The Evolution of Professional Liability Insurance

How Professional Liability Insurance Differs from General Liability

The Role of Professional Liability in Business Continuity

Think of professional liability insurance as an essential component of business continuity planning. It doesn’t simply protect your business; it helps ensure that you can continue to operate in the face of claims against you. By mitigating risks associated with lawsuits, you can maintain client trust and secure your revenue stream, even during challenging times.

How to Evaluate Your Need for Professional Liability Coverage

Evaluating your necessity for professional liability insurance starts with conducting a thorough risk assessment of your services. Consider the following:

- Nature of Work: Are you providing services that require expertise?

- Client Relationships: Do your clients depend heavily on your advice or services?

- Professional Reputation: Is your work subject to scrutiny that may lead to disputes?

Answering these questions will guide you in determining the level of coverage suitable for your business.

Tailoring Liability Insurance for the Tech Industry

Professional Liability Needs for Healthcare Providers

Insurance Challenges in the Construction Sector

Legal Professionals: Unique Insurance Considerations

The Impact of AI on Professional Liability Policies

As artificial intelligence technology continues to evolve, it is reshaping the landscape of liability insurance. AI introduces complexities regarding accountability and reliability, especially when AI recommendations lead to adverse outcomes. Professional liability policies now need to address potential liabilities arising from the use of AI in providing services.

Cybersecurity Threats and Their Influence on Insurance Needs

How Climate Change Affects Liability Risk Assessments

Social Engineering: A Growing Concern for Insurers

Navigating the Hard Market in Professional Liability

Lessons from High-Profile Professional Liability Lawsuits

High-profile lawsuits serve as cautionary tales for many professionals. Analyzing these cases can provide insights into common pitfalls and the importance of maintaining thorough documentation and communication. By learning from the mistakes of others, you can enhance your own risk management strategies.

How Large Corporations Manage Their Liability Risks

Large corporations often have dedicated risk management teams to oversee their liability risks. This team evaluates potential exposure across various departments, ensuring that all operational aspects are analyzed for liability risk. Small business owners can learn from this approach by implementing a risk management plan that identifies and mitigates risks.

Case Study: Successful Claims Mitigation Strategies

Looking at successful claims mitigation strategies from other businesses can provide valuable insights. Consider how companies have navigated claims effectively by investing in employee training, maintaining transparent communication, and fostering positive relationships with clients. By incorporating similar strategies, you can better protect your business from liability claims.

The Financial Impact of Negligence Claims on Small Businesses

A Step-by-Step Guide to Filing a Professional Liability Claim

Filing a professional liability claim can seem overwhelming. Here’s a step-by-step guide to simplify the process:

- Notify your insurer: Contact your insurer immediately to report the incident.

- Document the incident: Keep detailed records of all communications and events leading up to the claim.

- Provide necessary information: Be prepared to supply any information required by the insurer, including contracts and emails.

- Follow-up regularly: Keep in communication with your insurer to track the claim’s progress.

- Consult with an attorney if necessary: If the claim escalates, consider legal advice to navigate complexities.

- Assess Your Risks: Evaluate the potential liabilities in your line of work.

- Compare Policies: Don’t settle for the first offer. Compare multiple policies to find the best fit.

- Understand Coverage Limits: Be aware of what is covered and the limits associated with the policy.

- Review Exclusions and Endorsements: Understand what’s not covered.

- Discuss with an Insurance Professional: Engage a broker or agent to clarify any confusing terms and conditions.

It’s essential to understand how policy limits and deductibles impact your coverage significantly. The policy limit is the maximum amount your insurer will pay for a covered claim. Deductibles, on the other hand, are the amounts you must pay before your coverage kicks in. Balancing these two elements wisely can ensure your business is adequately protected without overwhelming financial exposure.

Tips for Negotiating Better Terms with Your Insurer

- Highlight Your Experience: Use your business’s successful history to negotiate premiums.

- Present a Risk Management Plan: Show your insurer how you actively mitigate risks.

- Seek Multiple Quotes: Leverage competing quotes to negotiate better terms.

- Ask About Discounts: Inquire about available discounts for combined policies or loyalty.

