The Evolution of Professional Liability Insurance

Professional liability insurance has come a long way since its inception. Initially created to protect professionals from negligence claims, it has evolved into a crucial safety net for various industries. In today’s fast-paced world, professionals face not just legal battles but also reputational challenges. It’s essential to understand how these policies have changed over the years to appreciate their value in modern business environments.

How Professional Liability Insurance Differs from General Liability

The Role of Professional Liability in Business Continuity

How to Evaluate Your Need for Professional Liability Coverage

Factors to Consider

| Factor | Consideration |

|---|---|

| Industry Risk | Some fields, like healthcare and finance, have higher risks. |

| Client Expectations | Are your clients likely to pursue claims for errors? |

| Regulatory Requirements |

Tailoring Liability Insurance for the Tech Industry

Professional Liability Needs for Healthcare Providers

Insurance Challenges in the Construction Sector

Legal Professionals: Unique Insurance Considerations

The Impact of AI on Professional Liability Policies

Cybersecurity Threats and Their Influence on Insurance Needs

How Climate Change Affects Liability Risk Assessments

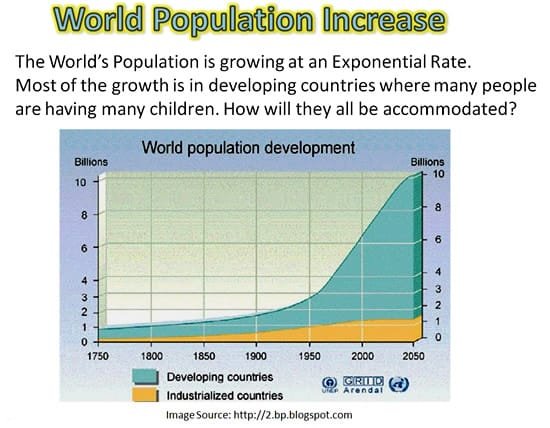

With climate change becoming a more pressing issue, professionals must consider how environmental factors might impact liability. For instance, construction firms may face claims related to environmental damage or changes in regulations. Assessing risk in light of climate change is a new reality that requires thorough evaluation.

Social Engineering: A Growing Concern for Insurers

Navigating the Hard Market in Professional Liability

In a hard insurance market, obtaining coverage can be more challenging and expensive. It’s crucial to carefully navigate this environment, ensuring that you’re still adequately protected. Educating yourself on the current market dynamics can help you make informed decisions.

Lessons from High-Profile Professional Liability Lawsuits

How Large Corporations Manage Their Liability Risks

Larger corporations often have dedicated risk management teams to address liability risks. They typically conduct regular audits and evolve their approaches based on emerging trends. Emulating some of these practices in your business, no matter its size, can lead to better protection against potential claims.

Case Study: Successful Claims Mitigation Strategies

The Financial Impact of Negligence Claims on Small Businesses

Technology Sector

Example: A software development company was sued when a major bug caused a financial loss for a client.

Resolution: The company communicated transparently with the client while negotiating with their insurance provider. They settled for a fraction of the potential claims by addressing the issue promptly and implementing measures to prevent future occurrences.

Healthcare Sector

Example: A doctor faced a malpractice claim for an alleged misdiagnosis that allegedly led to a delay in treatment.

Resolution:

Construction Sector

Example: A contractor was accused of negligence when a design flaw led to costly repairs.

Resolution: The contractor worked with their insurer to cover legal costs. They conducted a thorough review of internal processes, improving quality control to limit future liability and demonstrating a commitment to proactive risk management.

Financial Services

Example: A financial advisor was sued for misrepresenting investment risks to clients.

Resolution:

A Step-by-Step Guide to Filing a Professional Liability Claim

If you ever find yourself in a situation where you need to file a claim, understanding the process can ease your stress. Here’s a breakdown of the steps:

-

Notify Your Insurer: As soon as you become aware of a potential claim, notify your insurance provider.

-

Gather Documentation: Collect all necessary documentation, including contracts, communications, and any evidence related to the claim.

-

Respond Promptly: Detail your side of the story when your insurer contacts you. Quick responses can help facilitate the claims process.

-

Work with Legal Counsel: Depending on the claim’s nature, it may be wise to engage a lawyer specializing in professional liability claims.

-

Follow Up: Keep communication open with your insurer to monitor the progress of your claim.

