The Evolution of Professional Liability Insurance

Professional liability insurance has come a long way from its origins. Initially designed for sectors like healthcare and law, this type of coverage has expanded to include a wide array of professions. As businesses grow more complex and the demand for specialized services increases, understanding the nuances of professional liability insurance becomes important.

Many professionals now face significant risks that were not as prevalent in previous generations. The rise of technology, changes in regulatory environments, and evolving client expectations have all contributed to a landscape where the need for robust professional liability coverage is more essential than ever.

How Professional Liability Insurance Differs from General Liability

Understanding the distinction between professional liability insurance and general liability insurance is crucial in evaluating your coverage needs.

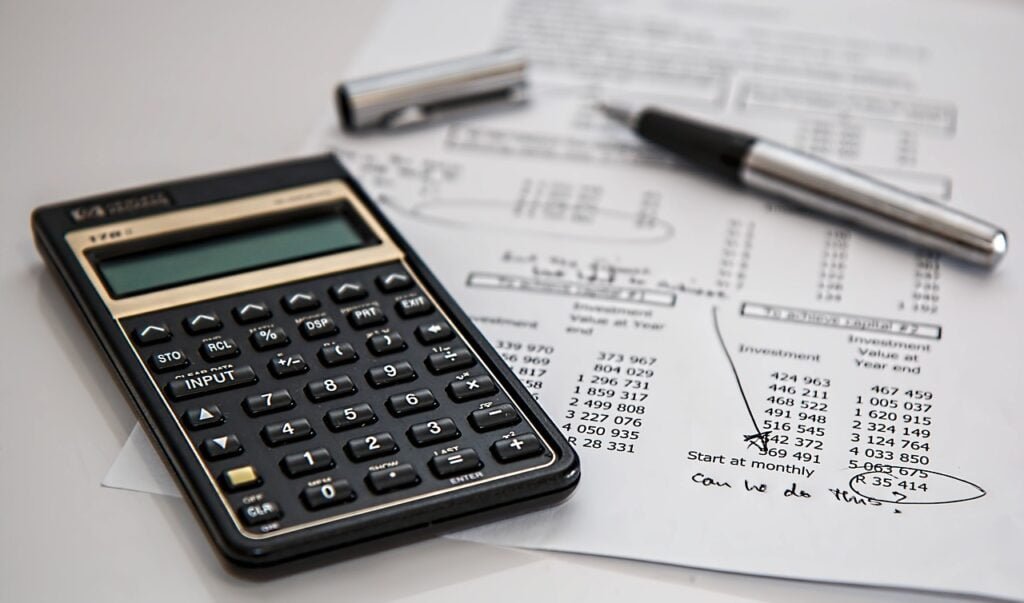

| Aspect | General Liability Insurance | Professional Liability Insurance |

|---|---|---|

| Coverage Focus | Bodily injury and property damage | Errors and omissions in professional services |

| Claims Covered | Slip and fall accidents, property damage | Misleading advice, professional negligence |

| Industries Covered | All industries | Primarily service-oriented professions |

| Cost | Generally lower premiums | Typically higher premiums due to specialized risk |

This table illustrates the key differences, emphasizing that your choice between these policies should align with the specific risks associated with your profession.

The Role of Professional Liability in Business Continuity

When evaluating your liability insurance, consider how much loss your business could incur from claims. This perspective not only ensures financial stability but also reinforces your reputation as a professional who is concerned about both client and business well-being.

How to Evaluate Your Need for Professional Liability Coverage

Evaluating your need for professional liability coverage can feel overwhelming, but breaking it down into manageable steps can simplify the process.

1. Assess Your Industry Risks

The first step is to evaluate the risks specific to your profession. Some industries naturally face higher risks due to the nature of their work. For instance, healthcare providers deal with patient safety, while IT professionals address cybersecurity issues. Understand the nuances of your field and consider potential pitfalls that could lead to a claim.

2. Analyze Your Client Base

Next, consider your client demographics. The more high-profile or high-stakes your clients, the higher your liability risk becomes. If your services impact a client’s financial situation significantly, or if they involve complex regulatory standards, you must prioritize coverage.