How to Educate Employees About Liability Risks

Educating your team about liability risks is crucial. Conduct regular training sessions on recognizing potential liability scenarios. Promote a culture of risk awareness by encouraging open discussions about claims and near-misses in the workplace. Utilizing real-world examples can help illustrate the importance of diligence in everyday tasks.

Exploring Niche Markets for Professional Liability Coverage

Customizing Policies for Emerging Industries

The Role of Professional Associations in Shaping Coverage Needs

Professional associations often play a pivotal role in shaping the liability needs for their respective industries. They provide guidance, resources, and often group insurance options tailored to specific fields. Engaging with your association can yield insights into the best coverage practices for your profession.

Leveraging Industry-Specific Insights to Enhance Coverage Options

Professional Liability Insurance 101: A Beginner’s Guide

- Errors: Mistakes made while providing professional services.

- Omissions: Failure to provide agreed-upon services or advice.

- Liability: Responsibility for damages incurred due to errors or omissions.

Understanding these basics can help clarify why this type of insurance is crucial for anyone offering professional services.

Why Every Professional Needs Liability Coverage

Understanding the Claims Process: What to Expect

Navigating the claims process can feel intimidating. Generally, the procedure involves notifying your insurer, providing detailed documentation of the incident, and cooperating with any investigation. Understanding what to expect at every stage can alleviate some stress during an already challenging time.

Key Terms and Definitions in Professional Liability Insurance

Familiarizing yourself with key insurance terminology can enhance your understanding of policy discussions. Common terms include:

- Coverage Limit: Maximum amount your insurer will pay.

- Premium: The cost of your insurance policy.

- Deductible: Amount paid out of pocket before coverage kicks in.

Getting to know this language will empower you in conversations with insurers and help you evaluate policies effectively.

The Role of Risk Management in Mitigating Liability

Factors Affecting Professional Liability Premiums

Comparing Claims-Made vs. Occurrence Policies

The Importance of Adequate Coverage Limits

Determining the appropriate coverage limit requires understanding the unique risks associated with your profession. A limit that’s too low could leave you exposed to significant liabilities, while excessive coverage could lead to unnecessarily high premiums. Balancing these factors is essential for effective risk management.

How to Choose the Right Deductible for Your Business

The Impact of Prior Claims on Future Insurability

A history of claims can affect your future insurability and premium costs. Insurers often evaluate your claims history when underwriting a new policy, and prior claims may signal higher risk. Maintaining a strong risk management strategy can help mitigate this impact.

When to Review and Update Your Liability Coverage

The Role of Brokers and Agents in the Insurance Process

Insurance brokers and agents can be invaluable resources during the insurance process. They help navigate the complexities of various policies, provide insights into coverage options, and negotiate terms on your behalf. Establishing a solid relationship with a trusted broker can greatly enhance your insurance experience.

Tips for Communicating with Your Insurer

Effective communication with your insurer is vital for a smooth insurance experience. Here are some tips:

- Be Clear and Concise: Clearly explain any incidents or claims.

- Maintain Records: Keep thorough documentation of all communications.

- Ask Questions: Don’t hesitate to inquire about anything you don’t fully understand.

By fostering an open line of communication, you can ensure that both you and your insurer are on the same page.

Professional Liability for Accountants: Beyond the Numbers

Architects and Engineers: Building a Strong Insurance Foundation

Attorneys at Law: Protecting Your Practice from Malpractice Claims

Dentists: Navigating the Complexities of Liability Insurance

Financial Advisors: Shielding Your Clients’ Investments

Healthcare Professionals: The Importance of Malpractice Insurance

For healthcare professionals, malpractice insurance is vital in protecting against claims related to medical errors or negligence. Understanding your specific practice area and associated risks will help you choose the right coverage tailored to your professional needs.