- What specific risks does your profession face?

- Are there industry standards you need to comply with?

- How much coverage do you need, considering your potential liability?

Key Elements to Assess

| Element | Considerations |

|---|---|

| Coverage Limits | Ensure they match your potential exposure. |

| Deductibles | Determine an appropriate deductible amount. |

| Exclusions | Review what’s not covered in the policy. |

| Endorsements | Consider optional add-ons for specialized risks. |

Knowing the policy limits and deductibles is crucial in understanding your financial responsibilities. The policy limit is the maximum amount your insurer will pay for a covered claim, while deductibles are the amounts you pay out-of-pocket before insurance kicks in. A balance between manageable deductibles and adequate policy limits is ideal.

Tips for Negotiating Better Terms with Your Insurer

When renewing or purchasing a policy, negotiation is essential. Here are some tips for securing favorable terms:

-

Do Your Research: Understand current market rates and policy offerings.

-

Combine Policies: Bundling various types of insurance can lead to discounts.

-

Shop Around: Obtain multiple quotes and consider the insurer’s reputation.

-

Be Transparent: Clearly discuss your business activities and any modifications in risk exposure.

How to Educate Employees About Liability Risks

Empowering your employees to understand liability risks is key to risk management. Conduct regular training sessions to discuss potential pitfalls and best practices. Ensuring that staff is educated about their responsibilities can help mitigate risks significantly.

Exploring Niche Markets for Professional Liability Coverage

Customizing Policies for Emerging Industries

The Role of Professional Associations in Shaping Coverage Needs

Professional associations often provide valuable resources and guidance for their members regarding liability coverage. Engaging with these organizations can help you stay informed about the best practices and evolving risks in your field.

Leveraging Industry-Specific Insights to Enhance Coverage Options

Professional Liability Insurance 101: A Beginner’s Guide

If you’re new to professional liability insurance, remember it’s designed specifically to protect against claims associated with the services you provide. Familiarizing yourself with the terms and conditions helps ensure you understand what’s covered and what isn’t.

Understanding the Claims Process: What to Expect

Whenever a claim is filed, having a clear understanding of the claims process can alleviate stress. You’ll typically follow the trajectory of informing your insurer, gathering evidence, working with adjusters, and potentially negotiating settlements.

Key Terms and Definitions in Professional Liability Insurance

Knowing what your policy doesn’t cover can help you avoid surprises. Common exclusions might include intentional acts, criminal activities, or claims arising from employee actions. Understanding these helps you plan alternative strategies to mitigate those risks.

The Role of Risk Management in Mitigating Liability

Factors Affecting Professional Liability Premiums

Comparing Claims-Made vs. Occurrence Policies

You need to know the difference between claims-made and occurrence policies. Claims-made policies cover claims only while the policy is active. In contrast, occurrence policies cover any claim arising during the coverage period, even if the policy has been canceled. Deciding which suits your needs best is essential for adequate protection.

The Importance of Adequate Coverage Limits

Ensuring your coverage limits are adequate is critical. Underinsurance can lead to significant losses if a claim exceeds your limits. Assess your exposure and adjust your policy accordingly to maintain robust protection.

How to Choose the Right Deductible for Your Business

Selecting the right deductible involves balancing affordability with risk. A higher deductible can lower your premium, but be cautious; ensure that you can absorb those costs should a claim arise.

The Impact of Prior Claims on Future Insurability

Having prior claims can affect your insurability. Insurers may view your history as indicative of future risks, resulting in higher premiums or difficulty obtaining coverage. Building a track record of positive risk management can mitigate this issue.

When to Review and Update Your Liability Coverage

The Role of Brokers and Agents in the Insurance Process

Tips for Communicating with Your Insurer

Effective communication with your insurer is fundamental to a harmonious relationship. Be clear about your business operations, provide all necessary documentation promptly, and maintain regular contact to ensure all parties are aligned.

