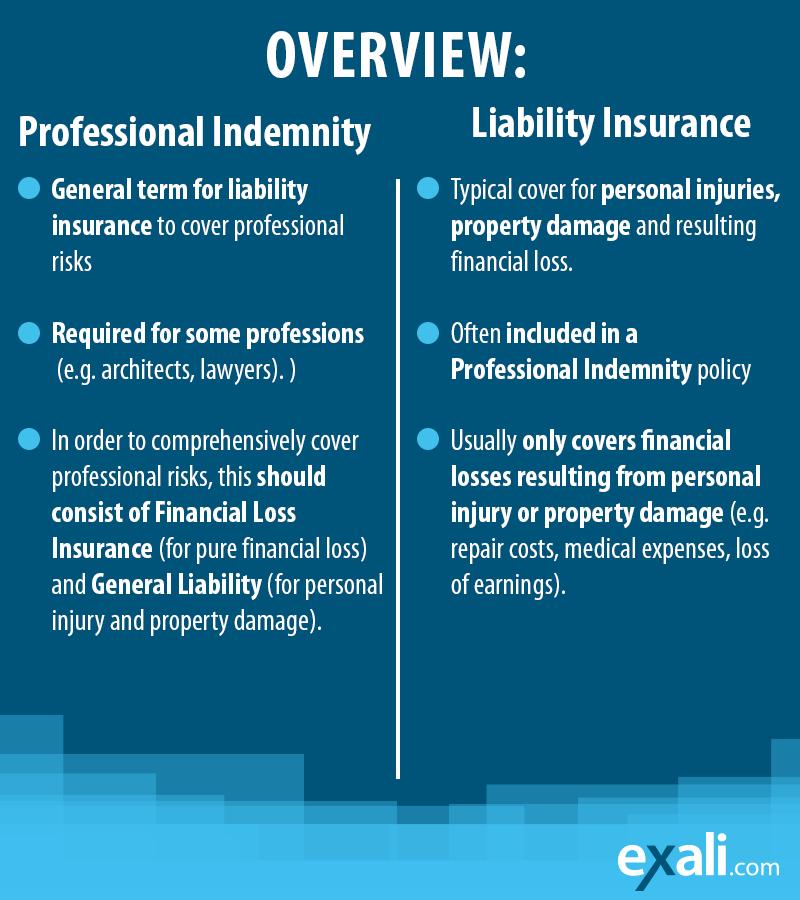

When it comes to understanding Errors and Omissions Insurance, there are several misconceptions that often mislead professionals. Many believe that General Liability Insurance provides adequate protection against all professional risks. While General Liability typically covers third-party bodily injury and property damage, it does not cover claims arising from professional services or advice.

How Professional Liability Insurance Differs from General Liability

Understanding the distinctions between Professional Liability Insurance and General Liability is paramount for any professional. Here’s a breakdown that highlights their key differences:

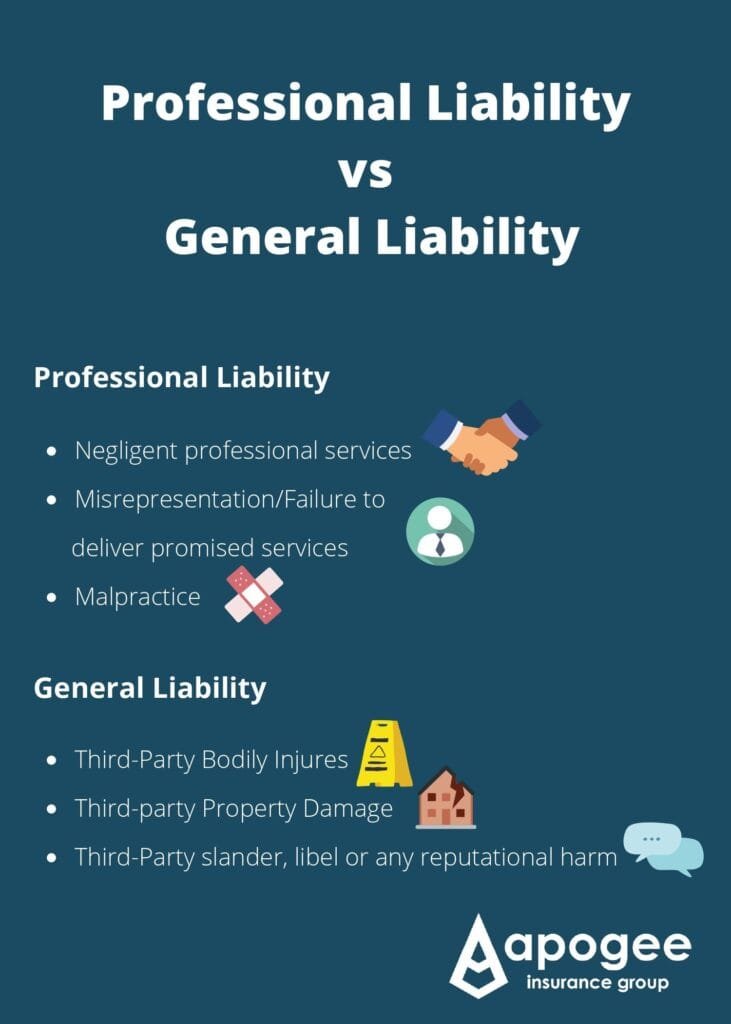

| Feature | Professional Liability Insurance | General Liability Insurance |

|---|---|---|

| Coverage Type | Covers claims of negligence, errors, and omissions in services | Covers bodily injury and property damage |

| Applicability | Relevant for service-oriented professions | Covers businesses with physical premises |

| Claim Triggers | Claims are triggered by failure to deliver services as promised | Claims typically arise from accidents |

| Legal Defense Costs | Often includes legal defense costs against claims | Legal costs may not be fully covered |

| Policy Limits | Usually higher due to the nature of potential claims | Generally lower limits |

The Role of Professional Liability in Business Continuity

Additionally, it reinforces your business’s reputation. Clients will feel more secure engaging with you, knowing that you have the necessary safeguards in place. In industries where trust and credibility are paramount, this insurance becomes an integral part of your risk management strategy.

How to Evaluate Your Need for Professional Liability Coverage

Evaluating your need for Professional Liability Insurance involves assessing risks tied to your profession. Here are a few factors you should consider:

-

Nature of Services

-

Client Base

-

Industry Standards

-

Past Claims

By thoughtfully assessing these factors, you can make an informed decision on whether you need Professional Liability coverage.

Tailoring Liability Insurance for the Tech Industry

-

Cyber Liability: With an increasing number of tech companies experiencing data breaches, you should consider policies that offer protection against breaches and breaches of confidentiality.

-

Intellectual Property: If your work involves creating software or applications, having coverage for potential IP issues is crucial.

-

Service Interruptions: As a tech professional, any downtime you cause in a client’s operation can lead to financial loss, necessitating coverage for service errors.

Tailoring your Professional Liability Insurance to meet these specific risks will ensure adequate protection and peace of mind.

Professional Liability Needs for Healthcare Providers

The healthcare profession carries significant liability risks. Errors in treatment or misdiagnosis can result in substantial claims. Here are several factors healthcare providers should consider:

-

Malpractice Coverage

-

Regulatory Compliance

-

Patient Confidentiality: In healthcare, the protection of patient information is vital. Your liability coverage should include clauses regarding breach of confidentiality and HIPAA violations.

Investing in the right Professional Liability Insurance can shield you against financial risks while enhancing your credibility as a trusted healthcare provider.

Insurance Challenges in the Construction Sector

Working in the construction sector presents unique liability challenges, ranging from contractual disputes to construction defects. Here are essential insurance considerations for construction professionals:

-

Contractual Liability: Ensure your Professional Liability coverage addresses liabilities stemming from contractual obligations.

