What if a seemingly small mistake could lead to the downfall of your business? For many professionals, understanding the intricacies and importance of professional liability insurance is essential to maintaining business continuity. This article will discuss the role of professional liability in business continuity plans, guiding you through its evolution, specific needs for various industries, and best practices in managing risks.

The Evolution of Professional Liability Insurance

Understanding Professional Liability Insurance

Professional liability insurance helps protect you from claims that arise due to negligence, errors, or omissions in the professional services you provide. It covers legal defenses and settlements, making it a financial safeguard for professionals in various fields.

When it comes to professional liability insurance, several misconceptions often cloud judgment. It’s time to clear those up.

It Only Covers Major Errors

Many believe that professional liability insurance is only for catastrophic mistakes. In reality, even minor oversights can lead to significant claims. Therefore, it’s essential to consider coverage for a broader range of scenarios, no matter how trivial they may seem.

It’s the Same as General Liability Insurance

Professional liability insurance is distinct from general liability insurance. While general liability covers physical injuries or property damage that arises in a business context, professional liability focuses on claims related to professional services. This is especially crucial for professions that provide advice or consulting.

How Professional Liability Differs from General Liability

To better understand what professional liability insurance covers, let’s break down the differences between it and general liability insurance.

| Aspect | Professional Liability Insurance | General Liability Insurance |

|---|---|---|

| Coverage Focus | Errors and omissions in services | Bodily injury and property damage |

| Industry-Specific | Tailored for specific professions | Broad coverage for businesses |

| Claim Nature | Based on negligence | Based on accidents |

This table highlights how the two types of insurance serve different purposes, reflecting their importance in safeguarding your business.

The Role of Professional Liability in Business Continuity

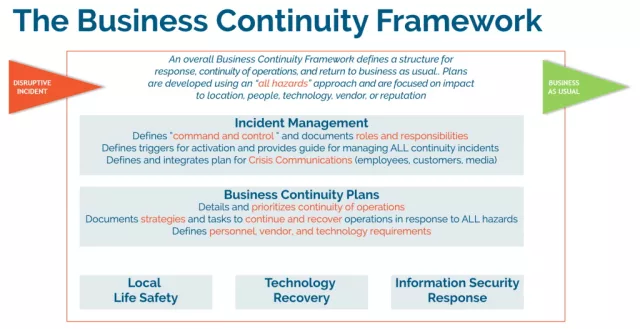

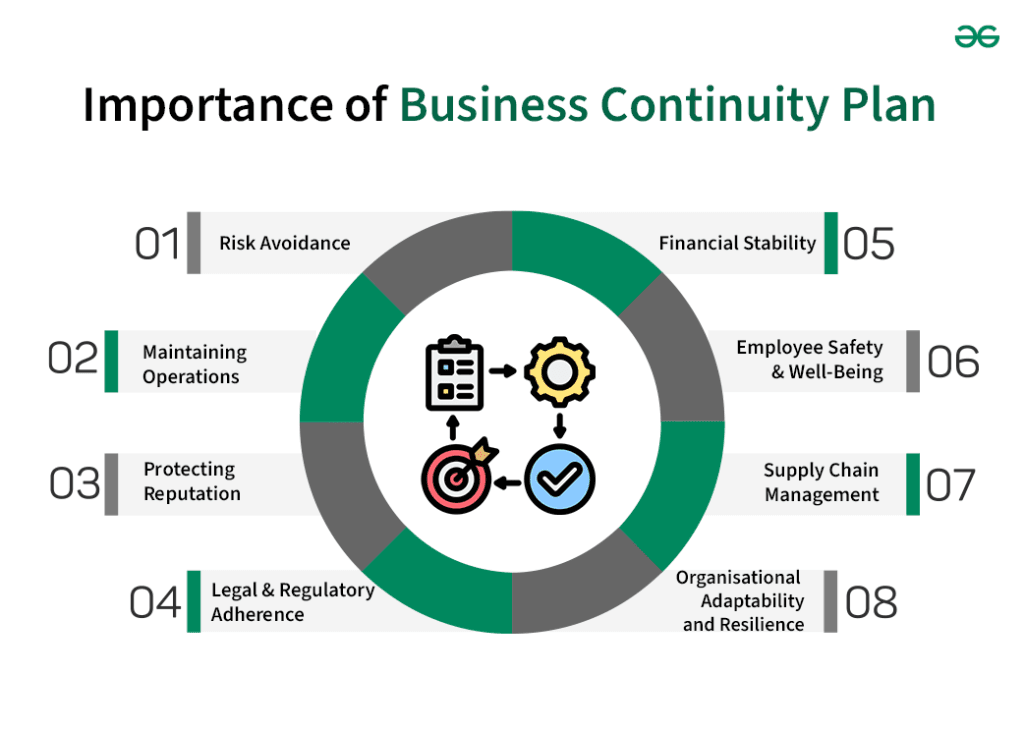

Integrating professional liability insurance into your business continuity plan is vital for several reasons.

Risk Mitigation

Having this insurance means you’re better prepared to handle claims, allowing you to manage risks associated with unexpected incidents without crippling your finances.

Trust and Credibility

Clients want assurance that you’re not just knowledgeable but also responsible. Having professional liability coverage enhances your credibility, showing that you’re serious about your profession.

Financial Protection

Should a claim arise, professional liability insurance can cover legal fees and potential settlements, ensuring your business remains financially stable. This kind of protection can be the difference between bouncing back and facing bankruptcy.

How to Evaluate Your Need for Professional Liability Coverage

Determining your need for professional liability insurance involves assessing your specific situation.

Analyze Your Industry’s Risks

Different professions face varying levels of risk. For instance, healthcare providers might encounter more litigation than a graphic designer. Understanding these risks is the first step.

Assess Your Client Relationships

If you offer advisory services or work closely with clients, the chances of facing claims increase. Evaluate your interactions to determine the level of risk involved.

Tailoring Liability Insurance for the Tech Industry

The tech industry is ever-evolving, and so are its risks.

Understanding Unique Challenges

With rapid advancements, cybersecurity threats, and the use of artificial intelligence, tech professionals are increasingly exposed to liability claims. Tailoring your coverage to these unique challenges is essential.

In selecting the correct errors and omissions policy, consider including coverage for data breaches, technology errors, and software failure. This will better protect your business against the variety of potential pitfalls in the tech landscape.

Professional Liability Needs for Healthcare Providers

Healthcare providers face significant liability risks due to the nature of their work.

Key Risks in the Healthcare Sector

From misdiagnoses to surgical errors, the stakes are high. Therefore, having comprehensive malpractice insurance is paramount for protection.

Malpractice Insurance Essentials

This type of professional liability insurance not only covers legal fees but also helps protect your practice’s reputation. In today’s litigious environment, you can’t afford to overlook this essential coverage.

Insurance Challenges in the Construction Sector

The construction industry has unique requirements when it comes to liability insurance.

Navigating Complex Risks

Construction projects come with a range of unpredictabilities. Project delays, safety violations, and contractual disputes can all result in claims, making insurance coverage critical.

Importance of Builder’s Risk Insurance

This insurance covers property damage during construction. Ensure your policy reflects the common hazards specific to construction work to protect your investment.

Legal Professionals: Unique Insurance Considerations

For attorneys, professional liability insurance isn’t just an option; it’s a necessity.

Understanding Malpractice Claims

Common causes of malpractice claims include failure to meet deadlines or inadequate representation. Understanding these risks will help you gauge your insurance needs more accurately.

Coverage for Legal Services

Ensure your policy not only covers basic errors but also extends to specific practice areas within law. Each specialty has different risks, and coverage should match those risks.