3. Review Past Claims

Have you had previous claims made against you? If so, it’s essential to analyze these instances to identify patterns in risks. Even if they were resolved amicably, the knowledge gained can guide you in adjusting your coverage.

4. Consult with Professionals

Seeking advice from insurance professionals can provide further insights. They can help assess your unique circumstances and recommend appropriate coverage levels. Be open about your concerns and ask them to explain any complex terms or conditions.

Tailoring Liability Insurance for the Tech Industry

In the tech sector, rapid advancements and an ever-changing landscape pose unique risks that require tailored liability insurance. Whether you’re developing software, providing IT consulting, or managing data, ensuring your coverage aligns with the specifics of your practice is crucial.

Key considerations include:

-

Cybersecurity Risks: As a tech professional, your work often involves handling sensitive data. A breach can lead to significant claims.

-

Intellectual Property Issues: With the potential for disputes over code ownership or patent infringements, having coverage tailored to these scenarios is vital.

Professional Liability Needs for Healthcare Providers

-

Claims Exposure: Analyze the type of services you provide and any potential claims that could arise.

-

Regulatory Compliance: The healthcare industry is subject to strict regulations; coverage can protect you in the event of a compliance issue.

Insurance Challenges in the Construction Sector

The construction industry presents its own unique set of liability risks. From occupational hazards to regulatory compliance, understanding these risks can help in choosing an appropriate insurance policy.

Factors to consider include:

-

Project Size and Complexity: Large-scale projects often come with increased risk and require more comprehensive coverage.

-

Subcontractor Liability: Ensure that your coverage adequately addresses risks that arise from subcontractors.

Legal Professionals: Unique Insurance Considerations

For attorneys, errors and omissions insurance holds significant value. Given the stakes involved in legal representation, a mistake could lead to substantial financial consequences for your clients. Considerations include:

-

Client Trust and Confidence

-

Regulatory Requirements

-

Client Expectations: Clients expect their advisors to provide sound advice; insurance protects both parties in the event of a misjudgment.

-

Potential Financial Losses: Given the nature of financial services, the potential losses from claims can be substantial.

The Impact of AI on Professional Liability Policies

As AI technology continues to permeate various industries, its effects on professional liability policies are worth examining. The increasing reliance on AI systems raises key concerns, such as:

-

Product Liability: If an AI system malfunctions or fails to deliver as promised, who is liable?

-

Data Privacy and Security: AI often deals with sensitive information; coverage must account for potential breaches.

Cybersecurity Threats and Their Influence on Insurance Needs

With the increase in cyber threats, having robust cybersecurity protections can’t be overstated. As a professional, your exposure to these risks may include:

-

Data Breaches

-

Reputation Management: The fallout from a cybersecurity incident can be long-lasting; consider coverage options that assist with crisis management.

How Climate Change Affects Liability Risk Assessments

As climate change events become more frequent and severe, their implications for professional liability insurance are evolving. Professionals should consider:

-

Environmental Impact: Assess how the nature of your work may be affected by climate events and the potential liability associated with them.

-

Regulatory Compliance: Changes in regulations due to climate initiatives could pose new risks needing mitigation strategies.

Social Engineering: A Growing Concern for Insurers

Social engineering is a growing trend where malicious actors manipulate people into divulging confidential information. Insurers are increasingly addressing this risk within coverage discussions. Considerations include:

-

Training and Awareness: Implementing comprehensive training can reduce risks related to social engineering, making your organization a lesser target.

-

Policy Gaps: Review your existing policies to ensure coverage addresses social engineering risks adequately.

Navigating the Hard Market in Professional Liability

In a hard insurance market, obtaining coverage can become challenging. Here are a few strategies to help navigate this context:

-

Build Relationships: Strong relationships with brokers or agents can significantly ease the process.

-

Highlight Risk Management Practices: Demonstrating robust risk management strategies can make your business a more attractive option for insurers.

Lessons from High-Profile Professional Liability Lawsuits

High-profile lawsuits can serve as effective learning experiences. Understanding the circumstances surrounding these cases can help professionals avoid similar pitfalls. Consider the following lessons:

-

Documentation: Comprehensive documentation is essential; it provides protection and aids in dispute resolution.