-

Design Errors

-

Project Delays: Delays can lead to contractual disputes, which your insurance should be equipped to handle.

Legal Professionals: Unique Insurance Considerations

As a lawyer, professional liability is a cornerstone of your practice. Here are key elements to consider:

-

Malpractice Insurance: Commonly referred to as legal malpractice insurance, this specialty coverage is crucial in protecting against claims resulting from negligence, errors, or omissions in your legal practice.

-

Policy Limits and Scope: You’re often held to high standards, so you’ll want to ensure your policy limits are sufficient to cover potential claims and suit costs.

-

Claims-Made vs. Occurrence Policies: Familiarizing yourself with the differences between claims-made and occurrence policies is essential for legal professionals, especially when considering new clients and ongoing practices.

Understanding your unique insurance landscape ensures you are well-prepared for any claims while maintaining your professional integrity.

For those in the financial sector, Professional Liability Insurance can shield you from claims related to financial advice, investment strategies, or mismanagement of client funds. Here are a few reasons why this coverage is vital for your practice:

-

Client Trust: With the stakes as high as they are in finance, clients often expect their advisors to have comprehensive insurance to mitigate potential errors.

-

Compliance Landscape: The financial industry is heavily regulated. Ensure your insurance meets the standards set forth by regulatory bodies.

-

Market Volatility

By being proactive about your insurance needs, you safeguard both your business and your clients’ investments.

The Impact of AI on Professional Liability Policies

As Artificial Intelligence continues to grow and influence various industries, understanding how this affects your professional liability is crucial. Here are a few considerations:

-

Risk Assessment: AI tools can assist in identifying risks before they become claims. Consider integrating technology to better assess your liability exposure.

-

Policy Adaptability

-

Ethical Considerations: As AI evolves, so do ethical implications. Acknowledge these in your services, backed by robust liability coverage.

Overall, recognizing AI’s impact on your business can help reshape your insurance needs and strengthen your risk management framework.

Cybersecurity Threats and Their Influence on Insurance Needs

In an increasingly digital world, cybersecurity threats are on the rise, impacting liability insurance needs across all industries. Here’s why integrating cybersecurity considerations into your liability coverage is imperative:

-

Data Breaches: If your services involve handling sensitive data, ask your insurer about coverage options that specifically address data breach claims.

-

Cyber Liability Policies

-

Client Expectations: Many clients require businesses to demonstrate they have adequate cybersecurity measures and insurance in place.

By proactively addressing cybersecurity risks, you can enhance your overall liability protection while satisfying client demands.

How Climate Change Affects Liability Risk Assessments

Climate change is reshaping the landscape of risk management and liability insurance needs. Here are a few aspects to consider:

-

Increased Weather-Related Claims: As extreme weather events become more frequent, the potential for liability claims increases. Coverage that addresses these risks may be necessary.

-

Sustainability Practices: Clients and governments increasingly demand sustainable practices. Insurance companies are likely to take this into account when assessing risk.

-

Long-Term Implications: Evaluate how industry trends related to climate change will affect future liability insurance needs. Being ahead of the curve can position your business favorably.

Recognizing the influence of climate change on your professional liability can facilitate informed decision-making about your coverage.

Social Engineering: A Growing Concern for Insurers

With the rise of social engineering scams, having comprehensive insurance coverage becomes even more critical. Here’s how this emerging threat affects your liability insurance:

-

Fraudulent Claims: Social engineering can lead to fraudulent claims against your business. Make sure your policy covers these types of incidents.

-

Employee Training: Educating employees about identifying and preventing social engineering scams will help safeguard your business.

-

Incident Response

By acknowledging social engineering risks, you create a nest of protection around your business that can mitigate future losses.

Navigating the Hard Market in Professional Liability

The insurance market can fluctuate, leading to a hard market scenario where premiums rise, and coverage options become limited. Here are some strategies for navigating this tough landscape:

-

Renewal Timing: Be proactive about your renewal process. Start discussions with your insurer early to avoid last-minute challenges.

-

Explore Multiple Insurers: Don’t hesitate to explore various insurance providers. Different insurers may view your risk profile differently, potentially leading to better rates.

-

Improve Risk Management: Demonstrating effective risk management can lead to better rates and terms even in a hard market.

Navigating a hard market requires diligence, but with the right strategies, you can protect your business and secure the coverage you need.

Lessons from High-Profile Professional Liability Lawsuits

-

Policy Gap Awareness: Many professionals found themselves in trouble due to misunderstandings about coverage limits and exclusions in their policies.

-

Documentation Importance: High-stakes cases have underscored the importance of meticulous documentation, illustrating its role in defending against claims.

-

Risk Assessment: Regularly assessing risk exposure in light of industry developments can help avoid becoming the next cautionary tale.

By learning from those who faced liability issues, you can fortify your own practices and minimize future risks.

How Large Corporations Manage Their Liability Risks

Large corporations often have more resources to deal with liability risks, but they also face more extensive exposure. Here’s how they typically manage these risks:

-

Layered Insurance Strategies: Corporations often utilize layered insurance approaches, purchasing both General and Professional Liability Insurance to cover multiple risk areas.

-

Specialized Risk Management Teams: Many larger firms have dedicated teams that focus solely on risk assessment and management.

-

Legal Support: In-house legal teams are invaluable for navigating claims and insurance negotiations, ensuring comprehensive coverage for any potential issues.

While your business might be smaller, there are lessons to be learned from the robust strategies employed by larger corporations.

Case Study: Successful Claims Mitigation Strategies

Reflecting on real-world scenarios can guide your approach to claims mitigation. Consider the strategies employed by a successful consulting firm that managed to reduce claims significantly:

-

Strict Engagement Contracts: Detailed contracts defined scope and expectations clearly, minimizing misunderstandings with clients.

-

Regular Training: Ongoing training for staff ensured that everyone understood the risks and knew how to mitigate them.

-

Client Communication: Establishing open lines of communication with clients helped address concerns before they escalated to claims.

By analyzing successful mitigation strategies, you can determine actionable steps tailored to your business.

The Financial Impact of Negligence Claims on Small Businesses

Negligence claims can have catastrophic financial consequences, particularly for small businesses. Here are a few statistics to consider:

-

Average Cost of Claims: Research indicates that the average cost of a professional liability claim can exceed $35,000 when attorney fees and settlements are factored in.

-

Closure Rates: Many small businesses face closure after paying out on negligence claims, making robust insurance crucial for survival.

-

Professional Reputation: Negative publicity surrounding a negligence claim can also lead to a loss of clients, further compounding financial challenges.

Understanding the financial implications underscores the importance of investing in comprehensive Professional Liability Insurance.

Reviewing real-world Examples of Errors and Omissions claims can help you appreciate how different industries handle such challenges. Here are a few examples across various sectors:

-

Consulting Firms: A firm provided faulty analysis that led to substantial losses for a client. The claim ended up costing the firm $100,000 in settlements.

-

Real Estate Agencies: Failure to disclose property defects led to a lawsuit. The agency paid over $50,000 in legal fees and settlements.

-

IT Companies: An IT provider faced a claim for a data breach that led to a severe loss for the client. Resolution took the form of both settlement and improved security protocols.

A Step-by-Step Guide to Filing a Professional Liability Claim

Filing a claim can be daunting, especially during stressful situations. Here’s a detailed guide to simplify the process for you:

Step 1: Notify Your Insurer

As soon as you’re aware of a potential claim, contact your insurance company immediately to report it. Ensure you provide all relevant details for accurate processing.

Step 2: Collect Documentation

Gather any necessary documentation related to the claim. This may include contracts, emails, and any other correspondence relevant to the situation.

Step 3: Provide a Written Statement

Prepare a clear and concise written statement of the incident, outlining the facts as you understand them. Be honest and straightforward.

Step 4: Cooperate with Your Insurer

Throughout the claims process, cooperate fully with your insurer’s investigation. This can help resolve claims more effectively while demonstrating good faith.