Professional Liability for Accountants: Beyond the Numbers

Architects and Engineers: Building a Strong Insurance Foundation

Attorneys at Law: Protecting Your Practice from Malpractice Claims

Dentists: Navigating the Complexities of Liability Insurance

Financial Advisors: Shielding Your Clients’ Investments

Healthcare Professionals: The Importance of Malpractice Insurance

IT Professionals: Mitigating Cyber Risks and Data Breaches

Real Estate Agents: Avoiding Liability in Property Transactions

Tech Startups: Tailoring Coverage for Emerging Risks

Nonprofits: Addressing Unique Liability Concerns

Media and Entertainment: Managing Risks in a Creative Field

Hospitality Industry: Protecting Your Guests and Reputation

Educational Institutions: Liability Concerns in Academia

The Rise of Cyber Liability: Protecting Against Digital Threats

The Impact of AI on Professional Liability: New Risks and Opportunities

As AI technologies advance, new legal and ethical responsibilities emerge. Understanding how these changes affect liability is essential for professionals to remain compliant and protected.

Climate Change and Liability: Assessing Evolving Risks

Climate change introduces new liability considerations for various sectors. Professionals must assess the evolving risks in their industries and adjust their coverage accordingly to ensure robust protection.

Social Engineering: The Human Factor in Liability Claims

Social engineering attacks are increasingly common and can lead to devastating liability claims. Understanding this risk and having the right coverage can protect your business from significant financial losses.

Navigating the Hard Market: Strategies for Securing Coverage

During hard markets, securing coverage can be more challenging. Strategies such as demonstrating strong risk management practices and seeking broker support can help you navigate this environment successfully.

The Gig Economy: Liability Considerations for Freelancers and Contractors

Telemedicine: Addressing Liability Concerns in Remote Healthcare

Remote Work: The Impact on Professional Liability Risks

As remote work becomes more common, understanding how this shift affects liability exposure is vital. Businesses must adapt their risk management strategies to address the evolving landscape.

Evolving Regulatory Landscape: Staying Compliant with Insurance Requirements

The Role of Data Privacy in Liability Insurance

Mental Health Professionals: Addressing Unique Liability Concerns

The Impact of Social Media on Reputation and Liability

Social media offers businesses opportunities and risks. Missteps on these platforms can lead to liability claims. Understanding how social media impacts your reputation and liability can help you navigate challenges effectively.

Professional Liability in the Age of Globalization

In an increasingly globalized world, professionals must recognize how international considerations affect their liability exposure. Understanding cross-border risks can better prepare you for potential claims.

Drones and Autonomous Vehicles: New Liability Frontiers

The Future of Professional Liability Insurance: Predictions and Trends

The landscape of professional liability insurance is constantly evolving. By staying informed about industry trends and emerging risks, you can proactively manage your coverage needs.

Creating a Culture of Risk Awareness: Employee Training and Education

Fostering a culture of risk awareness within your organization enhances your overall protection. Regular training and education equip your employees with the knowledge needed to mitigate potential risks effectively.

Implementing Effective Risk Management Strategies

Establishing a comprehensive risk management plan is essential for safeguarding your business. Identify potential risks, develop response strategies, and regularly assess your processes to ensure ongoing protection.

Developing Comprehensive Incident Response Plans

Having clear incident response plans is crucial for managing potential claims effectively. Outline steps for responding to various situations, allowing for quick and efficient resolution.

The Importance of Documentation in Liability Claims

Proper documentation can significantly impact the outcome of a liability claim. Maintain thorough records of all client interactions, services provided, and critical decisions made to support your position during a dispute.

Best Practices for Client Communication and Engagement

Engaging in open and transparent communication with clients can help prevent misunderstandings that could lead to claims. Establishing best practices for client interactions fosters trust and protects your business.

Managing Conflicts of Interest to Minimize Risk

To minimize liability claims, managing potential conflicts of interest is essential. Establish clear policies and procedures to identify and address any conflicts that may arise in your professional relationships.

Utilizing Technology to Enhance Risk Management

Leveraging technology can enhance your risk management efforts. Implement tools for tracking client interactions, managing documents, and facilitating secure communication to reduce exposure to potential claims.

The Role of Internal Audits in Loss Prevention

Case Studies: Lessons Learned from Liability Claims

Analyzing case studies of liability claims offers valuable insights into best practices for risk management. Learn from the experiences of others to refine your approaches and protect your business effectively.

Expert Insights: Interviews with Risk Management Professionals

Engaging with experts in risk management can provide invaluable knowledge. Their insights can help you navigate complex issues related to liability and refine your strategies for protection.