IT Professionals: Mitigating Cyber Risks and Data Breaches

Real Estate Agents: Avoiding Liability in Property Transactions

Tech Startups: Tailoring Coverage for Emerging Risks

Nonprofits: Addressing Unique Liability Concerns

Media and Entertainment: Managing Risks in a Creative Field

Hospitality Industry: Protecting Your Guests and Reputation

Educational Institutions: Liability Concerns in Academia

The Rise of Cyber Liability: Protecting Against Digital Threats

The Impact of AI on Professional Liability: New Risks and Opportunities

The rise of artificial intelligence presents both challenges and opportunities for liability insurance. Businesses leveraging AI must reconsider their risk assessments and insurance needs to stay ahead of evolving trends.

Climate Change and Liability: Assessing Evolving Risks

Social Engineering: The Human Factor in Liability Claims

Social engineering attacks rely on exploiting human psychology, leading to significant risks for businesses. Understanding these threats and integrating training into your risk management strategy can help mitigate exposure to liability claims.

Navigating the Hard Market: Strategies for Securing Coverage

The Gig Economy: Liability Considerations for Freelancers and Contractors

Telemedicine: Addressing Liability Concerns in Remote Healthcare

Remote Work: The Impact on Professional Liability Risks

The shift to remote work necessitates reassessment of professional liability risks. Organizations must consider how remote work impacts client interactions, deliverables, and overall risk management strategies in the evolving workplace.

Evolving Regulatory Landscape: Staying Compliant with Insurance Requirements

Keeping track of regulatory changes related to liability insurance requires diligence. Staying informed about updates can empower you to adhere to requirements while also ensuring your coverage meets necessary legal obligations.

The Role of Data Privacy in Liability Insurance

Mental Health Professionals: Addressing Unique Liability Concerns

The Impact of Social Media on Reputation and Liability

Social media can significantly influence public perception, leading to reputational risks. Professionals must be aware of how social media interactions can open them up to liability claims and ensure coverage addresses these nuances.

Professional Liability in the Age of Globalization

Globalization introduces unique challenges and risks in professional liability. Companies operating internationally must understand the complexities of liability across different jurisdictions and ensure adequate protection against potential claims in a global context.

Drones and Autonomous Vehicles: New Liability Frontiers

The Future of Professional Liability Insurance: Predictions and Trends

Creating a Culture of Risk Awareness: Employee Training and Education

Cultivating a workplace culture focused on risk awareness ensures everyone understands their role in minimizing potential liabilities. Regular training sessions, workshops, and clear communication channels can foster this culture.

Implementing Effective Risk Management Strategies

Effective risk management strategies should encompass identifying, assessing, and mitigating risks. Regular risk assessments, employee training, and clear policies can ensure that your business is well-prepared for potential claims.

Developing Comprehensive Incident Response Plans

Having a robust incident response plan is crucial. This plan should outline procedures for managing and reporting incidents, ensuring all team members understand their roles in mitigating potential liabilities.

The Importance of Documentation in Liability Claims

Maintaining thorough documentation is essential in navigating liability claims. Well-organized records of contracts, communications, and incident reports can significantly bolster your position if a claim arises.

Best Practices for Client Communication and Engagement

Effective communication with your clients is vital in reducing liability risks. Establishing clear lines of communication and setting realistic expectations can help foster positive relationships and minimize misunderstandings that may lead to disputes.

Managing Conflicts of Interest to Minimize Risk

Proactively managing conflicts of interest is essential for minimizing liability risks. Establishing clear policies, transparent communication, and regular training can help ensure all team members understand how to navigate potential conflicts effectively.

Utilizing Technology to Enhance Risk Management

Leveraging technology can improve your risk management practices. Tools such as risk assessment software, client relationship management systems, and data analytics can enhance your understanding of potential risks and improve your overall insurance strategy.

The Role of Internal Audits in Loss Prevention

Conducting regular internal audits can be a powerful tool in loss prevention. Assessing your operations for potential liability exposure and implementing corrective measures can significantly reduce the likelihood of claims.

Case Studies: Lessons Learned from Liability Claims

Studying case studies can provide valuable insights into effective risk management practices. By reviewing real-world examples of liability claims, you can identify common factors leading to claims and implement strategies to avoid similar situations.

Expert Insights: Interviews with Risk Management Professionals

Avoiding Common Pitfalls: Tips for Reducing Liability Exposure

The Importance of Continuous Improvement in Risk Management

Continuous improvement is essential for effective risk management. Regularly reassessing your strategies, incorporating feedback, and staying informed about industry trends will ensure your approach remains relevant and effective.