-

Open Communication: Transparency with clients about the services being provided can mitigate misunderstandings.

How Large Corporations Manage Their Liability Risks

Large corporations often face intricate liability landscapes. The scale of their operations necessitates robust risk management frameworks.

Key strategies include:

-

Integrated Risk Management: Many large firms establish centralized risk management teams to oversee all liability risks across departments.

-

Continuous Training: Large organizations invest heavily in ongoing training and education for employees regarding liability risks and best practices.

Case Study: Successful Claims Mitigation Strategies

Examining successful claims mitigation strategies can provide valuable insights. A notable case is an IT company that experienced a data breach, leading to potential liability claims. They implemented a series of strategies:

-

Investing in Cybersecurity: By bolstering their cybersecurity measures, they significantly reduced the likelihood of future breaches.

-

Employee Training Programs: Developing robust training programs kept employees informed about potential risks associated with their roles.

The Financial Impact of Negligence Claims on Small Businesses

For small businesses, negligence claims can be particularly damaging, potentially leading to severe financial consequences.

Strategies to manage this risk include:

-

Adequate Coverage

-

Proactive Risk Management: Establishing proactive risk management plans can minimize the chances of mistakes that lead to claims.

- Resolution

These situations underscore the necessity for professionals across all sectors to evaluate their liability coverage continuously.

A Step-by-Step Guide to Filing a Professional Liability Claim

Knowing how to file a claim correctly can make a significant difference in the outcome. Here’s a simplified guide:

-

Review Your Policy

-

Gather Evidence: Document all relevant details related to the claim, including communications and agreements.

-

Notify Your Insurer: Contact your insurance company promptly to report the claim.

-

Follow Up: Maintain communication with your insurer throughout the claims process.

Coverage Options

Review the coverage options available. Ensure they align with the specific risks associated with your profession.

Premiums and Deductibles

Seek out policies with premiums that suit your budget while picking deductibles that you are comfortable paying in case of a claim.

Policy Limits

Make sure you have adequate coverage limits to protect against substantial claims that could arise.

-

Policy Limits: This indicates the maximum amount your insurance will pay for a claim. Choose limits that reflect the potential risk in your profession.

-

Deductibles: A deductible is the amount you agree to pay out of pocket before the insurance coverage kicks in. A higher deductible typically results in lower premiums, but you must be ready to shoulder more in the event of a claim.

Tips for Negotiating Better Terms with Your Insurer

When it comes to dealing with your insurer, negotiation is key. Here are some tips you might find helpful:

-

Research Comparable Policies: Knowing what other policies offer can strengthen your negotiating position.

-

Discuss Your Risk Management Practices: Highlight the measures you’ve implemented to manage risk effectively.

How to Educate Employees About Liability Risks

Creating a culture of awareness surrounding liability risks is crucial for any organization. Consider these strategies:

-

Training Programs: Regularly conduct training sessions to educate employees about potential liability risks related to their roles.

-

Open Communication: Foster an environment where employees feel comfortable discussing risk management and reporting potential issues.

Exploring Niche Markets for Professional Liability Coverage

As industries evolve, so do niche markets for professional liability coverage. Identifying and leveraging these opportunities can lead to tailored insurance products that meet your specific needs.

Examples include:

-

Telemedicine: With the rise of remote healthcare, tailored E&O coverage is becoming increasingly important.

-

E-learning: As online education grows, so too does the necessity for liability coverage that addresses specific risks within this realm.

Customizing Policies for Emerging Industries

Finally, as emerging industries continue to develop, customizing liability insurance policies becomes paramount.

-

Consult with Experts: Engaging future-focused insurance professionals helps in tailoring your coverage to fit the unique needs of emerging sectors.

-

Stay Informed: Keep abreast of industry changes that could influence the nature of risk and the required coverage.

In conclusion, the need for professional liability coverage varies from person to person based on numerous factors, like your profession and industry. Taking the time to evaluate these aspects and understand the necessary coverage will undoubtedly help protect your business and foster greater confidence in your professional services.