Avoiding Common Pitfalls: Tips for Reducing Liability Exposure

Awareness of common pitfalls can help you reduce your liability exposure. Implement proactive measures and best practices to prevent mistakes that could lead to claims.

The Importance of Continuous Improvement in Risk Management

Reviewing and improving your risk management processes is an ongoing effort. Stay vigilant and open to change, as continually honing your practices can help protect your business from potential claims.

Creating a Safe and Secure Work Environment

A healthy work environment reduces risks for both employees and clients. Implementing safety protocols, training, and guidelines ensures that potential hazards are minimized.

Managing Third-Party Risks: Vendors and Contractors

Engaging with third parties introduces additional risks. Conduct due diligence in selecting vendors and contractors, and ensure that they maintain appropriate insurance coverage.

The Role of Professional Associations in Risk Management

Professional associations often serve as valuable resources for best practices in risk management. Engaging with these organizations can provide insights and support for navigating liability challenges.

Understanding the Claims Notification Process

If a claim arises, knowing the notification process is crucial. Understanding your responsibilities can streamline communication and facilitate a smoother claims experience.

Working with Claims Adjusters: Tips for a Smooth Experience

Establishing a cooperative relationship with claims adjusters is essential. Being transparent and communicative will help ensure a streamlined process, minimizing disruptions to your operations.

The Role of Legal Counsel in Liability Claims

Having legal counsel involved from the start can greatly influence the outcome of a liability claim. Engage lawyers experienced in professional liability to guide you through the intricacies of the legal process.

Preparing for Litigation: Key Considerations

If litigation becomes necessary, being prepared is vital. Understanding the steps involved, being aware of potential costs, and having a robust strategy in place can make the process less daunting.

Mediation and Alternative Dispute Resolution: Options for Resolving Claims

Consider mediation as a potential solution before proceeding to court. Alternative dispute resolution methods can be more efficient and less costly, often leading to satisfactory outcomes for all parties.

Expert Witnesses: Their Role in Liability Cases

Expert witnesses can provide invaluable testimony in liability cases. Understanding their role and how their insights may support your case is crucial for effective resolution.

Managing the Emotional Impact of a Liability Claim

Liability claims can take a toll on your emotional well-being. Engaging in self-care and seeking support during these challenging times is essential for maintaining your focus and resilience.

Case Studies: Analyzing Real-World Claim Scenarios

Studying real-world claim scenarios offers practical insights into best practices for handling liability issues. Learn from both successes and mistakes to refine your approach.

The Impact of Litigation on Reputation and Brand Image

Litigation can severely impact your reputation and brand. Proactively addressing potential claims and managing your public relations can minimize damage to your professional image.

Protecting Your Business During a Claim: Continuity Strategies

Even when facing a claim, it’s crucial to maintain operational continuity. Developing strategies to ensure that your business can function effectively through the process will safeguard your interests.

The Role of Public Relations in Managing Liability Crises

In the event of a liability crisis, effective public relations can help manage the narrative. Crafting clear messages and maintaining transparency can bolster public trust during challenging times.

Lessons Learned from High-Profile Liability Lawsuits

High-profile lawsuits often provide valuable lessons for professionals across all sectors. Analyzing these cases equips you with insights to bolster your own liability management strategies.

Understanding the Financial Costs of Litigation

The financial costs associated with litigation can be staggering. Understanding these expenses can help you budget and prepare for potential legal battles.

Strategies for Negotiating Favorable Settlements

Successful negotiation can lead to favorable settlements in liability claims. Preparing thoroughly, understanding the interests of both parties, and presenting compelling arguments can significantly influence outcomes.

The Importance of Post-Claim Analysis and Improvement

After navigating a claim, review the experience to identify areas for improvement. This analysis can help refine your practices and enhance your risk management strategies moving forward.

The History of Professional Liability Insurance

The Role of Insurance in Economic Growth and Stability

Professional Liability Around the World: International Perspectives

The Ethics of Professional Liability Insurance

Ethical considerations around professional liability insurance involve transparency, responsibility, and care. Engaging in ethical practices enhances trust with clients and cultivates a positive professional reputation.

The Impact of Technology on the Insurance Industry

Technology continues to reshape the insurance industry, providing new ways to assess risk, process claims, and provide customer service. Staying abreast of these changes can enhance your approach to finding adequate coverage.