Financial advisors and planners are particularly vulnerable to liability claims.

Navigating the Complex Financial Landscape

This insurance type should cover a wide range of scenarios, from investment errors to inadequate financial planning. A comprehensive policy will protect you against the costs of litigation and help safeguard your client relationships.

The Impact of AI on Professional Liability Policies

As technology advances, so does the complexity of liability coverage.

New Risks Arising from AI

The integration of AI into services introduces new risks, such as data misuse or algorithmic errors. Professional liability policies must adapt to cover these implications.

Insurer Adjustments

Insurance providers are evolving their offerings to address these emerging concerns, ensuring that you’re adequately protected in an increasingly digital world.

Cybersecurity Threats and Their Influence on Insurance Needs

Cybersecurity threats pose significant risks across industries.

Understanding Cyber Liability Insurance

Given the frequency of data breaches and cyberattacks, many professionals are turning to cyber liability insurance as an additional safety net.

Coverage Essentials

Look for policies that cover data breaches, network security failures, and customer notification costs. This adds another layer of protection tailored to modern business needs.

How Climate Change Affects Liability Risk Assessments

Climate change is becoming an undeniable factor in risk assessments.

Evolving Liability Due to Environmental Factors

Natural disasters and increasingly severe weather patterns can impact various industries. Understanding these vulnerabilities allows you to adapt your insurance accordingly.

Policy Adjustments for Changing Risks

As conditions evolve, so should your liability policies. Ensure your coverage accounts for climate-associated risks that could pose a threat to your business operations.

Social Engineering: A Growing Concern for Insurers

As digital interactions become more common, social engineering presents a new avenue for liability risks.

Understanding the Threat

Social engineering manipulates individuals into divulging confidential information. This rising threat emphasizes the importance of educating staff and reviewing insurance coverage.

Preventative Measures

Consider implementing training programs to help your team identify and resist social engineering attempts. With the right policies in place, you can protect your business from these insidious threats.

Navigating the Hard Market in Professional Liability

In recent years, the insurance industry has faced a hard market, impacting coverage availability and costs.

Understanding the Hard Market

A hard market often leads to increased premiums and stricter underwriting standards, affecting your ability to secure reasonable coverage. Recognizing these trends can inform your business strategy.

Strategies for Managing Costs

Explore alternative coverage options, negotiate with insurers, and assess your business’s risk profile thoroughly. Engaging with professionals can ensure you find the best deal amid challenging conditions.

Lessons from High-Profile Professional Liability Lawsuits

High-profile lawsuits serve as vital reminders of the importance of professional liability insurance.

Analyzing Case Outcomes

Examining notable cases can unveil common pitfalls and the consequences of inadequate coverage. Understanding these scenarios encourages proactive risk management.

Implementing Best Practices

Learn from these lessons by scrutinizing your internal procedures, ensuring compliance, and regularly updating your coverage to meet evolving industry standards.

How Large Corporations Manage Their Liability Risks

It’s instructive to see how large enterprises handle their liability risks.

Strategies Employed by Corporations

With greater resources at their disposal, large organizations often focus on comprehensive risk management frameworks, including thorough insurance evaluations and ongoing compliance checks.

Responsive Action Plans

In unforeseen events, large corporations typically implement robust action plans to mitigate fallout and protect their reputation, providing useful insights for smaller organizations as well.

Case Study: Successful Claims Mitigation Strategies

Real-life examples shed light on effective claims management.

Learning from Success Stories

Studying successful claims mitigation strategies can provide valuable insights into what works. Engage in open conversations with peers to gather their experiences and apply best practices to your situation.

Proactive Risk Management

Employ proactive measures, including regular audits and thorough employee training. This approach decreases the likelihood of incidents leading to liability claims.

The Financial Impact of Negligence Claims on Small Businesses

Small businesses often bear the brunt of negligence claims.

Understanding the Costs

The financial ramifications of one negligence claim can be crippling. From lost revenue to legal costs, you may find yourself in a vulnerable position if unprepared.

Preventative Measures

Investing in professional liability insurance is a crucial step toward safeguarding your financial health. Combine this with effective risk management strategies to minimize exposure.

Highlighting Notable Claims

Reviewing notable cases of errors and omissions provides insight into how claims arise, what they entail, and how your coverage can impact outcomes.

Best Practices Based on Examples

Learn from successful resolutions in these cases. Understanding different scenarios will help foster a more robust approach to your own liability coverage.

A Step-by-Step Guide to Filing a Professional Liability Claim

Filing a claim can be complex if you’re not familiar with the process. Here’s a straightforward guide to follow.

Step 1: Document the Incident

Keep thorough records of the events leading up to the claim. This includes emails, contracts, and any communication that may serve as evidence.

Step 2: Notify Your Insurer

Contact your insurance provider as soon as possible. They can guide you through the necessary steps to formally initiate the claims process.

Step 3: Cooperate with Investigations

During the investigation, stay cooperative and transparent. This will foster goodwill and ensure a smoother resolution.

Step 4: Review Settlements Carefully

Consider any settlements offering to ensure they align with your best interests. Don’t rush into any decisions without consulting your legal counsel.

Assess Your Needs

Start by outlining your specific risks related to your profession. This clarity will serve as a foundation for finding the right coverage.

Compare Different Policies

Take the time to compare various policies. Pay attention to coverage limits, exclusions, and additional benefits offered.

Familiarizing yourself with policy limits and deductibles is crucial for preparedness.

What Are Policy Limits?

Policy limits refer to the maximum amount an insurer will pay for a covered claim. It’s essential to ensure these limits match your potential exposure adequately.

Understanding Deductibles

A deductible is the amount you pay out of pocket before your insurance kicks in. Opt for a deductible that strikes a balance between affordability and coverage adequacy.

Tips for Negotiating Better Terms with Your Insurer

Negotiating with your insurer can lead to better terms and potentially lower costs.

Understand Your Value

When discussing your policy with an insurer, emphasize the value of your business and the proactive measures you’ve taken to minimize risks. This can strengthen your negotiating position.

Seek Multiple Quotes

Don’t settle for the first offer you receive. Seeking multiple quotes can help you gauge the market and find competitive terms.

How to Educate Employees About Liability Risks

Employee education is critical for minimizing risks.

Create a Training Program

Develop a comprehensive training program to inform employees about potential liability risks and proactive measures they can take. Knowledgeable staff are less likely to create situations that might lead to claims.

Encourage Open Communication

Foster a culture of transparency within your business, allowing employees to voice concerns and report issues before they escalate. This proactive approach can help manage risks efficiently.

Exploring Niche Markets for Professional Liability Coverage

Understanding niche markets can enhance your coverage options.

Identify Niche Opportunities

Certain professions may require specialized coverage, which standard policies may not adequately address. Research these niches within your industry to identify unique needs.

Tailor Your Insurance Solutions

Work closely with your insurer to customize policies that reflect niche demands, ensuring comprehensive protection against specific risks associated with your profession.

Customizing Policies for Emerging Industries

Emerging industries present new risks that may not be covered under traditional policies.

Recognize the Unique Challenges

Stay informed about trends within your industry. For example, tech startups may face different liabilities compared to traditional manufacturing businesses.

Partner with Insurers

Collaborate with your insurer to create customized policies that reflect the unique landscape of emerging industries. This will ensure your protections grow alongside your business.

The Role of Professional Associations in Shaping Coverage Needs

Professional associations play an essential role in influencing industry standards.

Engage with Associations

Participate in discussions and activities offered by professional associations. They can provide insights, resources, and connections, enhancing your understanding of liability considerations.

Leverage Guidance

Many associations provide resources or guidelines on selecting appropriate insurance. Use these tools to enhance your decision-making process regarding coverage.