Step 5: Keep Records

Maintain detailed records of all communications and documents exchanged during the claims process.

Step 6: Stay Informed

Keep yourself updated on the progress of your claim and be sure to ask your insurer for clarifications if needed.

Filing a claim doesn’t have to be an overwhelming process if you approach it methodically.

Choosing the right Professional Liability Insurance policy requires careful consideration. Here are essential factors to keep in mind:

-

Coverage Options: Understand what is included in the policy. Ensure it covers the specific risks relevant to your profession.

-

Limits and Deductibles: Analyze policy limits and deductibles. Higher limits are generally advisable for high-stakes professions.

-

Exclusions: Be aware of coverage exclusions. Understanding what isn’t covered is just as essential as knowing what is.

-

Claims Process: Evaluate the claims process of potential insurers. A streamlined process can make a world of difference when dealing with claims.

By being diligent in your research, you can select a policy that meets your needs effectively.

Navigating policy limits and deductibles is vital in ensuring comprehensive coverage. Here’s a brief guide:

-

Policy Limits: This defines the maximum amount your insurer will pay for a claim. Make sure these limits align with the potential risks in your field.

-

Deductibles: The deductible is the amount you must pay out-of-pocket before your insurer covers claims. Choose a deductible that remains manageable within your budget while providing adequate security.

-

Occurrence vs. Claims-Made Policies: Understand the difference between occurrence policies (which cover incidents occurring during the policy period) and claims-made policies (which cover claims made during the policy period).

Having a clear understanding of these elements will help you navigate your coverage effectively.

Tips for Negotiating Better Terms with Your Insurer

Negotiating your Professional Liability Insurance terms offers considerable benefits. Here are some tips to achieve favorable outcomes:

-

Do Your Homework: Research the averages for your profession to understand standard prices and coverage levels before negotiating.

-

Be Honest About Your Risks: Disclose all relevant information, including past claims history. This transparency can facilitate better terms.

-

Ask About Bundling

-

Leverage Competition: Get quotes from several insurers; this gives you leverage during negotiations when discussing premiums and terms.

Effective negotiation can lead to favorable terms, which can save your business substantial funds and ensure better coverage.

How to Educate Employees About Liability Risks

Investing in employee education about liability risks is vital. Here are strategies to enhance awareness:

-

Regular Training Programs: Implement routine training sessions that emphasize the importance of adhering to best practices to minimize liability risks.

-

Create Accessible Resources: Develop materials like handbooks or online resources that outline key liability risk factors specific to your industry.

-

Foster Open Communication: Encourage employees to raise concerns and questions regarding liability risks. A culture of open communication fosters awareness.

By prioritizing education, you cultivate an informed employee base, which helps in effectively managing liability risks.

Exploring Niche Markets for Professional Liability Coverage

As industries evolve, niche markets are emerging, prompting the need for tailored professional liability coverage. Here are some niches that show promise:

-

Technology Startups: Tailored coverage is essential for tech startups facing unique challenges, from software errors to IP infringement.

-

Environmental Consultants: Increased regulations necessitate coverage that addresses both compliance and liabilities arising from environmental consulting.

-

Telemedicine Professionals: As telemedicine continues to surge, specialized coverage addressing remote practices can safeguard healthcare providers.

Identifying niche markets allows for the development of customized policies that effectively protect professionals operating in unique sectors.

Customizing Policies for Emerging Industries

Emerging industries require tailored insurance solutions that appreciate their specific risks. Here are approaches for customization:

-

Risk Assessment: Conduct thorough risk assessments to identify factors unique to your emerging industry.

-

Consult with Specialists: Engage with insurance professionals who specialize in your industry for insights on necessary coverage.

-

Policy Adjustments: Revise your policies as your business grows and evolves. Adaptability is key in dynamic sectors.

Customized Professional Liability Insurance ensures you’re not over- or under-insured, offering peace of mind as you navigate growth.

The Role of Professional Associations in Shaping Coverage Needs

Professional associations can play a constitutive role in shaping liability coverage requirements for their members. Consider these factors:

-

Standards and Guidelines: Many associations establish industry standards that set expectations for insurance coverage.

-

Group Insurance Plans: An association might offer group insurance plans, allowing members access to competitive rates.

-

Education and Training: Professional associations often provide resources for training and education that can further bolster liability management.

Aligning with your professional association can help you stay informed about best practices in liability insurance.

Leveraging Industry-Specific Insights to Enhance Coverage Options

Industry-specific insights can help tailor liability coverage to meet the unique challenges faced by professionals. Here’s how you can leverage these insights:

-

Stay Informed: Subscribing to industry newsletters or attending seminars can provide valuable risk management insights.

-

Network with Peers: Engage with peers to gather insights on common risks and learn how they navigate liability insurance.

-

Consult with Experts: Engage with insurance providers who have robust industry knowledge for tailored recommendations.

With a proactive approach, you can enhance your liability coverage options and effectively mitigate risks.

Implementing comprehensive Risk Management Plans can prevent potential claims. Here’s a process for the development of these plans:

-

Identify Risks: Begin with a thorough risk assessment to identify potential vulnerabilities in your business operations.

-

Mitigation Strategies: Develop strategies to mitigate identified risks. This may include employee training, process enhancements, or technology upgrades.

-

Continuous Monitoring: Regularly revisit and assess your risk management plan. Continuous adaptation is vital for ongoing effectiveness.

-

Engage Stakeholders: Involve key stakeholders in the development and review of risk management plans to ensure comprehensive perspectives.

Having a well-developed risk management plan can align seamlessly with your Professional Liability Insurance, thus enabling you to proactively manage potential claims.

Professional Liability Insurance 101: A Beginner’s Guide

If you’re new to Professional Liability Insurance, don’t worry! Here’s a straightforward guide to help you navigate the essentials:

What is Professional Liability Insurance?

Professional Liability Insurance provides protection against claims that arise from advice, services, or professional conduct. It can cover legal costs and settlements, depending on policy terms.

Who Needs It?

If your profession involves providing specialized services or advice (e.g., consultants, healthcare providers, legal firms), then you need this essential coverage.

Key Components of the Policy

Understanding the fundamentals of your policy is crucial. Here are some key terms to consider:

-

Coverage Limits: Know your policy’s maximum payment amounts for claims.

-

Exclusions: Understand what is not covered by your policy.

-

Premiums: Awareness of how premiums are calculated can help with budgeting.

When navigating the world of Liability Insurance, understanding the ABCs of Errors and Omissions Insurance is a massive advantage.

A: Awareness of Risks

Be aware of the inherent risks in your profession. Develop a thorough understanding of these risks, so you can select adequate insurance protection.

B: Benefits of Coverage

C: Compliance

By mastering the basics, you can confidently approach your coverage and establish a robust protective framework for your professional services.

Why Every Professional Needs Liability Coverage

Every professional needs Liability Insurance for a multitude of reasons:

-

Financial Protection: It protects against the potential financial ruin that can come from a negligence claim.

-

Professional Reputation: Having coverage shows clients you take your responsibilities seriously, bolstering trust.

-

Legal Support: Insurance often includes legal defense, guiding you through complicated legal processes.

With tightly wound networks of legal expectations in place, Professional Liability Insurance is essential in providing security and peace of mind for any professional.

Understanding the Claims Process: What to Expect

Navigating the claims process can seem daunting, but it doesn’t have to be. Here’s a brief overview of what you can expect:

-

Filing the Claim: Contact your insurer and complete any required documentation.

-

Investigation: The insurance company will investigate your claim by examining the evidence provided.

-

Resolution: Upon evaluation, the insurer will decide whether the claim is covered and what compensation (if any) will be provided.

-

Finalization: If the claim is valid, you’ll receive settlement amounts, and all remaining paperwork will be finalized.

Understanding these steps prepares you for potential claims and helps streamline the process.

