What are the top challenges you face in the construction sector when it comes to insurance? If you’re in the construction industry, you probably understand that navigating the world of insurance can feel like walking a tightrope. With construction projects comes an array of risks, from worker injuries to property damage and everything in between. Let’s break down the various insurance challenges you might encounter and what you can do to address them.

The Evolution of Professional Liability Insurance

Professional liability insurance has come a long way over the years. Initially aimed at protecting specific professions like medical practitioners and architects, this type of insurance has expanded to cover a wide variety of sectors, including construction. Understanding its evolution can help you appreciate its importance in today’s risky environment.

It’s essential to recognize that with the growth of technology and complexity in projects, construction firms face unique challenges that previous policies may not adequately address. This evolution means you should stay alert to how the life cycle of your projects might be covered differently by current policies compared to the past.

How Professional Liability Insurance Differs from General Liability

While both professional liability and general liability insurance are critical, they serve different purposes. General liability insurance covers bodily injury and property damage arising from your business operations. In contrast, professional liability insurance protects against claims of negligence in professional services rendered.

You’ll find that understanding these distinctions is essential. For instance, if a worker is injured on your construction site, general liability would kick in. However, if there’s a claim against you for an error in your architectural design, your professional liability insurance would be the one to respond.

The Role of Professional Liability in Business Continuity

The construction industry hinges on timelines and budgets, and any disruption can have severe consequences. Professional liability insurance can be a pillar of business continuity planning. When project delays or claims arise, having this coverage means you can respond without severely derailing your operations.

It’s worth noting that being proactive about your professional liability coverage can save your business from risks that could lead to significant financial losses down the line. Securing adequate coverage allows you to focus on completing projects and satisfying clients rather than constantly looking over your shoulder at potential liabilities.

How to Evaluate Your Need for Professional Liability Coverage

Determining whether you need professional liability insurance isn’t a one-size-fits-all scenario. To evaluate your specific needs, consider factors such as:

- The scope of services you provide.

- The complexity of your projects.

- Your past claims history.

By assessing these factors, you can ascertain whether you require additional coverage or if your current policies are sufficient.

Tailoring Liability Insurance for the Tech Industry

As technology continues to evolve, so too do the insurance needs of construction professionals working in tech-centric projects. This is particularly true for those involved in smart building technologies or construction software development.

A tailored approach may include coverage for software errors, data breaches, or even emerging technologies like drones. Engaging with an insurance broker experienced in these areas can help ensure that your policy meets the specific demands of your projects.

Professional Liability Needs for Healthcare Providers

If your construction firm is involved in building or renovating healthcare facilities, you should be particularly aware of the heightened liability risks. Not only do you need to consider general safety regulations, but you also need to ensure compliance with specific healthcare regulations.

Getting the right professional liability insurance for projects in the healthcare sector will help protect against claims stemming from malpractice, violations of patient privacy, and other unique challenges present in this sensitive environment.