Leveraging Industry-Specific Insights to Enhance Coverage Options

Industry insights can significantly influence your coverage selections.

Stay Updated

Keep yourself informed about changes in regulations, emerging risks, and best practices relevant to your profession. This knowledge can guide your insurance choices.

Collaborate Within Your Industry

Engage in networking opportunities to gather insights from peers. This shared knowledge can help you make informed decisions about your liability coverage.

Creating a risk management plan is an integral part of minimizing liability exposure.

Plan Basics

A comprehensive risk management plan should identify potential risks, establish mitigation strategies, and outline response procedures for various scenarios.

Make sure to include professional liability considerations when drafting your plan. Tailored strategies will enhance your ability to navigate risks specific to your field.

Professional Liability Insurance 101: A Beginner’s Guide

Understanding the basics of professional liability insurance is essential for any professional.

Key Concepts

Familiarize yourself with key concepts such as coverage limits, exclusions, and the claims process. This foundational knowledge is crucial in selecting the right policy.

Importance of Coverage

Recognize that professional liability insurance is vital for protecting your career and ensuring business continuity. Don’t underestimate the value it provides.

Errors and omissions insurance is often the safety net that protects professionals.

What You Need to Know

Get a clear grasp of essential aspects like coverage types, policy limits, and applicable professions. Each detail contributes significantly to your overall protection.

The Role of Claims-Made Policies

In professional liability, consider how claims-made policies can act as a safety net for claims made during the policy period. Ensure you understand the implications for your business strategy.

Why Every Professional Needs Liability Coverage

No matter your profession, liability insurance is a safety net for various unforeseen situations.

Understanding the Risks

Every profession, whether healthcare, legal, tech, or creative arts, has some level of risk involved. Having coverage protects you and your clients from potential mishaps.

Ensuring Business Continuity

A single claim can disrupt your business operations and financial stability. Comprehensive liability coverage ensures you’re equipped to handle unexpected events, preserving your business continuity.

Understanding the Claims Process: What to Expect

Filing a claim can be a daunting task if you don’t know what to expect.

Initial Steps

Document the incident thoroughly, and notify your insurer promptly. Keeping organized records will expedite the claims process.

Claim Investigation

Your insurer will perform an investigation, which may involve gathering evidence and speaking with involved parties. Maintain cooperation to facilitate a smooth investigation.

Key Terms and Definitions in Professional Liability Insurance

Familiarizing yourself with key terms can simplify your understanding of professional liability insurance.

Essential Terms

Here are a few critical terms to know:

- Claim: A formal request for payment under your insurance policy.

- Deductible: The amount you pay out-of-pocket before insurance coverage kicks in.

- Exclusions: Specific scenarios or conditions not covered by your policy.

Knowing these terms helps you navigate discussions about your insurance more effectively.

What Isn’t Covered

Be aware that several common exclusions may apply to your policy, including:

- Claims arising from intentional wrongdoing.

- Work done prior to your coverage period.

- Non-professional services.

Understanding these exclusions allows you to evaluate your liabilities accurately.

The Role of Risk Management in Mitigating Liability

Risk management is your primary defense against potential liability claims.

Assessing Risks

Regularly evaluate operational procedures and their potential risks. Identifying these risks early can help you implement mitigation strategies.

Developing Contingency Plans

Create comprehensive contingency plans for responding to incidents that could lead to liability claims. Being prepared reduces the chance of facing severe repercussions.

Factors Affecting Professional Liability Premiums

Understanding what affects your premiums can help manage costs.

Risk Exposure Assessment

Insurers assess your business risks based on factors like industry, claims history, and business size. A clean claims history typically results in lower premiums.

Continuous Improvement

Regularly improving your risk management practices can positively influence your premium costs over time.

Comparing Claims-Made vs. Occurrence Policies

Navigating the nuances between claims-made and occurrence policies can be challenging.

Definitions

- Claims-Made Policy: Provides coverage for claims made while the policy is active.

- Occurrence Policy: Covers claims for incidents that occur during the policy period, regardless of when they’re reported.

Understanding the differences between these formats can significantly influence your coverage decisions.

The Importance of Adequate Coverage Limits

Setting adequate coverage limits is essential for your business safety.

What Are Coverage Limits?

Coverage limits define the maximum amount your insurer will pay for a claim. Ensure your limits appropriately reflect your exposure to potential risks.

Assessing Your Needs

Regularly assess and adjust your coverage limits to align with your evolving business landscape and industry trends.

How to Choose the Right Deductible for Your Business

Selecting the right deductible influences your out-of-pocket costs.

Evaluating Financial Capacity

Consider your business’s financial capacity when choosing a deductible. Balancing affordability with coverage is essential for effective risk management.

Understanding Consequences

A lower deductible means a higher premium, while a higher deductible comes with lower premiums but increased upfront costs in the event of a claim.

The Impact of Prior Claims on Future Insurability

Previous claims can significantly influence your future insurance options.

Understanding How Claims Affect Premiums

Carrying a history of prior claims typically leads to increased premiums and may affect your ability to secure coverage.

Improving Your Risk Profile

Engaging in proactive risk management can mitigate this impact over time, leading to more favorable insurance conditions.

When to Review and Update Your Liability Coverage

Keeping your liability coverage current is essential for safeguarding your business.

Regular Assessment

At least annually, review your coverage needs, assessing any changes in business operations, client base, or industry regulations.

Staying Ahead of Trends

Be vigilant about emerging trends in your profession that might necessitate adjustments to your coverage. Staying informed ensures you’re adequately protected in a continuously evolving landscape.

The Role of Brokers and Agents in the Insurance Process

Brokers and agents play a crucial role in navigating the insurance landscape.

Choosing the Right Partner

Select an insurance broker or agent with expertise in your industry. Their insights can guide you to find appropriate coverage specific to your needs.

Utilizing Their Expertise

Engage actively with your broker, leveraging their knowledge to customize policies and navigate claims processes as needed.

Tips for Communicating with Your Insurer

Effective communication is key to securing favorable terms with your insurer.

Establish Clear Lines of Communication

Maintain open lines of communication with your insurer. Regular updates and dialogue can build rapport and foster better collaboration.

Transparency is Essential

Be transparent with your insurer regarding any potential claims or risks. This honesty can facilitate smoother claims processing down the line.

Professional Liability for Accountants: Beyond the Numbers

Accountants face unique liability concerns in their profession.

Understanding Common Risks

Common risks vary from errors in financial reporting to failure to comply with regulations. These pitfalls underscore the importance of robust professional liability coverage.

Tailoring Policies to Specific Needs

Make sure your policy encompasses coverage for specific financial services you provide. Understanding the nuances of your profession can help secure adequate protection.

Architects and Engineers: Building a Strong Insurance Foundation

The architecture and engineering industries come with unique liability exposures.

Identifying Key Risks

Importance of Professional Liability Coverage

Professional liability insurance not only protects your business but also cultivates client trust. As clients often rely on your expertise, covering potential exposures helps maintain solid relationships.

Attorneys at Law: Protecting Your Practice from Malpractice Claims

Lawyers are particularly vulnerable to malpractice claims due to the nature of their work.

Common Causes of Claims

Common claims stem from failure to meet deadlines, inadequate counsel, or conflict of interest. Understanding these risks aids in obtaining comprehensive coverage.

Importance of Malpractice Insurance

Malpractice insurance is vital for protecting your reputation and financial stability. An adequate policy serves as critical protection in an ever-evolving legal landscape.

Consultants operate in a realm that extends their influence— and potential liabilities— beyond immediate client relationships.

Key Risks for Consultants

Risks are heightened by the advisory nature of consulting work. Poor advice or project failures can lead to costly claims.