Key Terms and Definitions in Professional Liability Insurance

Familiarizing yourself with important terms can improve your understanding of Executive Liability Insurance. Here are some key definitions:

-

: Refers to the mistakes or oversights that professionals might make while providing their services.

-

Claim: A formal request for payment under your insurance policy.

-

Deductible: The amount you pay out-of-pocket before the insurance kicks in for a claim or loss.

-

Exclusions: Specific instances or scenarios that are not covered under the policy.

Having a clear understanding of these terms will empower you to communicate effectively with your insurer and make informed decisions.

-

Intentional Acts: Any claims arising from intentional wrongdoing are typically not covered.

-

Contractual Liability: Claims resulting from a breach of a contract may not be covered, depending on the circumstances.

-

Prior Knowledge: If you were aware of a potential claim before obtaining coverage, it likely won’t be covered.

Familiarizing yourself with exclusions in your policy can serve as a protective measure against unwelcome surprises down the line.

The Role of Risk Management in Mitigating Liability

Implementing effective risk management plays a crucial role in preventing potential claims. Here’s how risk management helps:

-

Identifying Risks: Developing a risk assessment strategy identifies potential exposures in your operations.

-

Mitigation Strategies: Discovering ways to manage or eliminate identified risks protects both your business and clients.

-

Ongoing Review: Carry out regular evaluations of operations to ensure changes in the environment do not increase your liability exposure.

Incorporating comprehensive risk management practices into your organization helps minimize the likelihood of claims while enhancing your overall security posture.

Factors Affecting Professional Liability Premiums

Your insurance premiums are influenced by various factors. Here’s what typically impacts your rates:

-

Industry Risk Level: Higher-risk industries may pay more due to the nature of claims associated with those fields.

-

Past Claims History: A history of claims can elevate premiums as insurers see you as a higher risk.

-

Coverage Limits: Higher coverage limits will lead to increased premiums.

-

Business Size: The size of your business, including your revenue and the number of employees, can influence your premium rates.

Understanding these factors can help you budget effectively for insurance and negotiate better terms with insurers.

Comparing Claims-Made vs. Occurrence Policies

When selecting your Professional Liability coverage, you’ll likely encounter two types of policies: claims-made and occurrence. Here’s a comparison:

| Feature | Claims-Made Policy | Occurrence Policy |

|---|---|---|

| Coverage Trigger | Coverage exists when a claim is made during the policy period | Coverage exists if the event occurred during the policy period, regardless of when the claim is made |

| Duration of Coverage | Ends once the policy is canceled or not renewed | Stays in effect as long as the incident occurred during the policy period |

| Cost | Typically lower premiums | Often higher premiums due to comprehensive coverage |

Each policy type has its pros and cons. Consider your business needs and how long you expect to maintain a relationship with clients when deciding which is right for you.

The Importance of Adequate Coverage Limits

Choosing appropriate coverage limits protects your business from potential losses. Here’s why it matters:

-

Financial Stability: Adequate limits can prevent costly out-of-pocket expenses for high-stakes claims.

-

Client Requirements: Some clients may require proof of coverage at specific limits before entering into contracts.

-

Risk Potential: Business sectors with higher risks often require larger coverage limits to mitigate significant exposures.

By ensuring adequate coverage limits, you can fortify your business against unforeseen liabilities and instill confidence in your clients.

How to Choose the Right Deductible for Your Business

Selecting the right deductible is also a critical aspect of your Professional Liability Insurance. Here are factors to consider:

-

Financial Comfort: Choose a deductible that fits within your financial capacity for out-of-pocket expenses in case of a claim.

-

Premium Savings: Higher deductibles often lead to lower premiums, which can be beneficial if you have a strong risk management strategy.

-

Claim Frequency: Consider how often you anticipate making claims. If you expect minimal claims, a higher deductible may be suitable.

Strategically considering your deductible can connect your insurance costs to your financial planning effectively.

The Impact of Prior Claims on Future Insurability

Your history of prior claims can have a significant impact on your future insurability. Here are some points to remember:

-

Higher Premiums: A history of claims can raise premiums as insurers perceive you as a greater risk.

-

Coverage Limitations: Insurers may impose additional exclusions or requirements for coverage based on past claims.

-

Reputation: Frequent claims can tarnish your professional reputation, potentially affecting new business acquisition.

Understanding these implications motivates you to maintain a proactive approach to risk management and compliance.

When to Review and Update Your Liability Coverage

Regularly reviewing and updating your liability coverage is essential to ensure it meets evolving business needs. Here are instances when you should reevaluate:

-

Business Growth: Any expansion or diversification in services often necessitates updates to coverage levels.

-

Regulatory Changes: Keeping first-hand contact with changes in industry regulations or standards can inform necessary modifications to your policy.

-

Claims History: After a claim, it’s vital to assess your coverage to accommodate newfound risk exposures.

Being diligent in reviewing your coverage ensures you’re protected against emerging risks while meeting the needs of your business.

The Role of Brokers and Agents in the Insurance Process

Working with experienced brokers and agents can streamline the insurance process. Here’s how they can help you:

-

Policy Experience: Brokers often have extensive knowledge of market offerings and can guide you toward suitable coverage.

-

Negotiation Skills: They possess negotiation skills that can yield better rates and terms from insurance providers on your behalf.

-

Claims Assistance: Should the need arise, brokers can assist in the claims process by ensuring all necessary steps are undertaken.

Utilizing the expertise of brokers or agents can enhance your insurance experience and enhance your business’s protection.

Tips for Communicating with Your Insurer

Successful communication with your insurer is essential for smooth operations. Here are effective strategies to foster communication:

-

Provide Clear Information: When speaking with your insurer, provide accurate and detailed information about your business and its operations.

-

Ask Questions: Don’t hesitate to seek clarification about terms, coverage, or claims processes to ensure your understanding.

-

Keep Documentation Updated: Regularly update your insurer on changes in your business structure or risks that could affect your coverage.

By maintaining clear channels of communication, you build a positive rapport that ensures your needs are met promptly.

Professional Liability for Accountants: Beyond the Numbers

Accountants play a vital role in business management but face significant risks regarding liability. Here are elements to consider for accountants seeking liability coverage:

-

Tax Filing Errors

-

Auditing Risks: Comprehensive auditing services require insurance that protects against misstatements or oversights.

-

Client Expectations: Delivering clear communication about your insurance demonstrates professionalism and instills trust with clients.

Architects and Engineers: Building a Strong Insurance Foundation

For architects and engineers, Professional Liability Insurance is critical. Here’s how to build a strong foundation:

-

Design Flaws: Coverage is essential for protecting against claims resulting from architectural or engineering errors.

-

Construction Timelines

-

Licensing Compliance: Review specific licensing regulations to ensure your coverage complies with state requirements.

Building a robust plan for Professional Liability Insurance guards against financial setbacks in these crucial professions.

Attorneys at Law: Protecting Your Practice from Malpractice Claims

For legal professionals, malpractice claims are a constant threat, making insurance essential. Here’s how to protect your practice:

-

Consultation Documentation: Documenting consultations and retaining records can protect against claims stemming from legal advice.

-

Client Communication: Establishing clear communication helps set expectations, reducing misunderstandings that can lead to claims.

-

Regular Training: Implementing ongoing legal trainings ensures staff remains informed, minimizing potential liabilities.

Prioritizing Professional Liability Insurance ensures legal practitioners remain secure while practicing their profession.

For consultants, Errors and Omissions Insurance is vital in protecting your expertise. Here are crucial aspects to consider:

-

Client Expectations: Clients expect consultants to have professional liability coverage, helping you build trust and credibility in your field.

-

Scope of Work: Clearly defining the scope of work in contracts helps manage client expectations, minimizing the risk of claims.

-

Indemnity Clauses: Review contracts to ensure clarity over indemnity clauses, protecting your interests during liability claims.