Creating a Safe and Secure Work Environment

Fostering a safe work environment is fundamental in reducing liability risks. Consider implementing safety protocols, training programs, and clear communication channels to identify and mitigate potential hazards.

Managing Third-Party Risks: Vendors and Contractors

Third-party risks represent a significant liability exposure for businesses. When working with vendors and contractors, it’s essential to establish clear contracts and liability clauses to minimize risk and ensure accountability.

The Role of Professional Associations in Risk Management

Professional associations often serve as invaluable resources for risk management best practices. Engaging with these organizations can provide guidance, insights, and potential insurance solutions tailored to your industry’s specific needs.

Understanding the Claims Notification Process

Working with Claims Adjusters: Tips for a Smooth Experience

Collaborating with claims adjusters effectively can greatly impact your claims experience. Be communicative and transparent, providing the necessary documentation while being open to questions or requests for further information.

The Role of Legal Counsel in Liability Claims

Preparing for Litigation: Key Considerations

If a claim escalates to litigation, preparation is crucial. This may include gathering documentation, understanding relevant laws, and seeking legal counsel. Being prepared can significantly impact the outcome of a lawsuit.

Mediation and Alternative Dispute Resolution: Options for Resolving Claims

Consider mediation and alternative dispute resolution as options for resolving claims outside of court. These avenues can be less costly and less time-consuming than litigation, allowing for more amicable resolutions.

Expert Witnesses: Their Role in Liability Cases

Expert witnesses can provide critical insights in liability cases, bolstering your case or that of the claimant. Selecting experts with relevant experience in your field can enhance the integrity of your position.

Managing the Emotional Impact of a Liability Claim

Liability claims can evoke stress and anxiety for business owners. Establishing a support network, engaging with mental health professionals, or seeking peer support can be beneficial in navigating the associated emotional toll.

Case Studies: Analyzing Real-World Claim Scenarios

Analyzing real-world claims provides valuable lessons on managing risk and liability exposure. Reviewing case studies highlights the importance of sound practices in minimizing potential claims and enhancing protective strategies.

The Impact of Litigation on Reputation and Brand Image

Litigation can significantly affect a business’s reputation and brand image. Establishing strong communication strategies and crisis management plans can mitigate damage to your reputation during challenging times.

Protecting Your Business During a Claim: Continuity Strategies

Effective continuity strategies are essential for protecting your business during a liability claim. Establish clear action plans to maintain operations and ensure client trust remains intact despite challenges.

The Role of Public Relations in Managing Liability Crises

Public relations play a critical role during liability crises. Engaging a skilled PR team can help craft appropriate messaging and navigate communications, mitigating reputational damage while addressing stakeholder concerns.

Lessons Learned from High-Profile Liability Lawsuits

High-profile liability lawsuits often present key lessons in risk management. By analyzing these cases, you can avoid similar pitfalls and implement strategies that strengthen your business against potential claims.

Understanding the Financial Costs of Litigation

Strategies for Negotiating Favorable Settlements

Negotiating settlements can be a complex process. Strategies for securing favorable outcomes may include documenting all communications and outlining the potential impacts of prolonged litigation.

The Importance of Post-Claim Analysis and Improvement

Once a claim is resolved, conducting a post-claim analysis is essential. Understanding what went right or wrong allows you to implement changes that improve your risk management processes and mitigate the likelihood of future claims.

The History of Professional Liability Insurance

The history of professional liability insurance dates back to the early 20th century, designed to protect specialized professions against negligence claims. Understanding this evolution can provide insights into the significance of these policies today.

The Role of Insurance in Economic Growth and Stability

Professional Liability Around the World: International Perspectives

Examining professional liability from international perspectives reveals diverse regulations and funding structures. Understanding these differences can better inform your insurance options and expectations.

The Ethics of Professional Liability Insurance

The ethics surrounding professional liability insurance involve providing adequate coverage, maintaining transparency with clients, and fostering trust within professional relationships. Upholding these ethical obligations is vital for sustaining your practice.