Careers in Professional Liability Insurance

The field of professional liability insurance offers diverse career opportunities. If you’re interested in working within this industry, exploring roles can lead to a fulfilling career.

The Future of the Insurance Industry: Predictions and Trends

As the insurance landscape continues to evolve, staying informed about emerging trends and developments will equip you to make the best decisions for your coverage needs.

Book Reviews: Must-Reads for Risk Management Professionals

Reading insightful books on risk management and liability can enhance your understanding of the field. Recommended literature can provide valuable lessons and knowledge to empower your practice.

Infographics and Visual Guides to Professional Liability

Visual aids can simplify complex information on professional liability insurance. Creating infographics and guides can make the subject more accessible and understandable.

Webinars and Online Courses: Continuing Education Resources

Participating in educational resources like webinars and online courses can keep you informed about the latest developments in professional liability insurance. They’re also excellent for networking with industry peers.

Podcasts and Interviews with Industry Leaders

Listening to podcasts featuring experts in the field allows you to gain insights into best practices and trends within the industry.

Conferences and Events: Networking Opportunities

Attending industry conferences is an excellent way to build connections and learn about advancements in professional liability insurance. Engaging with peers can enhance your understanding of the landscape.

Glossaries and Resource Guides: Essential Tools for Professionals

Having access to glossaries or resource guides keeps you informed about key terminology and practices in professional liability insurance.

Frequently Asked Questions About Professional Liability Insurance

Client Testimonials and Success Stories

Humorous Takes on Liability Insurance: Cartoons and Jokes

Light-hearted takes on liability insurance can make the subject more approachable. Sharing amusing content helps to frame serious topics in an engaging manner.

Industry News and Updates: Stay Informed About the Latest Developments

Keeping up with industry news ensures you’re aware of changes that may affect your liability coverage. Being informed allows for proactive management of your policies.

Regulatory Changes and Their Impact on Liability Coverage

Changes in regulations can profoundly impact professional liability insurance requirements. Staying abreast of these developments helps you remain compliant and properly covered.

Case Studies: Analyzing Landmark Court Decisions

Landmark court decisions can set precedents that influence liability insurance practices. Analyzing these outcomes can enhance your understanding of the legal landscape.

The Role of Insurance in Social Responsibility and Sustainability

Insurance has a role to play in promoting social responsibility. As more industries emphasize sustainability, understanding how liability policies can align with these values is essential.

Thought Leadership: Essays and Opinion Pieces from Experts

Engaging with thought leaders provides various perspectives and insights into professional liability challenges. These contributions are fundamental to fostering a more robust understanding of evolving practices.

Debunking Myths and Misconceptions About Liability Insurance

Clearing up common misconceptions about liability insurance will empower professionals to make informed decisions. Awareness of these myths will prevent potential pitfalls.

Interactive Quizzes and Assessments: Test Your Knowledge

Interactive tools can help deepen your understanding of liability insurance. Quizzes and assessments provide engaging ways to reinforce what you’ve learned.

Tips for Marketing and Promoting Your Professional Services

Effective marketing strategies enhance your visibility and reputation. Understanding how professional liability insurance plays into your promotion can help you communicate your value to potential clients.

Building a Strong Online Presence: Websites and Social Media

In today’s digital world, a robust online presence is essential for attracting clients. Understanding how to navigate liability implications within this space is critical.

Professional Liability for Medical Device Manufacturers: Navigating Complex Risks

Insurance Considerations for Architects Designing Sustainable Buildings

Protecting Your Law Firm from Cyberattacks and Data Breaches

Malpractice Insurance for Nurse Practitioners and Physician Assistants

Nurse practitioners and physician assistants face unique liability risks. Malpractice insurance tailored to their services is crucial for safeguarding their practice.

Liability Concerns for Financial Planners and Wealth Managers

Insurance Solutions for Mental Health Professionals in Private Practice

Cybersecurity Insurance for IT Consultants and Managed Service Providers

For IT professionals, cybersecurity insurance is crucial. Safeguarding against risks associated with data management and breaches ensures lasting client trust.