Tailoring Your Coverage

Dentists: Navigating the Complexities of Liability Insurance

Dentists face distinct liability risks in their practices.

Identifying Potential Claims

Risks range from misdiagnoses to treatment errors. A solid malpractice insurance policy is imperative to protect against these threats.

Importance of Specialized Coverage

Opt for tailored coverage that addresses the specific challenges faced in dentistry. Adequate insurance is vital for ensuring business continuity while safeguarding your practice.

Financial Advisors: Shielding Your Clients’ Investments

Financial advisors are unique targets for liability claims due to the nature of their work.

Navigating Regulatory Risks

Advisors must navigate a complex landscape of regulations. Failure to comply can result in serious claims, necessitating robust protection through insurance.

Crafting Specialized Policies

Healthcare Professionals: The Importance of Malpractice Insurance

Healthcare professionals are often at the highest risk for liability claims.

Common Areas of Exposure

From surgical errors to misdiagnoses, the potential for claims in healthcare is significant, leading to an urgent need for malpractice insurance.

Comprehensive Coverage Strategies

Invest in a comprehensive policy that covers various specialties within the healthcare field. This precaution helps protect your practice while fostering patient trust.

IT Professionals: Mitigating Cyber Risks and Data Breaches

As technology takes center stage, IT professionals face unique liability risks.

Risks Associated with Data Breach

Cybersecurity incidents can result in significant liability claims, highlighting the importance of both professional liability and cyber liability insurance.

Tailoring Your Coverage

Ensure your coverage addresses data breaches, network failures, and client-related exposure. As the tech landscape evolves, so too should your insurance protections.

Even insurance professionals face liability risks.

Risk Exposure for Insurance Agents

Errors in advice or oversight in policy details can lead to claims. This underscores the need for robust liability coverage.

Selecting Appropriate Coverage

Ensure your professional liability insurance adequately reflects the specific risks faced by insurance agents. This coverage is essential for protecting your practice.

Real Estate Agents: Avoiding Liability in Property Transactions

Real estate agents encounter a distinct set of liability risks during transactions.

Understanding Common Liabilities

Importance of Coverage

Professional liability insurance is essential for safeguarding your business reputation and ensuring the smooth handling of transactions.

Tech Startups: Tailoring Coverage for Emerging Risks

New technologies bring unique risks for startups.

Identifying Emerging Liability Risks

From software failures to data privacy concerns, startups must be vigilant about liability exposures.

Customizing Your Coverage

Work with an experienced insurer to craft customized policies addressing the distinctive risks associated with rapidly-developing technologies.

Nonprofits: Addressing Unique Liability Concerns

Nonprofits often encounter unique liability challenges.

Understanding Specialized Needs

Liability exposures in nonprofits may include volunteers, contracts, and fundraising activities.

Securing Comprehensive Coverage

Invest in tailored liability insurance that reflects the organization’s unique dynamics. Ensuring comprehensive protection is vital for your mission success.

Media and Entertainment: Managing Risks in a Creative Field

The media and entertainment industries encompass diverse liability exposures.

Navigating Potential Liabilities

Issues can arise from copyright breaches to defamation claims. Understanding these risks helps safeguard your endeavors.

Importance of Proper Insurance

Comprehensive professional liability insurance is essential for protecting creative professionals and organizations against unpredictable challenges.

Hospitality Industry: Protecting Your Guests and Reputation

The hospitality industry faces unique liability threats.

Recognizing Common Risks

Liabilities can emerge from guest injuries or food-related incidents, emphasizing the need for adequate coverage.

Tailored Liability Insurance

Investing in tailored liability insurance ensures that your establishment is equipped to manage various risks associated with hospitality.

Educational Institutions: Liability Concerns in Academia

Educational institutions are not exempt from liability exposure.

Understanding Key Risks

Risks encompass student safety, discrimination claims, and faculty-related incidents. Each factor requires careful consideration.

Comprehensive Coverage Strategies

Engage with insurers to secure liability coverage that protects against the unique challenges faced by educational institutions.

The Rise of Cyber Liability: Protecting Against Digital Threats

Today’s digital landscape poses a significant risk for businesses.

Immediate Importance of Cyber Liability

With breaches becoming more common, cyber liability insurance is crucial for protecting both the business and its clients.

Customizing Coverage

Establish a robust policy that addresses a range of potential threats in today’s digital world, ensuring you remain protected.

The Future of Professional Liability Insurance: Predictions and Trends

As we look ahead, changes in professional liability insurance are on the horizon.

Anticipating Market Shifts

Emerging technology, evolving regulations, and changes in consumer behavior will likely influence the professional liability landscape.

Staying Informed

Stay engaged in industry developments and adjust your policies to remain adequately protected amidst these shifts.

Creating a Culture of Risk Awareness: Employee Training and Education

Fostering a culture of risk awareness is fundamental to mitigating liabilities.

Importance of Employee Training

Educate employees about the importance of risk awareness and encourage responsible behavior in their professional interactions.

Regular Assessments and Updates

Establish a regular training schedule to engage employees continually and ensure they stay informed about best practices in risk management.

Implementing Effective Risk Management Strategies

Effective risk management is an ongoing obligation for every professional.

Identify and Mitigate Risks

Conduct regular assessments of possible risks related to your operations, implementing strategies to mitigate them.

Encourage Collaboration

Engage your entire team in risk management discussions. Collective input can yield insightful strategies for improvement.

Developing Comprehensive Incident Response Plans

An incident response plan is critical in managing potential liability claims.

Plan Components

Key components of an effective plan include identifying potential risks, establishing communication guidelines, and detailing emergency procedures.

Training and Drills

Regularly train your team on the intricacies of the response plan, ensuring everyone knows their role in the event of an incident.

The Importance of Documentation in Liability Claims

Proper documentation is vital for the protection of your interests.

Keeping Accurate Records

Maintain thorough records of your work, communications, and any incidents. Accurate documentation will support your claims process significantly.

Using Documentation for Defense

In the event of a claim, having well-organized documentation can prove invaluable in defending against allegations.

Best Practices for Client Communication and Engagement

Clear communication with clients fosters trust and reduces liability risks.

Building Trust

Ensure open lines of communication with your clients. Transparency encourages clients to voice concerns that can be addressed promptly.

Setting Clear Expectations

Clearly outline deliverables and timelines. Establishing these parameters can help mitigate misunderstanding and potential issues.

Managing Conflicts of Interest to Minimize Risk

Conflicts of interest can lead to significant liabilities if not managed effectively.

Identifying Potential Conflicts

Regularly evaluate your work and relationships to identify potential conflicts that could arise.

Establishing Protocols

Create protocols for resolving conflicts and maintain transparency with clients to manage risks effectively.

Utilizing Technology to Enhance Risk Management

Technology can be a powerful ally in protecting against liability risks.

Implementing Data Monitoring

Use technology to monitor data and communications for potential risks, ensuring your operations remain compliant and transparent.

Engaging with Risk Management Software

Investing in risk management software can streamline analysis and ensure you stay ahead of emerging challenges.

The Role of Internal Audits in Loss Prevention

Conducting regular internal audits can significantly influence your risk management strategy.

Developing an Audit Schedule

Establish a schedule for audits to regularly evaluate processes, compliance, and overall risk exposure.

Identifying Areas for Improvement

Use audit results to identify weaknesses and implement strategies for enhancement, ultimately minimizing potential liability.

Case Studies: Lessons Learned from Liability Claims

Real-world case studies can yield insightful lessons for your business.

Learning from Various Outcomes

Review different cases to understand what led to claims, their resolutions, and how you can adapt your strategies moving forward.