Dentists: Navigating the Complexities of Liability Insurance

In the healthcare field, dentists are exposed to unique risks. Here’s how to navigate liability effectively:

-

Malpractice Coverage: Investing in malpractice insurance is crucial as it safeguards you against claims arising from dental negligence.

-

Record Keeping: Maintain meticulous patient records to provide protection should a claim arise.

-

Informed Consent: Always gather informed consent before procedures, serving as documentation of patient agreement.

By establishing solid risk management practices backed by robust insurance, dentists can safeguard their practices and reputations.

Financial Advisors: Shielding Your Clients’ Investments

For financial advisors, professional liability is essential to protecting both you and your clients. Here are a few considerations:

-

Investment Strategies

-

Regulatory Compliance: Stay informed about the evolving regulations governing financial services to minimize liability risks.

-

Ethical Obligations: Upholding a strong ethical foundation helps protect your practice, creating a level of trust with your clients.

Securing professional liability coverage is vital for shielding your financial advisory practice from potential claims.

Healthcare Professionals: The Importance of Malpractice Insurance

Healthcare professionals know all too well the importance of malpractice insurance in their field. Here are key components to consider:

-

Patient Safety: The risk of patient claims necessitates malpractice coverage, especially in medical practices.

-

Licensure Compliance: Watch for licensing requirements regarding malpractice insurance. Non-compliance can hinder your practice.

-

Crisis Management: In the event of a claim, adequate malpractice insurance can mitigate financial repercussions and assist with legal representation.

By prioritizing malpractice insurance, healthcare professionals not only protect themselves but also ensure continued patient trust.

IT Professionals: Mitigating Cyber Risks and Data Breaches

-

Data Breach Protection: Given that IT professionals manage sensitive data, cyber insurance is a must for addressing potential data breaches.

-

Service Agreements: Ensure service agreements are comprehensive to minimize potential liability stemming from software failures or data loss.

-

Regular Training: Implement ongoing training to keep staff informed on best practices in data management.

By investing in targeted insurance coverage, IT professionals fortify their businesses against the evolving landscape of cyber risks.

-

Client Expectations: Clients expect their agents to carry necessary liability coverage, thus enhancing client confidence.

-

Contractual Obligations: Review contracts with insurance carriers to ensure comprehensive understanding and transparency.

-

Communication: Keep clients informed about coverage details, ensuring they fully comprehend what is protected.

By safeguarding your practice with appropriate Professional Liability Insurance, you ensure your ability to operate confidently in your role as an agent.

Real Estate Agents: Avoiding Liability in Property Transactions

Real estate agents face unique liabilities involving property transactions. Here are key components to mitigate risks in your practice:

-

Disclosure Obligations: Full disclosure of property details protects against claims from buyers over misrepresentation.

-

Strong Contracts: Utilize clear agreements to establish terms and minimize misunderstandings with clients.

-

Professional Indemnity: Consider additional layers of professional indemnity insurance to protect against transaction-related liabilities.

In the dynamic real estate sector, securing appropriate insurance coverage is essential for safeguarding your practice.

Tech Startups: Tailoring Coverage for Emerging Risks

Tech startups present a unique set of challenges, making tailored insurance coverage essential. Here are crucial considerations:

-

Product Liability: If your startup develops software or technology products, product liability insurance may protect against claims stemming from technology failure.

-

IP Theft: Intellectual property liability insurance can provide coverage against claims related to IP violations.

-

Funding Guidelines

By carefully defining your insurance approach, you can effectively navigate the risks associated with being a tech startup.

Nonprofits: Addressing Unique Liability Concerns

Nonprofits face specific liability challenges while doing essential work in society. Here are important points for effective liability management:

-

Volunteer Liability: Consider coverage that addresses potential claims stemming from the actions of volunteers.

-

Event Risks: Plan for liability insurance that covers events to protect against claims arising from management issues.

-

Regulatory Compliance: Ensure that you remain compliant with all regulations impacting nonprofit operations and insurance requirements.

By addressing the unique liability concerns faced by nonprofits, you can safeguard your mission and ensure effective service delivery.

Media and Entertainment: Managing Risks in a Creative Field

The media and entertainment industry faces various unique liability challenges. Here are essential elements to consider:

-

Copyright Issues: Coverage for intellectual property disputes is crucial for protecting creative works.

-

Contractual Risks: Strong contracts are essential in defining agreements and managing liability risks in collaborations.

-

Public Appearances: Ensure liability coverage extends to risks related to public appearances or events featuring talent.

By investing in specialized insurance coverage, professionals in the media and entertainment industry can effectively navigate the creative landscape while safeguarding their craft.

Hospitality Industry: Protecting Your Guests and Reputation

In the hospitality industry, safeguarding guests and your reputation is vital. Here are strategies to consider for effective liability protection:

-

Guest Safety: Liability for safety breaches can lead to considerable claims. Protect against incidents affecting your guests.

-

Event Management: Ensure your liability coverage addresses risks associated with hosting events or functions.

-

Employee Training: Provide training for staff on safety protocols to minimize liability risks.

By implementing targeted strategies, hospitality professionals can protect their guests and maintain strong reputations.

Educational Institutions: Liability Concerns in Academia

Educational institutions face unique challenges regarding liability. Here are points to consider for effectively managing those risks:

-

Student Safety: Liability coverage for student incidents or injuries is essential to secure against potential claims.

-

Compliance with Regulations: Understanding applicable laws and regulations surrounding educational practices can help mitigate risks.

-

Contracts with Third Parties: Review contractual agreements with third-party providers for clear liability definitions.

Implementing comprehensive liability strategies in educational institutions ensures safety for students and enhances the overall educational experience.

The Rise of Cyber Liability: Protecting Against Digital Threats

Cyber liability insurance has seen rapid growth as businesses face increasing digital threats. Here’s how to navigate this area effectively:

-

Data Breach Coverage

-

Incident Response Plans: Develop a robust incident response plan as part of your cybersecurity strategy.

-

Employee Training: Regularly conduct training to keep staff informed on cyber threats and responses.

Investing in adequate cyber liability coverage can safeguard your business against the digital risks that continue to grow in today’s technological landscape.

The Impact of AI on Professional Liability: New Risks and Opportunities

As AI systems become integrated into various industries, understanding their impact on Professional Liability Insurance is critical. Consider these factors:

-

New Risks: AI introduces risks related to biased algorithms, data privacy violations, and unexpected outcomes.

-

Evolving Insurance Needs: Adapt your insurance coverage to address potential liabilities connected to AI deployments.

-

Opportunities in Service Enhancements: AI can enhance risk management practices, offering new solutions for protecting your business.

By embracing the opportunities and challenges presented by AI, you can develop informed strategies for Professional Liability Insurance.

Climate Change and Liability: Assessing Evolving Risks

Climate change influences liability decisions as businesses assess their exposure to evolving risks. Here’s how to navigate this area effectively:

-

Environmental Risks: Proactively consider potential liabilities arising from environmental impacts associated with your operations.

-

Regulatory Compliance: Stay informed about emerging legislation related to climate change that may impact your insurance needs.

-

Community Communication: Engage with stakeholders to understand community expectations and risks tied to climate change.

By becoming aware of the influence of climate change, you can make informed decisions about your professional liability coverage.

Social Engineering: The Human Factor in Liability Claims

Social engineering poses a unique challenge for professionals regarding liability claims. Here are several ways to mitigate exposure:

-

Employee Awareness Training: Regularly train employees to recognize social engineering techniques commonly deployed by fraudsters.

-

Incident Response Protocols: Develop and enforce protocols for responding to incidents that arise from social engineering attempts.

-

Robust Security Measures: Implement comprehensive security measures to enhance your organization’s overall defense against social engineering attacks.

By addressing social engineering threats, you can minimize liability exposure while enhancing your overall risk management strategies.