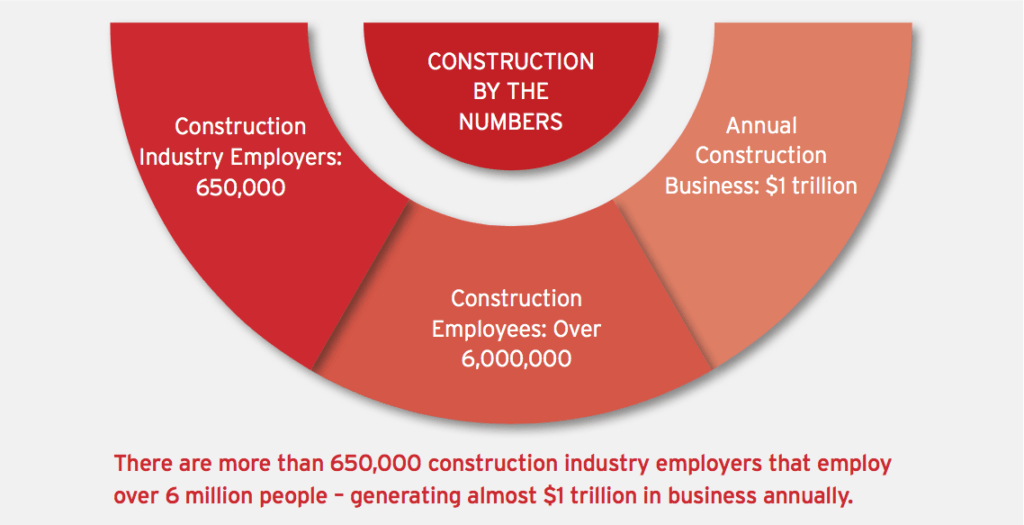

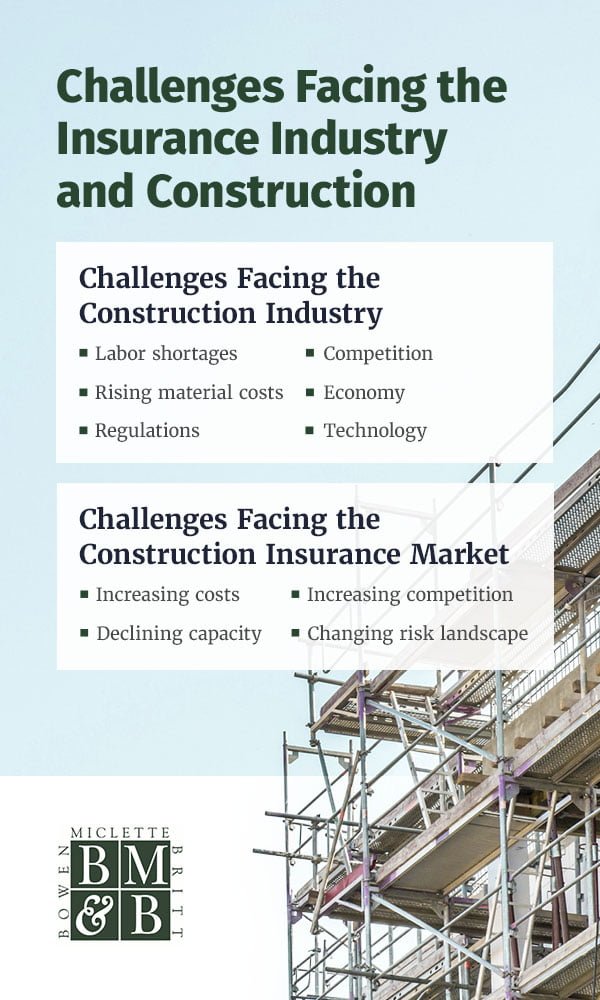

Insurance Challenges in the Construction Sector

In the construction sector, you face a host of unique challenges that can complicate your insurance needs:

-

Complexity of Contracts: Every construction project has its own set of contracts. Understanding your liabilities within these can be daunting, especially when contracts are specific and nuanced.

-

Frequent Changes: Construction projects often undergo various modifications, which can lead to increased risk exposure. Properly documenting these changes and understanding how they impact your insurance coverage is crucial.

-

Higher Claim Frequency: The construction industry sees a relatively high frequency of claims, whether from worker injuries, equipment failures, or environmental impact. This necessitates a robust insurance strategy.

-

Regulatory Compliance: Navigating the regulatory landscape can be tricky. Understanding evolving laws and regulations affecting construction liabilities is essential for maintaining compliance—and coverage.

Legal Professionals: Unique Insurance Considerations

If you’re working with legal professionals in construction—be it through contracts, negotiations, or dispute resolutions—you’ll need to be aware of their unique insurance requirements. Even the legal side brings its own set of challenges.

Construction lawyers often require professional liability insurance that protects them against malpractice claims. Being well-informed about these intricacies not only helps you navigate your projects better but can also be a point of collaboration with legal partners.

The Impact of AI on Professional Liability Policies

Artificial Intelligence (AI) is reshaping various industries, including construction. As construction firms adopt AI technologies—everything from project management software to robotics—the insurance landscape will inevitably change.

You may find that your current professional liability policies need updates to reflect the new risks associated with AI technologies. Understanding how these tools impact your workflow and the potential liabilities they introduce will be key to maintaining appropriate coverage.

Cybersecurity Threats and Their Influence on Insurance Needs

No industry is immune to cyber threats, and construction is no exception. As more contractors adopt technology solutions that rely on data, the risk of data breaches increases. A comprehensive insurance policy should, therefore, address potential cybersecurity threats and their implications for liability.

Consider acquiring cyber liability insurance in addition to your traditional policies. This specialized coverage can mitigate financial losses stemming from data breaches affecting your construction operations.

How Climate Change Affects Liability Risk Assessments

Climate change is reshaping not only the environment but also the landscape of liability in the construction sector. If you are involved in projects that could be impacted by natural disasters or environmental regulations, you may face increased risks and liabilities.

Be proactive in assessing how climate factors could affect your projects. Whether through tougher regulatory standards or increased threat from natural disasters, adapting your insurance strategy to consider climate change impacts can save you significant troubles in the future.

Social Engineering: A Growing Concern for Insurers

Social engineering—where human interaction is manipulated to breach security—poses a growing concern for businesses, including those in construction. Educating yourself and your employees about these risks is essential.

Furthermore, ensure that your insurance coverage includes provisions against social engineering scams. This could protect you against significant financial losses due to fraud committed through deceptive practices targeting employees.

Navigating the Hard Market in Professional Liability

If you’ve experienced recent increases in insurance premiums, you’re not alone. The market has shifted, making it more challenging to secure affordable coverage. Understanding the hard market helps you strategize effectively.

Keep an eye on industry trends and be prepared for negotiations with your insurer. Being proactive about your risk exposure and showing a commitment to effective risk management can also work in your favor during these discussions.

Lessons from High-Profile Professional Liability Lawsuits

Analyzing high-profile lawsuits can offer valuable lessons. By studying these cases, you can identify patterns or oversights that might apply to your projects.

Evaluate how these claims were handled, the outcome, and how the professionals involved managed their exposure to liability. This can inform your own strategies for injury prevention and risk management.

How Large Corporations Manage Their Liability Risks

Large corporations in the construction sector often have robust risk management frameworks. Understanding how they mitigate their exposure can be illuminating.

These firms typically employ teams of professionals specializing in risk assessment, legal issues, and insurance negotiations. By observing their practices, you might glean successful strategies that can be adapted to your own business size or structure.

Case Study: Successful Claims Mitigation Strategies

One way to learn about managing risks is through case studies highlighting successful claims mitigation strategies in the construction sector. For instance, a construction firm may have implemented effective training programs, which reduced workplace injuries and ultimately lowered claims experience.

By analyzing these cases, you can draw actionable insights that will help you improve your own approach to risk management.

The Financial Impact of Negligence Claims on Small Businesses

Negligence claims can have a profound financial impact, especially on small businesses in the construction sector. These claims can drain resources, strain cash flow, and impact your bottom line.

Understanding the financial repercussions can help you realize the importance of having adequate liability coverage and effective risk management practices in place.

Seeing real-world examples of Errors and Omissions claims can provide you with insights into what to expect should you find yourself facing such a situation. The resolution processes may vary greatly based on the specific claim, the parties involved, and the adequacy of coverage.

By being informed about potential pitfalls and pathways to resolution, you can be better equipped to handle claims if and when they arise.