Implementing Best Practices

Incorporate lessons learned into your own practices. This proactive approach can significantly enhance risk management efforts.

Expert Insights: Interviews with Risk Management Professionals

Gaining insights from experts can provide valuable perspectives on professional liability.

Engage with Professionals

Seek out interviews or discussions with risk management professionals to gather best practices and industry perspectives.

Incorporate Insights into Your Strategy

Utilize the knowledge collected to inform your insurance practices and navigate risks more effectively.

Avoiding Common Pitfalls: Tips for Reducing Liability Exposure

Proactively addressing potential pitfalls can safeguard your business.

Educate Yourself and Your Team

Continuous education regarding liability risks and prevention helps keep exposure levels low.

Regular Evaluations

Conduct regular evaluations of policies and operational practices to uncover vulnerabilities.

The Importance of Continuous Improvement in Risk Management

Adopting a mindset of continuous improvement can significantly bolster your risk management strategies.

Embrace Change

Recognize that risk landscapes evolve and adjust your strategies accordingly. Being adaptable will enhance your resilience against challenges.

Gather Feedback

Encourage team members to provide feedback on risk management practices and policies. This collaborative approach can yield valuable insights for further development.

Creating a Safe and Secure Work Environment

A safe work environment is foundational to minimizing liability risks.

Regular Safety Assessments

Conduct regular safety evaluations to identify and address hazards that could lead to potential claims.

Promoting a Culture of Safety

Involve your employees in discussions around safety to foster awareness and responsibility in the workspace.

Managing Third-Party Risks: Vendors and Contractors

Engaging with third parties introduces additional liability risks.

Assess Partner Reliability

Conduct due diligence on vendors and contractors before forming partnerships. Understanding their risk management practices can safeguard your interests.

Establish Fresh Protocols

Create protocols for managing relationships with third parties, ensuring that you maintain oversight over emerging risks.

The Role of Professional Associations in Risk Management

Professional associations can be invaluable resources for risk management strategies.

Engage with Networks

Participate in network activities and discussions to gather insights on best practices for managing liability risks.

Leverage Resources

Many associations offer resources and toolkits designed to enhance your understanding of liability and risk management.

Understanding the Claims Notification Process

Navigating claims notification is a necessity for effective risk management.

Review Policy Guidelines

Ensure you comprehend your insurer’s claims notification requirements. Being aware of timelines and processes can streamline your response.

Document Promptly

Act quickly to document incidents and notify your insurer as required. Timely communication can significantly impact your claims process.

Working with Claims Adjusters: Tips for a Smooth Experience

Engagement with claims adjusters can significantly influence your claims outcomes.

Communicate Clearly

Maintain clarity in your communications with adjusters. Providing accurate and detailed information can facilitate smoother processing.

Build Relationships

Establishing rapport with claims adjusters can foster goodwill and streamline your interactions during the claims process.

The Role of Legal Counsel in Liability Claims

Having legal counsel is critical during liability claims.

Engage Early

Involve legal counsel early in the claims process to navigate complexities and protect your interests.

Guidance Through Litigation

Your attorney’s insight can help you make informed decisions while working through potential litigation scenarios.

Preparing for Litigation: Key Considerations

Litigation can be a daunting process. Preparation is key.

Assemble Necessary Documentation

Gather all pertinent documentation related to the claim, including correspondence, contracts, and reports.

Understand Litigation Dynamics

Familiarize yourself with the litigation process, including timelines and expectations. Being informed can ease concerns as events unfold.

Mediation and Alternative Dispute Resolution: Options for Resolving Claims

Mediation and alternative dispute resolution offer valuable ways to address claims outside the courtroom.

Understanding Mediation Benefits

Mediation can lead to faster resolutions and reduced costs compared to litigation. Encourage open dialogue to explore potential solutions.

Consider Alternative Options

Evaluate alternative dispute resolution mechanisms to find the most suitable approach for your situation.

Expert Witnesses: Their Role in Liability Cases

Expert witnesses can provide crucial insights during liability claims.

Understanding Their Impact

Expert witnesses can strengthen your position by providing specialized knowledge and credibility during legal proceedings.

Selecting the Right Expert

Choose an expert with relevant experience and credibility in your industry to enhance your chances of a favorable outcome.

Managing the Emotional Impact of a Liability Claim

Liability claims can take a toll on you and your employees emotionally.

Acknowledging the Stress

Recognize that navigating a claim can be stressful and impact morale within your team. Offer support to employees as needed.

Supporting Emotional Well-being

Consider implementing stress management programs or resources to help your team cope during difficult times.

Case Studies: Analyzing Real-World Claim Scenarios

Case studies provide a comprehensive look into how claims unfold.

Learn from Various Cases

Reviewing diverse scenarios offers insights into common pitfalls and best practices for managing liability exposure.

Case Analysis

Analyze the outcomes to glean actionable lessons. Discovering what worked—or didn’t—can elevate your risk management strategies.

The Impact of Litigation on Reputation and Brand Image

Legal disputes can impact your reputation significantly.

Recognizing Reputational Risks

Being involved in a lawsuit can lead to negative perceptions among clients and stakeholders.

Proactive Communication

Maintain transparency with clients during disputes to minimize reputational impacts and foster continued trust.

Protecting Your Business During a Claim: Continuity Strategies

Developing continuity strategies ensures business stability during claims.

Establish Contingency Plans

Prepare for potential disruptions by crafting contingency plans that address business continuity during claims processes.

Maintain Operations

Ensure that your operations can continue while dealing with claims. Establish protocols to minimize downtime and maintain client relationships.

The Role of Public Relations in Managing Liability Crises

Public relations plays a pivotal role in managing liability crises.

Understand Messaging

Establish consistent messaging throughout any claims process to maintain public trust.

Engage Professionals

Consider working with a PR professional to manage communications strategically, particularly if reputational harm is at stake.

Lessons Learned from High-Profile Liability Lawsuits

High-profile lawsuits can be eye-opening for your risk management strategies.

Analyze Major Cases

Reviewing key lawsuits can highlight common pitfalls and establish actionable insights for your own practices.

Implement Changes

Use the lessons learned to make necessary adjustments in processes and coverage, improving your overall risk management posture.

Understanding the Financial Costs of Litigation

Understanding the financial dynamics of litigation can prepare you for potential costs.

Budgeting for Legal Expenses

Recognize that litigation can come with significant legal fees. Ensure you budget and allocate resources accordingly.

Assessing Potential Damages

Establish projections for potential damages associated with claims, enabling you to prepare financially in advance.

Strategies for Negotiating Favorable Settlements

Negotiating settlements requires tact and strategy.

Understand Your Position

Clearly assess your position before entering into negotiations, ensuring you’re informed about the best and worst-case scenarios.

Engage Professionals

When needed, involve legal counsel to navigate negotiations effectively and secure favorable terms.

The Importance of Post-Claim Analysis and Improvement

Conducting post-claim analysis can be instrumental in enhancing your risk management strategy.

Evaluate the Claims Process

Take time to review how the claims process was managed and identify areas for improvement.

Implement Changes

Utilize insights gained to refine your operations and policies. Continuous improvement based on real experiences is key to minimizing future exposure.

The History of Professional Liability Insurance

Understanding the history of professional liability insurance informs its modern application.

Key Developments Over Time

Awareness of key developments over the years allows you to grasp the importance of coverage in today’s context.

Evolution of Policies and Practices

Properly navigating how practices have changed enables better integration of insurance into your risk management strategies.

The Role of Insurance in Economic Growth and Stability

Insurance contributes significantly to economic stability and growth.

Understanding Its Broader Impacts

Recognize how professional liability insurance fosters businesses’ stability, promoting overall economic health.