Navigating the Hard Market: Strategies for Securing Coverage

Navigating a hard insurance market can be challenging. Here are strategic approaches to securing coverage:

-

Documentation: Prepare thorough documentation regarding your risk management practices to present to insurers.

-

Leverage Relationships: Build solid relationships with your current insurer, as this may yield favorable terms even in hard markets.

-

Explore Alternative Markets: Look beyond traditional insurers; explore non-traditional markets that may offer innovative solutions and pricing.

Adopting strategic practices can help you navigate through challenging economic conditions to ensure optimal coverage.

The Gig Economy: Liability Considerations for Freelancers and Contractors

-

Client Contracts: Clearly define terms in contracts to manage expectations and minimize potential disputes.

-

Coverage Awareness: Understand your liability exposure as a freelance professional, knowing when to seek additional coverage.

-

Service Clarity: Be clear about the services you provide, minimizing the potential for misunderstandings that lead to claims.

By recognizing the liability landscape within the gig economy, you can protect your interests effectively.

Telemedicine: Addressing Liability Concerns in Remote Healthcare

As telemedicine continues to evolve, understanding liability concerns remains essential for healthcare providers. Here are key components to consider:

-

: Ensure your Professional Liability Insurance extends to telemedicine services.

-

Adhere to Regulations: Keep abreast of regulatory requirements concerning telehealth services.

-

Patient Care Protocols: Maintain robust protocols for patient care within the telehealth model.

By consciously addressing the liability concerns tied to telemedicine, you can foster secure healthcare practices and build patient confidence.

Remote Work: The Impact on Professional Liability Risks

The shift to remote work brings both opportunities and challenges regarding liability. Here’s how to address these emerging risks:

-

Cybersecurity Measures: With remote work, ensure your cybersecurity strategies account for potential vulnerabilities exposed by a distributed workforce.

-

Compliance Checks: Verify that your remote policies comply with industry regulations, minimizing the risk of liability.

-

Employee Training: Provide training that addresses remote work best practices, empowering employees to manage risks effectively.

Recognizing the complexities of remote work can help you tailor your professional liability coverage to meet evolving needs.

Evolving Regulatory Landscape: Staying Compliant with Insurance Requirements

The regulatory landscape continually changes, impacting liability insurance. Here’s how to stay compliant:

-

Stay Informed: Regularly review relevant regulatory updates that may affect your industry.

-

Seek Professional Guidance: Consult insurance professionals to ensure your coverage meets new regulatory requirements.

-

Audit Practices: Conduct routine audits of your compliance practices, ensuring alignment with evolving regulations.

By prioritizing compliance within your insurance strategies, you can safeguard your business from potential regulatory liabilities.

The Role of Data Privacy in Liability Insurance

Data privacy plays an integral role in setting professional liability procedures. Here are key considerations to navigate this landscape effectively:

-

Privacy Laws: Stay informed about evolving data privacy laws that may impact your business operations and insurance coverage.

-

Client Agreements: Clearly outline data privacy processes within client agreements to manage expectations.

-

Security Measures: Invest in advanced security measures to protect client data from breaches that may trigger liability claims.

Addressing data privacy proactively not only shields your business from liabilities but also fosters trust with clients.

Mental Health Professionals: Addressing Unique Liability Concerns

Mental health professionals face distinct challenges regarding liability. Here are essential considerations:

-

Malpractice Claims: Ensure you have appropriate malpractice coverage to defend against potential claims.

-

Documenting Sessions: Meticulously document therapy sessions to provide evidence in case of liability issues.

-

Policy Review: Regularly review liability insurance policies to align with evolving practices in mental healthcare.

By recognizing the unique aspects of liability, mental health professionals can protect their practice while continuing to provide essential services.

The Impact of Social Media on Reputation and Liability

In the digital age, social media can significantly affect your reputation and liability. Here’s how to manage this influence effectively:

-

Online Presence Management: Monitor your online presence and respond to negative reviews or comments swiftly.

-

Privacy Awareness: Educate employees on maintaining privacy around the business on social media.

-

Crisis Management Plans: Develop crisis management strategies to mitigate reputational damage stemming from social media mishaps.

By managing your social media footprint diligently, you can influence your reputation positively while minimizing potential liability.

Professional Liability in the Age of Globalization

Globalization presents new dimensions of risk concerning professional liability. Here’s how to navigate these challenges effectively:

-

Cross-Border Regulations: Understand the regulatory environment in countries you operate within to ensure compliance.

-

Adapt your Policies: Ensure your insurance policies account for multinational operations to address potential liabilities effectively.

-

Cultural Sensitivity: Be aware of cultural differences that may impact client expectations and potential liabilities.

By understanding the global landscape, you can enhance your professional liability protections while effectively navigating international engagements.

Drones and Autonomous Vehicles: New Liability Frontiers

As innovative technologies like drones and autonomous vehicles grow in usage, corresponding liability considerations come into play. Here are factors to consider:

-

Coverage Needs: Consult with your insurer about the evolving nature of liability risks relating to these technologies.

-

Regulatory Compliance: Stay informed about regulatory developments affecting the use of drones and autonomous vehicles.

-

Risk Management Strategies: Develop procedures that address potential liabilities tied to these technologies.

By addressing these emerging trends, you’ll be better positioned to navigate the associated liability risks effectively.

The Future of Professional Liability Insurance: Predictions and Trends

As the professional landscape evolves, so too will trends in professional liability insurance. Here are some predicted trends to watch:

-

Increasing Cybersecurity Coverage: Expect insurers to enhance emphasis on cybersecurity protections as digital threats continue to rise.

-

Dynamic Risk Assessments: Insurers may begin utilizing AI and data analytics to tailor policies to reflect contemporaneous risks more accurately.

-

Niche Coverage Growth: Specialized insurance products for emerging professions will likely increase.

By keeping an eye on these trends, you can position yourself for effective liability protection in the future.

Creating a Culture of Risk Awareness: Employee Training and Education

Creating a culture of risk awareness within your organization is fundamental. Here are several ways to implement this:

-

Regular Training: Conduct training sessions routinely to keep employees aware of potential risks.

-

Empower Employees: Encourage employees to speak up about concerns, fostering a sense of accountability.

-

This is all about safety: Making safety a priority can reduce incidents that lead to liability.

By establishing a culture of risk awareness, you empower your organization to proactively manage potential liabilities.

Implementing Effective Risk Management Strategies

A robust risk management strategy can mitigate liability exposure. Here’s how to build one effectively:

-

Risk Identification: Conduct extensive assessments to identify possible risks within your operations.

-

Mitigation Planning: Develop strategies to address identified risks, such as creating response protocols for various scenarios.

-

Employee Involvement: Involve employees in risk management discussions to enhance awareness and develop comprehensive solutions.

-

Performance Evaluation: Regularly revisit and evaluate your risk management strategy, making necessary adjustments to remain compliant and effective.

Building a comprehensive risk management strategy can safeguard your business from liability risks.

Developing Comprehensive Incident Response Plans

In the event of a claim or incident, having an established response plan significantly aids in damage control. Here’s a framework to develop such a plan:

-

Responsibility Assignments: Clearly define roles and responsibilities within the response team.

-

Response Protocols: Create step-by-step procedures for addressing various types of incidents.

-

Communication Templates: Develop communication templates for notifying stakeholders during an incident.

By formalizing an incident response plan, you prepare your team to handle potential liabilities more effectively.

The Importance of Documentation in Liability Claims

Maintaining thorough documentation is crucial for effective handling of liability claims. Here’s why documentation matters:

-

Evidence Gathering: Accurate records provide valuable evidence during the claims process, safeguarding your position against claims.

-

Claim Tracing: Documentation facilitates tracking interactions and transactions related to claims.

-

Dispute Resolution: Well-organized documentation enhances your ability to resolve disputes, often preventing escalation.