The Impact of Technology on the Insurance Industry

Technology continues to revolutionize the insurance industry, enabling data analytics, digital communication, and streamlined claims processing. Professionals must stay informed about these advancements to optimize their coverage experiences.

Careers in Professional Liability Insurance

A career in professional liability insurance can be rewarding and impactful. From underwriters to risk managers, opportunities abound for individuals looking to contribute to the vital landscape of liability protection.

The Future of the Insurance Industry: Predictions and Trends

As the insurance industry evolves, several trends may emerge, such as a focus on customized policies, increased reliance on technology, and greater emphasis on transparency in pricing. Staying informed about these developments will help you make informed decisions concerning your coverage.

Book Reviews: Must-Reads for Risk Management Professionals

Reading insightful literature can strengthen your understanding of risk management best practices. Consider titles by industry experts that address liability insurance complexities for further education and professional growth.

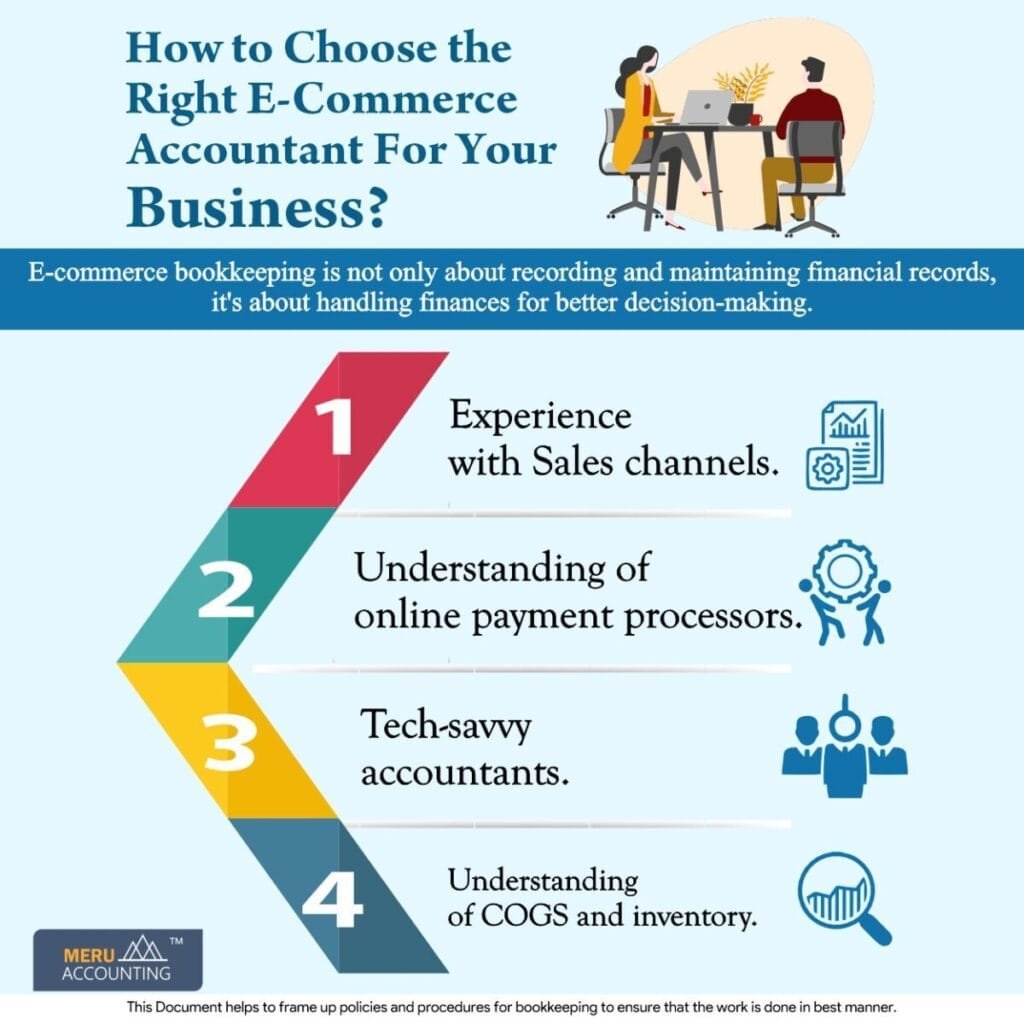

Infographics and Visual Guides to Professional Liability

Visual aids can simplify complex information. Infographics and visual guides illustrating key concepts in professional liability insurance can enhance understanding for professionals and businesses alike.