Engage in Economic Discussions

Participation in discussions regarding the economic role of insurance can deepen your understanding and perspective.

Professional Liability Around the World: International Perspectives

Professional liability insurance varies greatly across countries.

Understanding Global Standards

Familiarize yourself with international standards to understand unique challenges and practices elsewhere.

Broader Implications for Business

Recognizing these differences can help inform your strategies when working internationally or in cross-border scenarios.

The Ethics of Professional Liability Insurance

Ethical considerations shape the professional liability landscape.

Navigating Ethical Dilemmas

Identify ethical dilemmas that arise in liability insurance, ensuring your practices align with principles of fairness and transparency.

Establishing a Code of Ethics

Developing a code of ethics for your organization promotes responsible management of liability exposure.

The Impact of Technology on the Insurance Industry

Technology plays a transformative role in reshaping the insurance industry.

Understanding New Technologies

Stay informed about how technologies are implementing efficiencies and streamlining processes within insurance markets.

Engaging with Innovations

Embrace innovations that can enhance your risk management strategies, foster improvements in claims processing, and strengthen client relationships.

Careers in Professional Liability Insurance

The field of professional liability insurance offers various career opportunities.

Exploring Pathways

From underwriting to claims management, explore the diverse career pathways available in the professional liability insurance landscape.

Essential Skills

Recognize the essential skills needed for success in the field, including analytical thinking and strong communication abilities.

The Future of the Insurance Industry: Predictions and Trends

Looking toward the future reveals evolving trends in the insurance industry.

Adapting to Change

Remaining agile amidst industry changes is crucial for sustained success. Be prepared for new regulations, technologies, and consumer behaviors.

Engaging with Experts

Continually engage with industry experts to stay informed about trends. Their insights can guide your risk management and liability coverage strategies.

Book Reviews: Must-Reads for Risk Management Professionals

A plethora of literature exists for risk management professionals to enhance their understanding.

Suggested Reads

Consider exploring the top-rated books that provide insights into professional liability insurance and risk management.

Building Knowledge

Investing time in reading helpful literature ultimately builds your expertise and sharpens your approach.

Infographics and Visual Guides to Professional Liability

Visual resources can simplify complex concepts related to professional liability.

Utilize Infographics

Leverage well-designed infographics that distill information into easy-to-digest formats.

Enhance Learning

Utilizing visual guides can enhance understanding and create a more engaging learning environment.

Webinars and Online Courses: Continuing Education Resources

Continued education is vital in the complex field of professional liability insurance.

Explore Learning Opportunities

Seek out webinars or online courses that foster professional development and deepen your understanding of liability issues.

Faculty Expertise

Learn from experts in the field, who can share insights and knowledge through tailored educational experiences.

Podcasts and Interviews with Industry Leaders

Listening to podcasts and interviews offers valuable perspectives on professional liability.

Engaging with Experts

Tune into discussions with industry leaders, soaking in their experiences and insights related to liability challenges.

Incorporating Lessons

Use the lessons learned to inform your practices and enhance your risk management strategies.

Conferences and Events: Networking Opportunities

Conferences and events provide opportunities to engage with like-minded professionals.

Attend Industry Gatherings

Participate actively in industry conferences to develop valuable connections while engaging in meaningful discussions around liability.

Sharing Insights

Networking with peers allows for the exchange of insights and experiences, enriching your understanding of professional liability concerns.

Glossaries and Resource Guides: Essential Tools for Professionals

Gleaning a comprehensive understanding of industry terminology is vital.

Explore Key Terms

Engage with glossaries that clarify vital terms related to professional liability.

Informational Resources

Utilize resource guides to further enhance your knowledge and keep abreast of evolving trends in liability insurance.

Frequently Asked Questions About Professional Liability Insurance

Addressing common questions can enhance understanding of professional liability insurance.

Common Inquiries

Compile a list of frequently asked questions and provide clear answers to demystify concerns surrounding liability coverage.

Enhancing Clarity

Providing clarity helps professionals grasp the essential facets of insurance, enabling informed decision-making.

Client Testimonials and Success Stories

Client experiences provide insights into the value of professional liability insurance.

Gathering Feedback

Collect testimonials that highlight the experiences your clients had while navigating liability issues.

Utilizing Success Stories

Leverage these stories to showcase the importance of professional liability insurance and its positive impact.

Humorous Takes on Liability Insurance: Cartoons and Jokes

A lighter approach can be beneficial for understanding liability insurance.

Engage with Humor

Introduce cartoons, jokes, or lighthearted content focused on liability insurance to make the topic more accessible.

Engaging Content

Adding humor can enhance engagement while fostering a deeper understanding of the importance of professional liability coverage.

Industry News and Updates: Stay Informed About the Latest Developments

Keeping up with industry news is vital for informed decision-making.

Regularly Check Updates

Stay updated with news related to professional liability insurance, enhancing your overall understanding of shifts and trends.

Engage with Publications

Consider subscribing to relevant journals or publications that provide timely information about liability matters.

Regulatory Changes and Their Impact on Liability Coverage

Understanding regulatory frameworks is crucial for navigating liability insurance.

Staying Informed

Be aware of regulatory changes that may impact your coverage options and liability strategies.

Preparing for Changes

Ensure you stay compliant by regularly evaluating and updating your insurance as regulations evolve.

Case Studies: Analyzing Landmark Court Decisions

Examine landmark court decisions to glean lessons about liability.

Learning from Significant Cases

Review how particular court rulings have shaped liability standards, understanding their implications for your coverage.

Practical Applications

Applying the insights from these cases can enhance your own practices and reinforce your overall risk management strategy.

The Role of Insurance in Social Responsibility and Sustainability

The insurance industry plays a pivotal role in promoting social responsibility and sustainability.

Understanding Broader Implications

Recognize how insurance aligns with social responsibility efforts, fostering ethical practices throughout the sector.

Collaborating with Nonprofits

Consider partnerships with nonprofits or social responsibility initiatives, reinforcing your dedication to affordably managing liability risks.

Thought Leadership: Essays and Opinion Pieces from Experts

Engaging with thought leadership pieces enriches your understanding of the liability landscape.

Insights from Industry Leaders

Seek out essays or opinion pieces that provide deep insights into current trends and challenges.

Applying Ideas

Incorporate the lessons and ideas gleaned from thought leaders into your own practices.

Debunking Myths and Misconceptions About Liability Insurance

Addressing myths can help clarify misunderstandings around liability insurance.

Common Misunderstandings

Identify prevalent myths associated with professional liability insurance, offering clear explanations to demystify them.

Enhance Understanding

Engaging in education around these misconceptions can enrich professionals’ understanding of liability insurance.

Interactive Quizzes and Assessments: Test Your Knowledge

Interactive quizzes and assessments make griping with liability insurance more engaging.

Test Your Understanding

Create quizzes that test your understanding of professional liability concepts, enhancing the learning experience.

Gather Feedback

Provide feedback following assessments, allowing participants to learn and reinforce key principles around professional liability.

Tips for Marketing and Promoting Your Professional Services

Effective marketing is key to standing out in a competitive landscape.

Engage with Your Audience

Utilize strategic marketing efforts to engage with your target audience, promoting your expertise and services.

Maintain Professionalism

Ensure that your marketing efforts maintain a level of professionalism that reflects your brand values and expertise.

Building a Strong Online Presence: Websites and Social Media

An engaging online presence can build credibility and foster positive connections.

Create Engaging Content

Develop content that showcases your expertise, appealing effectively to potential clients.

Engage on Multiple Platforms

Utilize various platforms, including social media and blogs, to engage with your audience in authentic, meaningful ways.