A Step-by-Step Guide to Filing a Professional Liability Claim

If you find yourself in a situation where you need to file a professional liability claim, having a clear plan can ease the process. Here’s a step-by-step guide:

- Review Your Policy: Familiarize yourself with your coverage details and what’s needed for a claim.

- Document Everything: Collect all relevant documentation, such as contracts, communications, and incident reports.

- Notify Your Insurer: Prompt notification after a claim is possible is crucial. Provide your insurer with all necessary information.

- Cooperate with Investigations: Be responsive to requests from your insurance adjuster, as they investigate the claim.

- Follow Up: Stay in touch with your insurer throughout the claims process for updates.

Following these steps can streamline the claims process, allowing you to focus on your business rather than the logistics of filing.

Selecting the appropriate Errors and Omissions insurance is essential. Start by evaluating:

-

Coverage Limits: Be sure the limit reflects your project scope and potential exposure.

-

Exclusions: Understand what is and isn’t covered to avoid surprises later.

-

Cost: Balance premium costs with the level of coverage; the cheapest isn’t always the best.

Taking these factors into account will guide you to the best policy for your unique business needs.

When shopping for professional liability insurance, understanding policy limits and deductibles is essential. The policy limit is the maximum amount your insurer will pay, while the deductible is what you will need to cover before the insurer pays its share.

Choosing appropriate limits and deductibles will depend on your risk appetite and the financial stability of your business. Assessing potential costs involved in various scenarios will help you decide.

Tips for Negotiating Better Terms with Your Insurer

Negotiation can play a vital role in securing favorable policy terms. Here are some tips:

-

Do Your Homework: Understand market conditions and what your competitors are paying for similar coverage.

-

Highlight Your Risk Management Efforts: Showcase the measures your firm takes to mitigate risks, which can encourage insurers to offer better terms.

-

Explore Multiple Insurers: Securing quotes from various insurance providers can create leverage in negotiations.

Negotiating effectively can lead to optimal insurance arrangements that satisfy both coverage needs and financial constraints.

How to Educate Employees About Liability Risks

Employees are a key line of defense against liability claims. By implementing a training program that addresses potential risks, you can significantly reduce exposure.

Topics to cover in your training could include:

- Safety protocols on job sites.

- Best practices for documentation.

- Recognizing behaviors that may lead to liability issues.

Building a culture of awareness about liability risks will pay dividends in reducing claims.

Exploring Niche Markets for Professional Liability Coverage

Niche markets are emerging in construction as specific risks become more prevalent. Identifying industry trends could lead you to specialized coverage options that better suit your business.

For example, if your construction firm is increasingly involved in green building technologies, consider exploring insurance products that cater specifically to sustainability-focused projects.

Customizing Policies for Emerging Industries

As industries evolve, so do their insurance needs. For construction dealings with emerging industries—like renewable energy or smart technologies—customized coverages are beneficial.

Tailoring insurance products to meet these new needs will ensure your coverage is as comprehensive as possible, ultimately safeguarding your business against unique risks.

The Role of Professional Associations in Shaping Coverage Needs

Membership in professional associations can provide valuable insights into industry best practices, including insurance needs. By engaging with such organizations, you can stay informed about trends and challenges specific to your construction niche.

Moreover, these associations often provide resources and recommendations for insurance providers that specialize in your area. Leveraging these insights can lead to more informed decisions.

Leveraging Industry-Specific Insights to Enhance Coverage Options

Utilizing industry-specific insights can enhance your risk management and insurance strategy. For example, if you’re predominantly working with commercial properties, staying updated on the latest challenges facing commercial construction can guide your insurance needs.

Networking with peers in your sector can also surface key insights, allowing you to tailor your coverage more precisely. This will go a long way in safeguarding your projects against unique risks.

Establishing comprehensive risk management plans should include considerations for Errors and Omissions coverage. Identify potential pitfalls in your projects and institute safeguards beforehand.

Beyond this, regularly review and update your risk management strategies as projects evolve and regulations change. This not only helps prevent claims but can also lead to better terms with your insurer.

Professional Liability Insurance 101: A Beginner’s Guide

If you’re new to professional liability insurance, it can be overwhelming. Here’s a simplified breakdown:

-

Understand What It Covers: This type of insurance provides protection against claims of negligence or inadequate work.

-

Assess Your Risks: Consider the services you provide and how they might expose you to liability.

-

Choose the Right Provider: Look for an insurer with experience in your specific industry for tailored advice and better coverage.

-

Regularly Review Your Policy: As your business evolves, so should your coverage.

Educating yourself on the basics can empower you to make informed decisions.

Errors and Omissions insurance is a form of professional liability coverage aimed at protecting professionals against claims of negligence. Here’s what you need to know:

-

Who Needs It?

-

When to Purchase? Purchase this coverage as soon as you start offering professional services to protect yourself from future claims.

-

What’s Covered? Coverage is typically available for claims due to negligence, misrepresentation, or violation of good faith.

Understanding the fundamentals can bolster your confidence in your insurance strategy.

Why Every Professional Needs Liability Coverage

Whether you’re an independent contractor or a large construction firm, liability coverage is vital. It protects both your finances and your reputation by covering the costs associated with claims that may arise from your work.

Having the right coverage in place can save you from potentially devastating losses, allowing you to focus on what you do best—delivering exceptional construction projects.

Understanding the Claims Process: What to Expect

Understanding the claims process will make it easier should you find yourself in a situation requiring it. Here’s what you might experience:

-

Notification: Report the claim to your insurer immediately.

-

Investigation: The insurer will investigate to determine the validity of the claim.

-

Decision: After the investigation, the insurer will advise on coverage and next steps for resolution.

Keeping informed about the process allows for a smoother experience when navigating claims.