Webinars and Online Courses: Continuing Education Resources

Participating in webinars and online courses focused on professional liability can bolster your knowledge while providing insights into current best practices. Look for opportunities that align with your specific profession or industry.

Podcasts and Interviews with Industry Leaders

Listening to podcasts and interviews can provide valuable perspectives from seasoned industry leaders. Engaging with these resources can enhance your understanding of risk management and liability insurance.

Conferences and Events: Networking Opportunities

Attending industry conferences and events enables you to network with peers and experts, share best practices, and learn from the latest trends in professional liability and risk management.

Glossaries and Resource Guides: Essential Tools for Professionals

Utilizing glossaries and resource guides can simplify complex terminology in professional liability insurance. Keeping these tools handy will enhance your comprehension and communication with clients and insurers.

Frequently Asked Questions About Professional Liability Insurance

Client Testimonials and Success Stories

Humorous Takes on Liability Insurance: Cartoons and Jokes

Injecting humor into the realm of liability insurance can lighten the mood when discussing serious topics. Cartoons and jokes can provide comedic relief while illustrating key points.

Industry News and Updates: Stay Informed About the Latest Developments

Staying updated with industry news and developments is crucial for understanding shifts in coverage needs and regulations. Regularly engaging with news outlets specializing in insurance keeps you well-informed.

Regulatory Changes and Their Impact on Liability Coverage

Case Studies: Analyzing Landmark Court Decisions

The Role of Insurance in Social Responsibility and Sustainability

Thought Leadership: Essays and Opinion Pieces from Experts

Engaging with thought leaders’ opinions and analyses can enhance your understanding of the complexities surrounding professional liability insurance. These insights can inspire new ideas and innovative approaches to risk management.

Debunking Myths and Misconceptions About Liability Insurance

Addressing myths and misconceptions surrounding liability insurance helps clarify its purpose and importance. Identifying common claims and misunderstandings can lead to increased awareness and better-informed professionals.

Interactive Quizzes and Assessments: Test Your Knowledge

Tips for Marketing and Promoting Your Professional Services

Marketing your services effectively is crucial in attracting clients and establishing trust. Implementing best practices in client engagement, utilizing social media, and maintaining quality communication can enhance your marketing strategy.

Building a Strong Online Presence: Websites and Social Media

In today’s digital landscape, having a strong online presence is vital for attracting clients. Invest in developing a professional website and engaging with clients through social media channels to elevate your visibility and reputation.

Professional Liability for Medical Device Manufacturers: Navigating Complex Risks

Insurance Considerations for Architects Designing Sustainable Buildings

Protecting Your Law Firm from Cyberattacks and Data Breaches

Malpractice Insurance for Nurse Practitioners and Physician Assistants

Liability Concerns for Financial Planners and Wealth Managers

Insurance Solutions for Mental Health Professionals in Private Practice

Cybersecurity Insurance for IT Consultants and Managed Service Providers

Understanding Professional Liability for Commercial Real Estate Brokers

Tailoring Insurance for Biotech Startups and Pharmaceutical Companies

Addressing Liability Risks for Nonprofits Working in Disaster Relief

Protecting Film Producers and Directors from Production-Related Claims

Insurance Needs for Event Planners and Hospitality Management Companies

Event planners and hospitality management companies must consider insurance tailored to their industry, as they face unique liabilities surrounding guest experiences and event execution.

Liability Coverage for Online Educators and EdTech Platforms

Professional Liability for Drone Operators and Aerial Photography Businesses

Insurance Considerations for Companies Developing Artificial Intelligence

Companies engaged in AI development must secure policies that address the inherent risks associated with this evolving technology, ensuring adequate protection against claims arising from misuse or malfunctions.