Professional Liability for Medical Device Manufacturers: Navigating Complex Risks

Medical device manufacturers face unique liability challenges.

Understanding Liability Exposure

From product defects to inadequate usage instructions, manufacturers must navigate various liability risks.

Ensuring Comprehensive Coverage

Craft tailored insurance policies that address the distinct needs of the medical device landscape, ensuring adequate coverage for potential liabilities.

Insurance Considerations for Architects Designing Sustainable Buildings

Sustainable architecture presents unique considerations for architects.

Identifying Emerging Challenges

Identify potential liabilities associated with sustainable building practices, including regulatory compliance and functional risks.

Tailored Insurance Solutions

Work with insurers to secure coverage tailored to sustainability-focused architectural projects.

E&O Coverage for Engineers Working on Infrastructure Projects

Engineers engaged in infrastructure projects encounter specific risks.

Understanding Liability Exposures

Project delays and design flaws can lead to significant claims. Understanding these exposures is essential for effective risk management.

Creating Tailored Policies

Create professional liability policies that adequately cover the nuances of infrastructure engineering, enabling adequate protection.

Protecting Your Law Firm from Cyberattacks and Data Breaches

Legal firms are increasingly targeted by cyberattacks.

Identifying Vulnerabilities

Evaluate your firm’s cybersecurity measures to identify potential vulnerabilities and weaknesses.

Comprehensive Cyber Liability Protection

Invest in comprehensive cyber liability insurance to safeguard your firm against various digital threats.

Malpractice Insurance for Nurse Practitioners and Physician Assistants

Healthcare practitioners face unique malpractice liabilities.

Understanding Common Exposures

Identify key liability risks among nurse practitioners and physician assistants to inform coverage needs.

Tailored Malpractice Insurance Solutions

Work with insurers to craft comprehensive malpractice insurance policies to cover unique exposures in these roles.

Liability Concerns for Financial Planners and Wealth Managers

Financial planners and wealth managers face distinct liability challenges.

Identifying Key Risks

Understanding liability exposure, including poor investment advice, is crucial for developing comprehensive coverage.

Customized Insurance Strategies

Engage with insurer professionals to secure customized coverage addressing the distinct challenges faced by financial advisors.

Insurance Solutions for Mental Health Professionals in Private Practice

Mental health professionals confront unique liability risks related to client treatment.

Understanding Emerging Issues

Unanticipated risks like misdiagnoses and failed treatment can pose significant challenges. Understanding these risks will inform insurance coverage.

Tailoring Professional Liability Coverage

Focus on creating customized professional liability policies that address specific challenges faced in mental health care.

Cybersecurity Insurance for IT Consultants and Managed Service Providers

IT consultants are increasingly exposed to cybersecurity risks.

Identifying Key Threats

Understanding the evolving landscape of cyber threats is crucial in navigating liability coverage.

Comprehensive Solutions

Invest in comprehensive cybersecurity insurance that protects against a multitude of potential exposures.

E&O Coverage for Insurance Brokers Specializing in High-Risk Industries

Insurance brokers face unique risks when serving high-risk industries.

Identifying Unique Exposures

Engage with professionals in high-risk industries to identify potential liability risks that may arise.

Tailored Insurance Policies

Secure tailored professional liability policies that address the distinct risks faced by brokers in urgent industries.

Understanding Professional Liability for Commercial Real Estate Brokers

Commercial real estate brokers encounter specific liability challenges.

Identifying Key Risks

From misrepresentations to leasing claims, brokers face unique vulnerabilities, necessitating robust liability coverage.

Customized Insurance Strategies

Engage with your insurer to secure customized insurance programs that cover the multifaceted nature of commercial real estate transactions.

Tailoring Insurance for Biotech Startups and Pharmaceutical Companies

Biotech companies face unique and evolving liabilities.

Recognizing Emerging Risks

Identify unique liability risks biotech startups may encounter, from product liability to regulatory compliance.

Customized Policies

Craft tailored insurance solutions that adequately cover emerging liabilities pertinent to the pharmaceutical and biotech sectors.

Addressing Liability Risks for Nonprofits Working in Disaster Relief

Organizations working in disaster relief face myriad liability risks.

Understanding Exposure

Comprehend unique exposures faced by nonprofits, including volunteer activity and crisis response.

Developing Comprehensive Coverage

Work with your insurer to create comprehensive liability coverage tailored for disaster relief operations.

Protecting Film Producers and Directors from Production-Related Claims

In the entertainment industry, producers and directors face distinct liability challenges.

Identifying Unique Risks

Examine risks associated with filming—such as production delays or injury claims—critical for selecting liability coverage.

Tailored Coverage Solutions

Collaborate with insurers to secure comprehensive liability insurance that adequately reflects the industry’s unique demands.

Insurance Needs for Event Planners and Hospitality Management Companies

Event planners face unique liability exposures related to client projects.

Identifying Key Risks

Analyze potential risks like event cancellations or liability claims due to accidents or injuries during events.

Tailored Insurance Coverage

Work with your insurers to ensure comprehensive coverage appropriate for both event planning and hospitality management services.

Liability Coverage for Online Educators and EdTech Platforms

Online education has emerged as a distinct field with its own liability exposures.

Understanding Unique Risks

Identify liability risks in online education, such as copyright issues or student data privacy.

Tailored E&O Policies

Evaluate options for tailored professional liability insurance that addresses the specific challenges faced by online educators.

Professional Liability for Drone Operators and Aerial Photography Businesses

Drone operators encounter unique liability exposures in their work.

Identifying Key Risks

Recognize the unique liability risks associated with aerial photography, focusing on operational compliance and privacy concerns.

Tailored Coverage Solutions

Work with your insurance provider to secure comprehensive coverage designed specifically for the challenges faced by drone operators.

Insurance Considerations for Companies Developing Artificial Intelligence

AI companies face distinct liability challenges in their rapidly evolving field.

Understanding Emerging Risks

Identify risks associated with software errors, ethical considerations, and compliance issues in AI development.

Comprehensive Coverage Options

Collaborate with experts to craft customized insurance solutions that address evolving AI industry exposures.

E&O Coverage for Virtual Reality and Augmented Reality Content Creators

As emerging fields, virtual and augmented reality present unique liability risks.

Assessing Liability Exposures

Consider the unique exposures arising in VR and AR, including user experiences and content-related issues.

Customizing Policies

Ensure your liability coverage options reflect the unique challenges faced by kinesthetically interactive content creation.

Addressing Liability Risks in the Sharing Economy and Gig Platforms

The sharing economy presents unique liability challenges.

Understanding Potential Exposures

Identify risks associated with gig work, from contract violations to harm to clients or service users.

Crafting Comprehensive Solutions

Engage with your insurance provider to craft tailored liability coverage for gig economy participants.

Insurance Solutions for 3D Printing and Additive Manufacturing Companies

3D printing companies face evolving and unique liability challenges.

Recognizing Key Risks

Evaluate potential risks, including intellectual property violations and product liability claims.

Tailored Insurance Coverage

Work with insurers to develop comprehensive coverage solutions that adequately address the nuances of 3D printing risks.

Protecting Cryptocurrency Exchanges and Blockchain Technology Providers

Cryptocurrency encounters unique liability exposures in the marketplace.

Assessing Unique Risks

Identify possible risks faced by cryptocurrency exchanges and blockchain providers, especially in regulatory compliance.

Engaging with Insurers

Consult with insurers to secure tailored liability coverage that reflects the demands of the rapidly changing digital currency landscape.

Professional Liability for Space Tourism and Commercial Spaceflight Ventures

The emerging realm of space tourism offers unique liability considerations.

Identifying Potential Exposures

Examine the liability risks associated with rocket launches, passenger safety, and regulatory compliance.