Key Terms and Definitions in Professional Liability Insurance

Familiarizing yourself with key terms can clarify discussions around coverage. Here are a few essential definitions:

-

Deductible: The amount you pay out-of-pocket before your insurance kicks in.

-

Coverage Limits: The maximum amount your insurer will pay for covered claims.

-

Exclusions: Specific situations that aren’t covered under your policy.

Having a solid grasp of these terms will help you better communicate with insurers and understand your coverage options.

Understanding common exclusions can prevent nasty surprises down the line. Some frequent exclusions you may encounter include:

- Intentional acts or illegal conduct.

- Claims arising from prior acts before the coverage was in place.

- Personal injury claims unless specifically included.

Awareness of these exclusions will empower you to make informed decisions when selecting your policy.

The Role of Risk Management in Mitigating Liability

Implementing effective risk management strategies is essential for reducing potential liability. Regularly assessing risks associated with your operations, such as safety protocols and project management practices, is a proactive approach.

Training employees, establishing safety measures, and continuously updating policies will help mitigate risks long before they result in liability claims.

Factors Affecting Professional Liability Premiums

If you’ve noticed fluctuating premiums, various factors contribute to these changes. Consider the following:

-

Claims History: A history of claims may lead to higher premiums.

-

Industry Type: Some industries carry higher risks, leading to increased premiums.

-

Coverage Limits: The broader your coverage, the higher your premiums may be.

Understanding these factors can aid you in anticipating potential changes in your premiums.

Comparing Claims-Made vs. Occurrence Policies

When considering professional liability insurance, you’ll likely encounter claims-made and occurrence policies. Understanding the difference is crucial:

-

Claims-Made Policy: Provides coverage when a claim is made during the policy period, regardless of when the incident occurred.

-

Occurrence Policy: Covers incidents that occur during the policy period, regardless of when the claim is made.

Deciding between these options will depend on your project cycle and risk tolerances.

The Importance of Adequate Coverage Limits

Selecting adequate coverage limits is critical to protecting your business. You’ll want to tailor your limits to match the potential liabilities you anticipate encountering with your projects.

Failing to choose sufficient limits may leave you vulnerable to claims that exceed your policy’s maximum coverage, leading to out-of-pocket expenses you were unprepared for.

How to Choose the Right Deductible for Your Business

Determining the right deductible amount can significantly affect your premium and overall financial strategy. Consider the following:

-

Balance your deductible against your cash flow. A higher deductible can lower your premium but may strain financial resources during a claim.

-

Assess your risk tolerance. If you’re comfortable absorbing higher out-of-pocket costs, higher deductibles could make sense.

Finding the right deductible aligns your insurance strategy with your risk-reward tolerance.

The Impact of Prior Claims on Future Insurability

Having a history of claims can influence future insurability; insurers may view previous claims as a sign of higher risk, potentially increasing premiums or limiting your options.

Being proactive about reducing your risk factors can help mitigate these effects over time. Insurance is a long-term investment, so focusing on claims prevention today can reap rewards in pricing and coverage quality tomorrow.

When to Review and Update Your Liability Coverage

Regularly reviewing your professional liability coverage is essential, especially after a significant change in your operations or project types. Events that warrant a review include:

- Expanding your services.

- Changes in firm size.

- Increased project complexity.

Ensure that your coverage aligns with your evolving business. Being proactive can prevent gaps that may expose you to unnecessary risks.

The Role of Brokers and Agents in the Insurance Process

Insurance brokers and agents can be instrumental in navigating the complexities of professional liability. They can offer insights into:

- Policy comparisons and recommendations.

- Assistance in understanding complex legal terminology.

- Negotiating better terms on your behalf.

Leveraging their expertise can lead to a more straightforward insurance process.

Tips for Communicating with Your Insurer

Effective communication with your insurer can enhance your experience and ensure better outcomes. Here are some tips:

-

Be Transparent: Share as much relevant information as possible so your insurer can facilitate your needs adequately.

-

Ask Questions: Don’t hesitate to seek clarification on anything unclear about your policy or claims process.

-

Keep Records: Maintain clear records of all communications for reference.

Fostering open communication will help you build trust with your insurer and facilitate smoother interactions.

Professional Liability for Accountants: Beyond the Numbers

Accountants face unique liabilities, particularly concerning financial advice and tax services. Professional liability insurance for accountants typically covers negligence, errors in judgment, and omission incidents. Selecting the right coverage can protect your practice while allowing you to continue providing essential financial services confidently.

Architects and Engineers: Building a Strong Insurance Foundation

For architects and engineers, the stakes are high. Professional liability insurance is vital, covering claims that may arise from design errors or project mismanagement. Ensuring you have solid coverage can bolster your reputation and provide the financial security necessary for undertaking significant projects.

Attorneys at Law: Protecting Your Practice from Malpractice Claims

Lawyers face a distinct set of risks that necessitate professional liability insurance focused on legal malpractice. Having the right coverage can help attorneys manage claims resulting from errors, omissions, or negligence while serving clients.

Dentists: Navigating the Complexities of Liability Insurance

Dentists face specific risks, from malpractice claims to patient dissatisfaction. Tailoring your liability insurance to address these areas can safeguard against significant financial repercussions and protect your practice.

Financial Advisors: Shielding Your Clients’ Investments

Healthcare Professionals: The Importance of Malpractice Insurance

Healthcare professionals face unique liabilities concerning patient care and treatment. Malpractice insurance is a cornerstone for safeguarding practitioners against claims, allowing them to focus on patient outcomes.

IT Professionals: Mitigating Cyber Risks and Data Breaches

In an increasingly digital world, IT professionals face significant risks related to data breaches and cybersecurity. Professional liability insurance can help mitigate these risks by providing coverage for breaches stemming from negligence in IT services.