By prioritizing meticulous documentation in your operations, you enhance your organization’s defense against potential claims.

Best Practices for Client Communication and Engagement

Effective client communication bolsters your risk management. Here are best practices to implement:

-

Clear Expectations: Set clear expectations regarding service delivery, encouraging transparency in your processes.

-

Regular Updates: Keep clients informed about relevant developments that may impact their services.

-

Feedback Channels: Establish mechanisms for clients to provide feedback, enhancing your understanding of potential risks.

By adopting best practices in client communication, you can minimize misunderstandings and build lasting relationships.

Managing Conflicts of Interest to Minimize Risk

Managing conflicts of interest is fundamental to safeguarding your professional reputation. Here’s how to manage conflicts effectively:

-

Disclosure Policies: Have clear policies in place regarding the disclosure of conflicts of interest.

-

Client Agreements: Outline policies within client agreements to manage expectations regarding potential conflicts.

-

Regular Training: Conduct training on identifying and managing conflicts of interest, promoting transparency.

Effectively managing conflicts provides clarity to clients and enhances your professional integrity.

Utilizing Technology to Enhance Risk Management

Incorporating technology into your risk management strategies can significantly enhance effectiveness. Here’s how technology facilitates risk management:

-

Data Analytics: Use data analytics to identify risks within your processes, allowing for more strategic planning.

-

Incident Reporting Tools: Implement reporting tools that streamline communication during incidents.

-

Compliance Tracking: Employ technology to stay compliant with regulations and manage exposure effectively.

Integrating technology into your risk management practices can bolster your organization against potential liabilities.

The Role of Internal Audits in Loss Prevention

Internal audits play a crucial role in preventing potential losses. Here’s how to design effective audits:

-

Regular Scheduling: Conduct audits at regular intervals to assess adherence to policies and procedures.

-

Risk Assessment: Assess risk exposure within operations and identify opportunities for improvement.

-

Stakeholder Involvement: Involve key stakeholders in the audit process to ensure comprehensive input and perspectives.

By prioritizing internal audits, you maintain a proactive approach to loss prevention.

Case Studies: Lessons Learned from Liability Claims

Reflecting on case studies of real liability claims aids in understanding effective strategies. Here are key takeaways to consider:

-

Document Thoroughly: Many claims could have been avoided with better documentation practices.

-

Transparency Matters: Open and honest communication can prevent misunderstandings that often lead to claims.

-

Review and Learn: After resolving claims, reviewing the experience helps institutions bolster their risk management.

By learning from case studies, you can enhance your strategy and minimize potential claims.

Expert Insights: Interviews with Risk Management Professionals

The perspectives of experienced risk management professionals provide valuable insight. Here are a few takeaways one might glean:

-

Importance of Preparedness: Preparedness is a constant theme in risk management discussions; being proactive is essential.

-

Adapting to Change: Successful risk strategies are those that adapt to changing environments and regulations.

-

Collaboration is Key: Collaborating with diverse voices within your organization fosters a stronger risk management approach.

Engaging with expert insights can yield invaluable lessons and inspiration for enhancing your practices.

Avoiding Common Pitfalls: Tips for Reducing Liability Exposure

Identifying pitfalls can lead to protective strategies. Here are some tips to safeguard your business:

-

Thorough Contracts: Ensure contracts are comprehensive, defining roles and responsibilities clearly.

-

Training and Education: Implement ongoing training programs to keep employees informed about liability risks.

-

Maintain Documentation: Encourage a culture of meticulous documentation to enhance transparency and accountability.

By recognizing potential pitfalls, you can establish practices that effectively reduce liability exposure.

The Importance of Continuous Improvement in Risk Management

Continuous improvement in risk management practices reflects an adaptable and proactive organization. Here are ways to ensure ongoing enhancement:

-

Solicit Feedback: Regularly seek feedback from stakeholders regarding risk management practices.

-

Benchmarking Best Practices: Stay abreast of industry best practices and standards to align your strategies accordingly.

-

Regular Reviews: Conduct routine reviews of risk management policies to identify areas for improvement.

By fostering a culture of continuous improvement, you can enhance your organization’s resilience against liability risks.

Creating a Safe and Secure Work Environment

A safe work environment significantly reduces liability risks. Here’s how to foster security and safety at your organization:

-

Regular Safety Training: Conduct routine safety training for employees to instill awareness and compliance.

-

Maintain Facilitator Compliance: Ensure physical spaces comply with safety regulations to minimize exposure.

-

Encourage Reporting: Create a culture where employees feel safe reporting safety hazards.

By establishing a safety-first approach, you reduce potential exposure and enhance employee well-being.

Managing Third-Party Risks: Vendors and Contractors

Engaging with third-party vendors and contractors introduces new risks. Consider these aspects to mitigate those threats:

-

Vendor Due Diligence: Conduct thorough assessments of vendors and contractors before selection.

-

Contractual Agreements: Outline liability expectations within vendor agreements to manage responsibility.

-

Ongoing Monitoring: Implement regular oversight of vendor and contractor relationships to ensure compliance and accountability.

Being deliberate about managing third-party relationships can significantly bolster your overall liability protection.

The Role of Professional Associations in Risk Management

Professional associations often assume a vital role in industry risk management efforts. Here are ways to engage with your association effectively:

-

Stay Informed on Standards: Regularly access resources provided by your association, staying informed about best practices.

-

Engage in Networking: Participate in networking events to connect with peers and learn from their experiences.

-

Access Training Resources: Take full advantage of training programs that arise from professional associations for continuous learning.

Aligning with your professional association can provide access to crucial resources and support, strengthening your risk management efforts.

Understanding the Claims Notification Process

Getting familiar with the claims notification process is crucial for managing liability effectively. Here’s a straightforward process overview:

-

Prompt Notification: Contact your insurer as soon as you become aware of a potential claim.

-

Provide Necessary Information: Offer all relevant details pertaining to the claim during initial notification.

-

Document Communication: Keep records of all communication regarding notifications, enhancing transparency and tracing.

By mastering the claims notification process, you ensure seamless communication with insurers, assuring comprehensive coverage responses.

Working with Claims Adjusters: Tips for a Smooth Experience

Navigating claims adjustments can seem intimidating, but with proper preparation, it can be easier. Here are tips for working seamlessly with claims adjusters:

-

Be Prepared: Gather all documentation before engaging with adjusters, ensuring clarity in your communications.

-

Foster Open Communication: Maintain a cooperative relationship with adjusters, allowing for a smoother claims process.

-

Clarify Expectations: Ensure you understand the process by asking questions and clarifying any uncertainties that arise.

Establishing a strong rapport with claims adjusters pays dividends throughout the claims process, resulting in a more effective resolution.

The Role of Legal Counsel in Liability Claims

Legal counsel plays a pivotal role when navigating liability claims. Here’s how to leverage their expertise effectively:

-

When to Engage: Proactively engage legal counsel at the first signs of potential claims to navigate potential pitfalls.

-

Guidance on Documentation: Legal counsel can advise on what documentation is essential during the claims process.

-

Representation in Negotiations: Having legal counsel represent your interests during negotiations can facilitate better outcomes.

By enlisting legal expertise, you can enhance your capacity to handle potential claims efficiently.

Preparing for Litigation: Key Considerations

When facing potential litigation related to liability claims, preparation is vital. Here are considerations to keep in mind:

-

Documentation Review: Assess all relevant documentation to ensure accuracy and clarity.

-

Internal Communication: Establish clear communications internally to ensure everyone understands their roles in the litigation process.

-

Continuous Collaboration with Counsel: Regularly engage with legal counsel to understand the evolving landscape as litigation progresses.

By prioritizing thorough preparation, you can navigate litigation scenarios with greater confidence and security.

Mediation and Alternative Dispute Resolution: Options for Resolving Claims

Exploring mediation and alternative dispute resolution can offer viable solutions for resolving liability disputes. Here’s how it works:

-

Understand the Process: Familiarize yourself with mediation and its benefits in resolving disputes amicably.