Understanding Professional Liability for Commercial Real Estate Brokers

Tailoring Insurance for Biotech Startups and Pharmaceutical Companies

Addressing Liability Risks for Nonprofits Working in Disaster Relief

Protecting Film Producers and Directors from Production-Related Claims

Insurance Needs for Event Planners and Hospitality Management Companies

Liability Coverage for Online Educators and EdTech Platforms

Professional Liability for Drone Operators and Aerial Photography Businesses

Insurance Considerations for Companies Developing Artificial Intelligence

Addressing Liability Risks in the Sharing Economy and Gig Platforms

Insurance Solutions for 3D Printing and Additive Manufacturing Companies

As 3D printing continues to grow, customizing insurance solutions is vital. Addressing the unique risks associated with this industry will help protect businesses from liability claims.

Protecting Cryptocurrency Exchanges and Blockchain Technology Providers

Professional Liability for Space Tourism and Commercial Spaceflight Ventures

Insurance Needs for Companies Working with Gene Editing and Biotechnology

Addressing Liability Risks in the Cannabis Industry

Lessons from a High-Profile Medical Malpractice Lawsuit

Analyzing high-profile malpractice lawsuits offers valuable lessons for healthcare professionals. Understanding the reasons behind these claims can help improve risk management strategies across the industry.

Analyzing a Construction Defect Claim and its Impact on the Contractor

Construction defect claims can have serious financial implications. Understanding the factors that lead to these claims can help minimize risks and improve project management practices.

How a Cyberattack Crippled a Tech Company and its Insurance Response

Real-World Examples of Social Engineering Scams Targeting Businesses

Social engineering scams can pose serious risks for businesses. Analyzing these real-world examples helps illustrate the potential impacts on liability and emphasizes the need for adequate coverage.

Case Study: A Successful Claim Mitigation Strategy in the Healthcare Industry

A healthcare provider’s proactive measures in response to a claim led to an effective resolution. This case study exemplifies the importance of risk management and insurance as integral components of professional practice.

How a Small Business Overcame a Negligence Lawsuit and Thrived

A small business’s successful navigation of a negligence lawsuit serves as a powerful example of resilience. Learning from this experience highlights the importance of sound insurance practices and risk management strategies.

Analyzing the Financial Impact of a Data Breach on a Retail Company

Lessons Learned from a Professional Liability Claim in the Legal Profession

Reflecting on past claims within the legal profession demonstrates the importance of maintaining robust risk management strategies. Learning from these cases enhances the overall understanding of liability challenges.

Case Study: The Importance of Risk Management in the Construction Industry

Risk management practices within the construction industry can significantly influence outcomes. Analyzing this case study illustrates how proactive measures can help prevent costly claims.

The Role of Behavioral Economics in Understanding Liability Risks

Understanding behavioral economics allows professionals to assess liability risks from a psychological perspective. Incorporating this knowledge into risk management strategies can lead to improved outcomes.

The Intersection of Ethics and Professional Liability Insurance

Ethics plays a crucial role in shaping professional liability practices. Understanding how ethical considerations influence liability coverage can lead to better decision-making.

The Impact of Globalization on Professional Liability Claims

The increasingly interconnected world requires professionals to understand how globalization affects liability exposure. Awareness of these dynamics enables you to adapt your coverage effectively.

The Future of Risk Management: Predictive Analytics and AI

As predictive analytics and AI technologies evolve, they offer promising opportunities for risk management. Embracing these developments can enhance your approach to liability exposure.

The Role of Insurance in Promoting Social Justice and Equity

Insurance can help advance social justice and equity by addressing systemic disparities. Understanding how professional liability coverage factors into this discussion enriches the conversation on social responsibility.

Exploring the Psychological Impact of Liability Claims on Professionals

Liability claims can take a significant emotional toll on professionals. Recognizing this impact is essential for implementing support systems and maintaining overall well-being.

The Importance of Transparency and Communication in the Insurance Industry

In the insurance industry, transparency and communication foster trust and better outcomes. Advocating for open dialogue can contribute to a more positive experience for all parties involved.

The Role of Professional Associations in Shaping Liability Standards

Professional associations play a fundamental role in establishing liability standards. Engaging with these organizations can help you stay informed about evolving practices in your industry.

The Evolution of Risk: Historical Perspectives on Professional Liability

Tracking the evolution of risk highlights the changing landscape of professional liability. Understanding these shifts can better position you in navigating today’s challenges.

The Impact of Emerging Technologies on the Future of Insurance

Emerging technologies are set to reshape the insurance industry significantly. Embracing change is crucial for staying ahead of evolving liability exposure.