Real Estate Agents: Avoiding Liability in Property Transactions

Tech Startups: Tailoring Coverage for Emerging Risks

Tech startups face evolving risks, often linked to rapidly changing technology. Customizing coverage to address these emerging challenges ensures your startup can thrive amidst uncertainty.

Nonprofits: Addressing Unique Liability Concerns

Nonprofits may operate under unique liabilities, particularly around donor relationships and compliance issues. Securing liability coverage tailored to these concerns can protect the organization from financial loss.

Media and Entertainment: Managing Risks in a Creative Field

The media and entertainment sectors present specialized risks, from copyright infringement to reputational harm. Tailored professional liability coverage is crucial to mitigate unique challenges in these creative industries.

Hospitality Industry: Protecting Your Guests and Reputation

Hospitality businesses must ensure guest safety while navigating considerable liabilities. Liability insurance is vital to cover incidents that might occur on the property, allowing businesses to prioritize guest experiences without fear of excessive risks.

Educational Institutions: Liability Concerns in Academia

Educational institutions face the risks associated with providing a safe learning environment. Liability insurance is essential to safeguard against claims that may arise during educational activities or on campus.

The Rise of Cyber Liability: Protecting Against Digital Threats

As cyber threats continue to rise, specialized cyber liability insurance is becoming increasingly important for businesses across all sectors, including construction. This coverage helps protect against data breaches, cyberattacks, and the aftermath of such incidents.

The Impact of AI on Professional Liability: New Risks and Opportunities

While AI presents exciting opportunities for efficiency, it also introduces new complexities within liability insurance. As AI becomes more integrated into construction processes, understanding its implications on liability will be vital to safeguard your business effectively.

Climate Change and Liability: Assessing Evolving Risks

As the influence of climate change grows, assessing your vulnerability in construction will help you address and manage these risks.

Social Engineering: The Human Factor in Liability Claims

Social engineering presents a unique challenge where human manipulation leads to breaches or fraudulent activities. Employee training and awareness are paramount to mitigate these risks.

Navigating the Hard Market: Strategies for Securing Coverage

Navigating a hard insurance market requires proactive strategies:

-

Build Relationships with Insurers: Creating long-term relationships can yield better results during challenging times.

-

Review Your Risk Management Approach: A robust strategy can help demonstrate your commitment to minimizing risks, reassuring insurers.

-

Consider Alternative Options: Engaging in risk retention groups or captive insurance can be solutions during hard markets.

The Gig Economy: Liability Considerations for Freelancers and Contractors

As the gig economy grows, understanding liabilities for freelancers in the construction sector becomes increasingly important. Ensuring appropriate coverage can safeguard against various risks inherent to freelance work.

Telemedicine: Addressing Liability Concerns in Remote Healthcare

Emerging through necessity, telemedicine presents unique liability risks for healthcare professions. Professionals utilizing telehealth must secure appropriate malpractice insurance to protect against claims arising from remote consultations.

Remote Work: The Impact on Professional Liability Risks

The rise of remote work creates new exposure types for businesses, particularly in how they manage risks. Recognizing evolving liability risks in a remote work context can keep your coverage relevant and effective.

Evolving Regulatory Landscape: Staying Compliant with Insurance Requirements

Keeping abreast of changes in regulations will help you ensure compliance within your insurance policies. This vigilance is essential for minimizing risk and protecting your business interests.

The Role of Data Privacy in Liability Insurance

Data privacy is another cornerstone in the modern landscape, particularly for industries leveraging technology. Ensuring liability coverage adequately addresses data privacy will be essential.

Mental Health Professionals: Addressing Unique Liability Concerns

Mental health professionals face specific challenges regarding liability claims. Ensuring adequate malpractice insurance will protect practitioners in case claims arise from therapy or psychiatric services provided.

The Impact of Social Media on Reputation and Liability

Social media represents a double-edged sword for businesses. While it can enhance brand visibility, negative encounters on these platforms can lead to reputational harm and liability. It is essential to have coverage that addresses reputational risks tied to social media activity.

Professional Liability in the Age of Globalization

In a globalized world, construction professionals must understand how international laws can affect their liability. This recognition is vital for protecting clients and projects extending beyond domestic borders.

Drones and Autonomous Vehicles: New Liability Frontiers

As technology advances, the introduction of drones and autonomous vehicles in construction creates unique liability issues. Understanding how traditional insurance applies to these developments will be crucial in securing appropriate coverage.

The Future of Professional Liability Insurance: Predictions and Trends

The futuristic landscape of professional liability insurance is undoubtedly shaped by rapid technological advancements. Stakeholders must adapt to evolving risks and consider emerging trends that could impact their coverage needs in the future.

Creating a Culture of Risk Awareness: Employee Training and Education

Fostering a culture focused on risk awareness will involve continuous training and education. This culture can be the difference in reducing claims and enhancing safety in your operational environment.

Implementing Effective Risk Management Strategies

Having effective, documented risk management strategies is paramount. Regularly revisiting and improving these strategies helps ensure longevity and success for your business.

Developing Comprehensive Incident Response Plans

An incident response plan allows you to navigate crises efficiently when risk events occur. Ensuring that your employees understand their roles in these situations will be crucial for effective handling of unexpected events.

The Importance of Documentation in Liability Claims

Thorough documentation is your best defense in a liability claim. Keeping meticulous records of projects, communications, and protocols will serve both as a shield and a guide if a claim arises.

Best Practices for Client Communication and Engagement

Maintaining open lines of communication with clients ensures that questions, concerns, and expectations are clearly understood. Best practices include regular updates and transparent discussions about potential liabilities associated with projects.