-

Engage a Neutral Third Party: Mediation involves a neutral third-party mediator who facilitates discussions for resolution.

-

Voluntary Participation: Parties engage voluntarily, often resulting in satisfactory resolutions without formal litigation.

Incorporating mediation or alternative dispute resolution avenues can preserve relationships and enhance outcomes for all parties involved.

Expert Witnesses: Their Role in Liability Cases

Expert witnesses can play an influential role in liability claims. Here’s how to leverage their expertise:

-

Choosing Witnesses Wisely: Select experts who align with the specifics of the case and understand the complexities involved.

-

Thorough Preparation: Ensure expert witnesses are prepared to clearly articulate their assessments during consultations or testimonies.

-

Align with the Case Strategy: Coordinate expert witness contributions with your overall case strategy for cohesion.

By leveraging expert testimony effectively, you can strengthen your position during liability claims.

Managing the Emotional Impact of a Liability Claim

Navigating liability claims carries emotional weight for professionals. Here’s how to manage the emotional challenges:

-

Acknowledge Feelings: Validate the emotional impact of the situation and give yourself permission to feel those emotions.

-

Seek Support: Engage with colleagues, or professional therapists to discuss the stress and feelings associated with the claims process.

-

Focus on Self-Care: Prioritizing self-care through practices such as exercise, mindfulness, or hobbies can mitigate emotional distress.

By recognizing and addressing the emotional challenges of liability claims, you can cultivate resilience throughout the process.

Case Studies: Analyzing Real-World Claim Scenarios

Studying real-world claim scenarios can cultivate profound insights. Here are some examples that highlight key learnings:

-

Consulting Firm Claims: A consultancy faced a breach of contract claim, resulting in high legal fees. Key takeaways emphasized the importance of strong contracts and ongoing client communication.

-

Tech Startup Liability: A software development firm faced significant data breach claims after failing to implement adequate security measures. This case highlighted the need for robust cybersecurity coverage.

-

Healthcare Malpractice: A healthcare provider encountered claims stemming from misdiagnosis. This emphasized the need for thorough documentation and compliance with best practices.

By analyzing these scenarios, you can glean valuable lessons to inform your own liability management strategies.

The Impact of Litigation on Reputation and Brand Image

The reputation and brand image of your business are significantly influenced by litigation outcomes. Here are key points to remember:

-

Negative Publicity: Claims can result in negative publicity that may deter potential clients and impact business relationships.

-

Long-Term Effects: The effects of litigation may linger, affecting brand image long after claims have been resolved.

-

Community Perception: The way your business handles claims can shape community perceptions, impacting client trust.

Being aware of these factors underscores the importance of strong liability management and public relations efforts.

Protecting Your Business During a Claim: Continuity Strategies

Implementing effective continuity strategies during a liability claim can help protect your business. Here are considerations:

-

Establish Clear Protocols: Have defined protocols for managing claims while maintaining regular business operations.

-

Transparent Communication: Keep clients informed of developments as necessary to preserve trust.

-

Financial Resilience: Ensure sufficient financial backing to weather the potential economic impact of claims.

By prioritizing protective measures, you can safeguard your business against the adverse effects of liability claims.

The Role of Public Relations in Managing Liability Crises

Effective public relations strategies are pivotal during liability crises. Here’s how to integrate PR into your claims management:

-

Crisis Preparation: Develop a crisis communication plan that addresses potential risks and outlines your response strategies.

-

Transparency is Key: Be open about claims and what you’re doing to address them. This transparency builds goodwill and maintains trust.

-

Engagement with Media: Proactively engage with media when necessary, identifying the narrative you want to convey.

By integrating strong public relations strategies, you can improve your chances of successfully managing liability crises.

Lessons Learned from High-Profile Liability Lawsuits

High-profile liability lawsuits often serve as important learning moments for professionals. Here are common lessons that emerge from these cases:

-

Rigorous Documentation: Many claims highlight the importance of proper documentation, emphasizing how thoroughness can mitigate risk.

-

Robust Communication: Clear communication with clients enhances transparency, thereby reducing misunderstandings.

-

Adaptability is Crucial: Successful resilience during lawsuits often hinges on a business’s ability to adapt and navigate unforeseen circumstances.

Reflecting on these lessons can help you strengthen your own liability risk management strategies.

Understanding the Financial Costs of Litigation

The financial implications of litigation can be staunchly impactful. Here are factors to comprehend:

-

Direct Legal Costs: Legal fees and expenses can escalate quickly during litigation.

-

Settlements and Judgments: Large settlements may arise if claims are upheld, potentially threatening your financial stability.

-

Business Disruption: The operational disruption during litigation can delay revenue generation, impacting your bottom line.

Being acutely aware of these costs allows you to plan effectively, ensuring financial resilience during litigation scenarios.

Strategies for Negotiating Favorable Settlements

Negotiating favorable settlements can significantly impact the outcome of claims. Here are strategies to enhance your negotiating position:

-

Understanding Your Position: Have a clear understanding of your case’s strengths and weaknesses before entering negotiations.

-

Focus on Relationships: Maintain a collaborative approach, emphasizing the importance of relationships over confrontations.

-

Seek Mediation When Necessary: If tensions arise, consider involving a mediator to facilitate discussions toward a favorable resolution.

By approaching negotiations strategically, you can enhance the likelihood of reaching favorable settlements in liability claims.

The Importance of Post-Claim Analysis and Improvement

Conducting post-claim analysis is essential for improving your risk management practices. Here are steps to consider:

-

Evaluate the Process: Analyze the claims process to identify areas for refinement.

-

Document Learnings: Ensure lessons learned are documented and shared with your team.

-

Enhance Training Strategies: Use learnings to inform employee training programs, preventing recurrences of claims.

By prioritizing post-claim analysis, you can cultivate a proactive culture within your organization, continuously improving risk management practices.

The History of Professional Liability Insurance

The history of Professional Liability Insurance reveals the growth of risk management over time. Initially designed for specific professions, it has expanded to encompass diverse industries. As businesses evolve, the demand for tailored liability solutions continues to grow, leading to enhanced protections and broader coverage options.

The Role of Insurance in Economic Growth and Stability

Insurance plays a foundational role in driving economic growth and stability. By mitigating risks faced by businesses, insurance ensures continuity, encouraging investment and innovation. As professionals secure appropriate coverage, they can confidently navigate their industries, contributing to a robust economy.

Professional Liability Around the World: International Perspectives

International perspectives on Professional Liability Insurance shed light on unique challenges and opportunities faced globally. Different regulatory environments, cultural considerations, and business practices shape how professionals perceive and secure liability coverage. Engaging with international practices enhances understanding, fostering the development of versatile coverage solutions that address global risks.

The Ethics of Professional Liability Insurance

Ethics in Professional Liability Insurance plays a critical role in shaping industry standards. Ensuring that coverage aligns with ethical obligations is essential for maintaining integrity and protecting interests. Professionals should evaluate their insurance protections with an ethical lens to ensure they uphold standards while managing liabilities effectively.

The Impact of Technology on the Insurance Industry

Technology continues to transform the insurance industry, enhancing efficiency while expanding coverage options. Insurers leverage data analytics and AI to tailor policies, streamline claims processing, and identify evolving risks. As technological advancements reshape the landscape, it becomes crucial for professionals to engage with these innovations to bolster their liability protections.

Careers in Professional Liability Insurance

The field of Professional Liability Insurance offers diverse career opportunities spanning underwriting, claims processing, risk management, and legal advocacy. Professionals in this field play a pivotal role in safeguarding businesses against risks and navigating the complexities of claims management. As industries evolve, career opportunities in this space continue to grow, attracting individuals dedicated to risk mitigation and protection.

The Future of the Insurance Industry: Predictions and Trends