Addressing Liability Risks in the Sharing Economy and Gig Platforms

Insurance Solutions for 3D Printing and Additive Manufacturing Companies

Protecting Cryptocurrency Exchanges and Blockchain Technology Providers

Professional Liability for Space Tourism and Commercial Spaceflight Ventures

Insurance Needs for Companies Working with Gene Editing and Biotechnology

Addressing Liability Risks in the Cannabis Industry

Lessons from a High-Profile Medical Malpractice Lawsuit

Analyzing high-profile medical malpractice lawsuits can yield valuable lessons for healthcare professionals. Understanding the intricacies of past cases can inform strategies for managing liabilities effectively.

Analyzing a Construction Defect Claim and its Impact on the Contractor

Examining construction defect claims can provide insights into the associated liabilities and costs contractors face. Review case studies on these claims to develop stronger risk management strategies.

How a Cyberattack Crippled a Tech Company and its Insurance Response

Real-World Examples of Social Engineering Scams Targeting Businesses

Reviewing real-world examples of social engineering scams can help you identify potential vulnerabilities in your own operations. Knowing how these scams manifest will better equip you to protect your business.

Case Study: A Successful Claim Mitigation Strategy in the Healthcare Industry

Reviewing successful claim mitigation strategies within the healthcare sector can provide insights for managing risks effectively. Consider the measures adopted by industry leaders to bolster protection against liability.

How a Small Business Overcame a Negligence Lawsuit and Thrived

Examining a small business that successfully navigated a negligence lawsuit can highlight best practices for resilience. Analyzing their response strategies can inform your risk management approaches.

Analyzing the Financial Impact of a Data Breach on a Retail Company

Investigating the ramifications of a data breach on a retail company exposes critical lessons regarding liability and response strategies. Understanding these scenarios can inform your own breach preparations.

Lessons Learned from a Professional Liability Claim in the Legal Profession

Case Study: The Importance of Risk Management in the Construction Industry

Reviewing case studies on successful risk management strategies within the construction industry provides essential insights. Understanding how leading firms navigate claims can inform your own practices.

The Role of Behavioral Economics in Understanding Liability Risks

Behavioral economics plays a vital role in understanding how individuals perceive risk and make decisions regarding liability. Engaging with these concepts enhances your awareness of client behavior.

The Intersection of Ethics and Professional Liability Insurance

Understanding the ethical responsibilities surrounding liability insurance can enhance your risk management strategies, as maintaining integrity is paramount in fostering long-term relationships with clients.

The Impact of Globalization on Professional Liability Claims

Globalization introduces complexities in professional liability claims, as businesses must navigate various legal jurisdictions. Understanding these challenges can better equip you to address emerging liability risks.

The Future of Risk Management: Predictive Analytics and AI

Emerging technologies like predictive analytics and AI are shaping the future of risk management. Staying informed about these advancements will help you to remain proactive in addressing potential liabilities.

The Role of Insurance in Promoting Social Justice and Equity

Insurance plays a significant role in promoting social justice and equity by providing coverage where vulnerable populations face potential risks. Understanding these dynamics is essential for fostering corporate responsibility.

Exploring the Psychological Impact of Liability Claims on Professionals

Liability claims carry significant psychological burdens for professionals. Engaging with support resources and maintaining open communication can help mitigate the emotional impact associated with these claims.

The Importance of Transparency and Communication in the Insurance Industry

Transparency and effective communication are critical components in the insurance industry. Maintaining open dialogue fosters trust among clients and insurers, leading to better relationships and outcomes.

The Role of Professional Associations in Shaping Liability Standards

Professional associations hold substantial influence in establishing liability standards within their industries. Engaging with these organizations ensures that you stay informed about evolving best practices.

The Evolution of Risk: Historical Perspectives on Professional Liability

Examining the historical evolution of risk in professional liability offers crucial insights into contemporary practices and informs your understanding of ongoing challenges.

The Impact of Emerging Technologies on the Future of Insurance

Emerging technologies continue to transform the insurance industry, enhancing efficiency, transparency, and service delivery. Staying informed about these advancements is essential for optimizing your coverage experience.