Managing Conflicts of Interest to Minimize Risk

Conflicts of interest can create liability risks. Establishing clear protocols for identifying and managing conflicts proactively will protect you from exposure.

Utilizing Technology to Enhance Risk Management

Technology plays a significant role in risk management today. From project management software to compliance monitoring, embracing these tools can streamline your processes and reduce potential risks.

The Role of Internal Audits in Loss Prevention

Internal audits provide crucial insights into your operations and their risks. Conducting regular audits can help identify vulnerabilities and mitigate loss potentials before they escalate into claims.

Case Studies: Lessons Learned from Liability Claims

Analyzing case studies involving liability claims can offer powerful lessons for your practices. Developing awareness of literature documenting industry failures and successes is an invaluable tool for improving your own strategies.

Expert Insights: Interviews with Risk Management Professionals

Engaging with industry experts through interviews can yield tremendous insights into navigating insurance processes. This information can provide additional perspectives to enhance your business practices.

Avoiding Common Pitfalls: Tips for Reducing Liability Exposure

Reducing liability exposure often requires avoiding common pitfalls. Regular training and adequate oversight can deter mistakes, protecting your business from unnecessary claims.

The Importance of Continuous Improvement in Risk Management

Continuous improvement in your risk management practices is essential. Regularly revisiting and refining your strategies can significantly lower risks over time.

Creating a Safe and Secure Work Environment

A safe work environment reduces liability significantly. Regularly implementing training and safety protocols ensures that employees understand the risks and how to mitigate them.

Managing Third-Party Risks: Vendors and Contractors

Contracting work to third parties can expose you to their liabilities. Evaluating vendor contracts and their insurance coverage is critical for protecting yourself from potential claims.

The Role of Professional Associations in Risk Management

Professional associations can play a vital role in improving your risk management practices. Leveraging the resources, connections, and training this sector offers can ensure you’re well-protected.

Understanding the Claims Notification Process

Understanding how the claims notification process works will prepare you to act quickly and efficiently should you need to file a claim. Quick action can significantly impact the outcome of a claim.

Working with Claims Adjusters: Tips for a Smooth Experience

Fostering a collaborative relationship with your claims adjuster can ensure a smoother claims process. Be prepared with all documents and inquiries to facilitate efficient resolution.

The Role of Legal Counsel in Liability Claims

When liability claims emerge, having legal counsel on your side can make a difference. Understanding when to bring in legal experts helps to navigate the intricacies of claims effectively.

Preparing for Litigation: Key Considerations

Depending on the nature of your claims, preparing for litigation will be necessary. Adequely preparing by gathering evidence, understanding your policy limits, and collaborating with legal support from the outset can set the stage for successful navigation.

Mediation and Alternative Dispute Resolution: Options for Resolving Claims

Mediation provides a space for parties to negotiate claims without litigation. Understanding these processes can help you maintain control and reduce ambient stress associated with liability claims.

Expert Witnesses: Their Role in Liability Cases

Expert witnesses often play a critical role in liability cases, lending credibility to claims or defenses. Understanding how to engage and collaborate with these individuals can impact the final outcomes of disputes.

Managing the Emotional Impact of a Liability Claim

Liability claims can take an emotional toll on professionals. It’s essential to recognize the psychological impacts and how to manage them effectively. Seek support if the stress becomes overwhelming. Creating a supportive work environment can also benefit all employees involved.

Case Studies: Analyzing Real-World Claim Scenarios

Reviewing case studies allows you to learn from others’ experiences. Each scenario presents a different perspective on liability claims and how you can navigate potential pitfalls.

The Impact of Litigation on Reputation and Brand Image

Litigation can harm your reputation and brand image. Strategic management of claims and transparent communication with stakeholders can better protect your brand during difficult times.

Protecting Your Business During a Claim: Continuity Strategies

Your business’s continuity during a claim is crucial. Implementing strategies that allow workflows to continue despite challenges ensures you can recover and thrive even in adverse circumstances.

The Role of Public Relations in Managing Liability Crises

Public relations is critical during liability crises. Crafting clear messaging about incidents and your commitment to resolution can mitigate public backlash while reinforcing your brand’s trustworthiness.

Lessons Learned from High-Profile Liability Lawsuits

High-profile lawsuits often teach us significant lessons about liability management. Studying these cases allows you to glean insights into what works and what does not when navigating complex claims.

Understanding the Financial Costs of Litigation

Understanding the financial impact of litigation can help you prepare better for potential future events. The costs can be substantial, so taking proactive steps today to manage risks can save you time, money, and headaches.

Strategies for Negotiating Favorable Settlements

Negotiating favorable settlements should be a priority if you’re faced with claims. Consider the strengths and weaknesses of your case, and effectively communicate your points during discussions.

The Importance of Post-Claim Analysis and Improvement

After any claim, conducting a post-claim analysis is essential for identifying areas of improvement. Learning from claims will help refine your risk management strategies, reducing exposure going forward.

The History of Professional Liability Insurance

Understanding the historical context of professional liability insurance can lend insights into its necessity today. This knowledge helps you to appreciate its value in protecting against unforeseen risks.

The Role of Insurance in Economic Growth and Stability

Insurance plays a significant role in stabilizing businesses and fostering economic growth. Understanding the complexities of liability coverage will help your company contribute positively to economic resilience.

Professional Liability Around the World: International Perspectives

Exploring global professional liability practices offers opportunities to learn from different jurisdictions. Understanding diverse approaches to liability can enrich your strategic planning and risk management.

The Ethics of Professional Liability Insurance

Ethical considerations surrounding liability insurance can be complex. Engaging with these topics is vital for ensuring that your practices align not only with legal requirements but also with ethical standards within your profession.

The Impact of Technology on the Insurance Industry

Technology profoundly affects the insurance landscape. Remaining competitive requires staying informed about how technological advancements reshape insurance offerings and risk assessments.

Careers in Professional Liability Insurance

Understanding career opportunities in the insurance sector can help you appreciate the complexities of professional liability further. Consider exploring these pathways if you find the subjects engaging and valuable.

The Future of the Insurance Industry: Predictions and Trends

The insurance industry is at a crucial juncture, evolving with rapidly changing market conditions and technological transformations. Staying informed about predictions and trends will help you anticipate changes in coverage needs.

Book Reviews: Must-Reads for Risk Management Professionals

Engaging with literature on risk management can enhance your understanding. Look for well-reviewed books addressing various aspects of professional liability and risk mitigation strategies.

Infographics and Visual Guides to Professional Liability

Visual tools can simplify complex topics related to insurance. Seek readily available infographics that clarify professional liability concepts and help solidify your understanding.

Webinars and Online Courses: Continuing Education Resources

Embrace online learning opportunities to stay at the forefront of risk management practices. Webinars and courses allow you to learn about the latest trends and best practices from industry experts.

Podcasts and Interviews with Industry Leaders

Tune into podcasts featuring discussions and interviews with industry leaders. These resources can provide deep insights into the nuances of professional liability insurance and help enhance your knowledge.

Conferences and Events: Networking Opportunities

Networking through conferences allows you to connect with peers and industry experts. Engaging in these spaces can lead to valuable opportunities for collaboration and knowledge exchange.

Glossaries and Resource Guides: Essential Tools for Professionals

Familiarizing yourself with glossaries or resource guides can aid in navigating the complex terminology surrounding insurance. Equipping yourself with essential resources is a strategic step.

Frequently Asked Questions About Professional Liability Insurance

Being aware of commonly asked questions and their answers can clarify complexities surrounding liability insurance. This knowledge will prepare you for discussions with insurers or during planning sessions.

Client Testimonials and Success Stories

Learning from the experiences of others in the field can deepen your understanding of liability coverage. Seek testimonials and success stories that highlight successful claims navigation to enhance your perspective.

Humorous Takes on Liability Insurance: Cartoons and Jokes

Sometimes, laughter is the best medicine. Engaging with humorous content related to insurance might provide you with relatable insights into the challenges professionals face in a light-hearted manner.

Industry News and Updates: Stay Informed About the Latest Developments

Staying updated on industry news is critical. Follow reputable sources to keep up with developments affecting professional liability practices globally.

Regulatory Changes and Their Impact on Liability Coverage

Keep an eye on regulatory changes that could impact your coverage. Understanding these developments allows you to adapt your strategies accordingly, ensuring continued compliance and adequate protection.

Case Studies: Analyzing Landmark Court Decisions

Landmark court decisions concerning liability can have far-reaching implications. Analyzing these cases and their reasoning can clarify what constitutes liability in various contexts.

The Role of Insurance in Social Responsibility and Sustainability

Understanding the role of insurance in promoting social responsibility will allow you to align your business practices with broader societal considerations.

Thought Leadership: Essays and Opinion Pieces from Experts

Engage with thought leadership content to gain insights from experts within the field. These pieces can stimulate critical thinking and foster innovative strategies for navigating risks.

Debunking Myths and Misconceptions About Liability Insurance

Clearing up misconceptions surrounding liability insurance is critical for making informed decisions. Rely on credible sources to dispel myths that may hinder your understanding.

Interactive Quizzes and Assessments: Test Your Knowledge

Quizzes can be a fun way to challenge your understanding of liability insurance. Engage with assessment tools to reinforce concepts and deepen your knowledge.

Tips for Marketing and Promoting Your Professional Services

Effective marketing can set you apart in a competitive landscape. Tailoring your marketing strategy to highlight your commitment to professionalism and liability coverage can instill client confidence.

Building a Strong Online Presence: Websites and Social Media

A robust online presence can enhance your brand while providing essential information to clients. Invest in a user-friendly website and maintain engaging social media channels to connect with your audience.

Professional Liability for Medical Device Manufacturers: Navigating Complex Risks

Manufacturers of medical devices face unique liabilities tied to product safety. Securing comprehensive coverage is vital to protect against claims related to design flaws or improper use.

Insurance Considerations for Architects Designing Sustainable Buildings

As sustainability becomes increasingly prioritized, architects must consider liability coverage that reflects modern building practices. Such coverage will safeguard them against evolving standards and expectations.

Protecting Your Law Firm from Cyberattacks and Data Breaches

For law firms, safeguarding sensitive client data is paramount. Securing cyber liability coverage is vital in managing risks promulgated by technological vulnerabilities.

Malpractice Insurance for Nurse Practitioners and Physician Assistants

Healthcare providers face rigorous scrutiny. Engaging in malpractice coverage is crucial for nurse practitioners and physician assistants who offer essential care.

Liability Concerns for Financial Planners and Wealth Managers

Financial planners must cope with liabilities associated with investment strategies. Protecting your practice with appropriate coverage is key to ensuring client confidence.

Insurance Solutions for Mental Health Professionals in Private Practice

Mental health professionals in private practice should secure liability insurance tailored to their needs. This coverage will protect against claims tied to care and treatment complexities.

Cybersecurity Insurance for IT Consultants and Managed Service Providers

As IT professionals face increasing cybersecurity threats, securing specialized coverage ensures protection against data breaches and other tech-related liabilities.

Understanding Professional Liability for Commercial Real Estate Brokers

Commercial real estate brokers often encounter unique risks in their transactions. Having solid liability coverage can manage those risks effectively.

Tailoring Insurance for Biotech Startups and Pharmaceutical Companies

Biotech startups require tailored insurance to manage the dynamics of innovative fields, including product liability and research risks. Engaging with specialized insurers can bolster this protection.

Addressing Liability Risks for Nonprofits Working in Disaster Relief

Nonprofits engaged in disaster relief often encounter unexpected liabilities. Tailoring insurance coverage in alignment with these operational realities allows greater protection.

Protecting Film Producers and Directors from Production-Related Claims

Film productions carry unique risks. Securing liability coverage tailored for production environments can safeguard against claims arising from actors, crew, and even equipment.

Insurance Needs for Event Planners and Hospitality Management Companies

Event planners and hospitality firms face risks related to unforeseen circumstances affecting events. Having robust insurance coverage mitigates potential liabilities that may arise.

Liability Coverage for Online Educators and EdTech Platforms

Online educators and platforms present an ever-evolving landscape of risks to navigate. Customizing coverage for the unique challenges presented by the digital sphere is vital.

Professional Liability for Drone Operators and Aerial Photography Businesses

Drone operators face regulatory challenges along with potential liability risks. Ensuring suitable coverage will help manage these unique issues effectively.

Insurance Considerations for Companies Developing Artificial Intelligence

As AI companies navigate the complexities of liability, having tailored coverage will protect against emerging risks stemming from this new technology.

Navigating the landscape of virtual and augmented reality introduces specific liabilities. Securing appropriate E&O coverage mitigates risks tied to content creation.

Addressing Liability Risks in the Sharing Economy and Gig Platforms

The sharing economy requires an understanding of liability impacts. Exploring tailored insurance solutions will provide significant protection for businesses in this space.

Insurance Solutions for 3D Printing and Additive Manufacturing Companies

3D printing introduces unique risks, making it essential for companies involved in this sector to secure relevant liability coverage to manage potential claims.

Protecting Cryptocurrency Exchanges and Blockchain Technology Providers

As the landscape shifts towards cryptocurrency, companies in this sector face specific regulatory and liability risks. Tailored insurance solutions are paramount.

Professional Liability for Space Tourism and Commercial Spaceflight Ventures

Companies entering commercial spaceflight face unique liabilities that necessitate specialized insurance coverage to safeguard against project uncertainties.

Insurance Needs for Companies Working with Gene Editing and Biotechnology

Innovative biotechnology firms must carefully navigate liability risks associated with research and clinical applications. Specialized liability coverage is essential for such evolving sectors.

E&O Coverage for Environmental Consultants and Sustainability Professionals

Consultants working in environmental fields face liabilities tied to their recommendations. Comprehensive E&O coverage is essential for existing as an effective, responsible advisor.

Addressing Liability Risks in the Cannabis Industry

The burgeoning cannabis industry presents unique legal and liability complexities. Engaging in specialized coverage and risk assessments is a critical consideration for engaged businesses.

Lessons from a High-Profile Medical Malpractice Lawsuit

High-profile malpractice lawsuits provide case studies that may yield important lessons on risk management in the medical field. Dynamics from these situations can inform your future practices effectively.

Analyzing a Construction Defect Claim and its Impact on the Contractor

Understanding the implications of construction defect claims on contractors emphasizes the need for proper insurance coverage to mitigate potential losses.

How a Cyberattack Crippled a Tech Company and its Insurance Response

Learning from cases where cyberattacks threatened operations can inform your risk management directives. Study these examples to avoid making the same costly mistakes.

A Financial Advisor’s E&O Claim and the Importance of Client Communication

Exploring scenarios involving E&O claims and the simple act of client communication sheds light on best practices for financial services. Adapt these lessons to minimize your risks.

Real-World Examples of Social Engineering Scams Targeting Businesses

By examining social engineering cases, you can gain insights into risk conclusions and how to protect your operations proactively.

Case Study: A Successful Claim Mitigation Strategy in the Healthcare Industry

Understanding successful claim mitigation strategies in healthcare offers an excellent framework for risk management applicable to the construction sector.

How a Small Business Overcame a Negligence Lawsuit and Thrived

Small businesses can learn from those who have transformed challenges into opportunities. Analyze these lessons to bolster your resilience.

Analyzing the Financial Impact of a Data Breach on a Retail Company

Investigating the fallout from data breaches can underline implications for many industries, providing insights on securing sensitive information.

Lessons Learned from a Professional Liability Claim in the Legal Profession

Learning from experiences within the legal profession can enhance your approach to managing claims effectively in the construction sector.

Case Study: The Importance of Risk Management in the Construction Industry

Case studies aligning risk management in construction with tangible results underscore the necessity of proactive strategies across all operations.

The Role of Behavioral Economics in Understanding Liability Risks

Incorporating behavioral economics can provide a new lens on liability risks, helping you understand better how behaviors lead to both exposures and mitigations.

The Intersection of Ethics and Professional Liability Insurance

Understanding the ethical landscape of professional liability insurance can help guide your decisions and ensure alignment with broader professional standards.

The Impact of Globalization on Professional Liability Claims

Globalization introduces new dimensions of liability, especially when projects involve multiple jurisdictions. Keeping abreast of these expansions will guide your insurance strategies appropriately.

The Future of Risk Management: Predictive Analytics and AI

As predictive analytics and AI become more prevalent, they’re transforming risk management practices. Adapting these tools will equip your construction firm for better decision-making and liability management.

The Role of Insurance in Promoting Social Justice and Equity

Finally, understanding how insurance plays a role in promoting social equity can enrich your firm’s strategic planning. Social responsibility is increasingly seen as integral to sustainable business practices.

Navigating insurance challenges in the construction sector can feel daunting, but by arming yourself with information and insights, you can take steps to protect your business effectively. Understanding these nuances can empower you to serve your clients and uphold your standards confidently in an ever-evolving landscape.