Tailored Insurance Solutions

Work closely with your insurance professionals to secure comprehensive liability coverage specific to commercial spaceflight sectors.

Insurance Needs for Companies Working with Gene Editing and Biotechnology

Gene editing and biotechnology present cutting-edge challenges.

Understanding Unique Liabilities

Identify liability risks in areas of regulatory compliance, experimental failures, or claims arising from unintended consequences.

Comprehensive Coverage Options

Engage with your insurers to develop tailored insurance solutions for businesses in the biotechnology frontier.

E&O Coverage for Environmental Consultants and Sustainability Professionals

Environmental consultants must navigate complex liability scenarios.

Identifying Key Risks

Analyze risks associated with environmental practices, including regulatory violations or improper recommendations.

Customizing Insurance Solutions

Work with insurance professionals to establish comprehensive liability coverage that addresses these unique environmental challenges.

Addressing Liability Risks in the Cannabis Industry

The cannabis industry presents unique liability challenges that require careful consideration.

Understanding Market Dynamics

Identify the evolving liability risks associated with cannabis businesses, including regulatory and operational aspects.

Tailored Risk Management Coverage

Work with specialty insurers to develop robust liability coverage specific to the intricacies of the cannabis marketplace.

Lessons from a High-Profile Medical Malpractice Lawsuit

High-profile malpractice cases provide valuable lessons in liability exposure.

Analyzing Event Outcomes

Study notable medical malpractice lawsuits to understand their outcomes and how they shape future practices.

Implementing Recommendations

Incorporate the lessons learned into robust risk management strategies, minimizing future exposure.

Analyzing a Construction Defect Claim and Its Impact on the Contractor

Construction defect claims are prevalent in the building industry.

Understanding Liability Risks

Identifying liability risks associated with construction defects is essential for contractors.

Ensuring Comprehensive Insurance Coverage

Engage with your insurers to obtain comprehensive coverage for construction-related project risks.

How a Cyberattack Crippled a Tech Company and Its Insurance Response

Cyberattacks can lead to devastating consequences.

Analyzing Response Strategies

Study the response strategies employed by tech companies following cyberattacks, highlighting the importance of robust protective measures.

Enhancing Risk Management Practices

Learn from these case studies to bolster your business against potential cyber threats.

A Financial Advisor’s E&O Claim and the Importance of Client Communication

Errors and omissions claims in financial services emphasize the need for strong communication practices.

Recognizing the Impact of Communication

Analyze how communication failures can lead to liability claims, underscoring the importance of transparency.

Crafting Best Practices

Develop best practices rooted in effective client interaction to minimize exposure to similar E&O claims.

Real-World Examples of Social Engineering Scams Targeting Businesses

Social engineering poses significant risks for various businesses.

Analyzing Potential Claims

Examine real-world examples of successful social engineering scams, highlighting vulnerabilities and risk factors.

Preventative Measures

Develop training to educate employees about recognizing potential social engineering tactics before they can lead to significant liability exposure.

Case Study: A Successful Claim Mitigation Strategy in the Healthcare Industry

Healthcare organizations constantly strive to mitigate malpractice claims.

Understanding Successful Strategies

Study specific case studies that showcase effective strategies for mitigating liability claims in healthcare.

Implementing Similar Practices

Learn from successful initiatives to enhance your risk management within the healthcare sector.

How a Small Business Overcame a Negligence Lawsuit and Thrived

Examples of business resilience demonstrate how to navigate liability challenges.

Analyzing Positive Outcomes

Receive insights from small businesses that faced negligence lawsuits, focusing on their journeys to recovery.

Enhancing Risk Management Strategies

Emulate the positive practices established in these case studies to strengthen your approach.

Analyzing the Financial Impact of a Data Breach on a Retail Company

Data breaches can have significant financial ramifications.

Understanding the Implications

Examine case studies detailing how data breaches impact retail operations and liability exposures.

Developing Response Mechanisms

Enhance awareness of data breach risks, establishing comprehensive plans for insightful responses should they occur.

Lessons Learned from a Professional Liability Claim in the Legal Profession

Legal professionals face unique risks during their practice.

Analyzing Outcome Processes

Glean insights from claims faced by legal professionals, refining your understanding of professional liability coverage.

Implementing Effective Initiatives

Utilize the lessons learned to guide more effective risk management strategies within your practice.

Case Study: The Importance of Risk Management in the Construction Industry

Examining risk within the construction industry can yield valuable insights.

Analyzing Successful Companies

Study how successful construction companies manage risks effectively to mitigate liability exposure.

Adopting Best Practices

Adopt recommendations from these case studies to bolster your risk management strategies.

The Role of Behavioral Economics in Understanding Liability Risks

Behavioral economics offers insights into decision-making processes that can affect liability.

Understanding Participant Behaviors

Examine how psychological factors impact professional decisions related to liability and risk.

Informing Strategies

Incorporate behavioral insights into your risk management frameworks to combat liability effectively.

The Intersection of Ethics and Professional Liability Insurance

Ethical considerations shape the landscape of professional liability.

Compliance and Ethics

Understanding ethical considerations related to liability coverage ensures adherence to industry regulations.

Engaging with Professional Standards

Collaborate with professional organizations that establish ethical standards for liability insurance.

The Impact of Globalization on Professional Liability Claims

Globalization brings new challenges and exposures to liability.

Understanding International Risks

Examine how international regulations and practices affect liability claims across countries.

Developing Comprehensive Coverage Strategies

Adapting your policies to meet global needs ensures robust protection for international operations.

The Future of Risk Management: Predictive Analytics and AI

The use of predictive analytics is reshaping risk management practices.

Embracing Technology

Utilize technological advancements to anticipate risks and streamline insurance processes.

Enhancing Decision-Making

Implement analytics in decision-making to bolster your risk management strategies effectively.

The Role of Insurance in Promoting Social Justice and Equity

Insurance plays a vital role in promoting social justice.

Assessing Impacts

Explore how professional liability insurance fosters equitable practices in various industries.

Engaging with Equity Initiatives

Consider supporting initiatives centered around social equity and justice while advancing your insurance practices.

Exploring the Psychological Impact of Liability Claims on Professionals

Liability claims take a toll on professionals mentally and emotionally.

Understanding Impact Factors

Recognizing the psychological burden of liability claims helps foster a supportive environment.

Implementing Support Structures

Encourage well-being initiatives within organizations to support professionals navigating liability claims.

The Importance of Transparency and Communication in the Insurance Industry

Maintaining clear communication is key to securing trust and fostering relationships.

Cultivating Transparency

Engage with your clients openly about coverage options, claims processes, and risks to strengthen relationships.

Establishing Open Channels

Foster an environment that encourages dialogue and inquiry, linking clients with thorough support and clarity.

The Role of Professional Associations in Shaping Liability Standards

Professional associations impact liability standards profoundly.

Engaging with Associations

Active participation can shape industry standards while establishing valuable connections.

Advocating for Change

Collaborate with associations to promote necessary changes in the liability landscape, enhancing industry performance.

The Evolution of Risk: Historical Perspectives on Professional Liability

Understanding historical perspectives on professional liability highlights its evolution.

Analyzing Trends Over Time

Review how liability coverage evolved in various professions through changes in regulation, technology, and societal attitudes.

Impacts on Current Practices

Utilize historical insights to inform current risk management practices effectively.

The Impact of Emerging Technologies on the Future of Insurance

Emerging technologies are driving change in the insurance landscape.

Embracing Innovation

Utilizing new technologies can streamline processes, improve customer experiences, and inform decision-making.

Adapting to Trends

Regularly monitor industry advancements and innovations to ensure your insurance practices remain robust and on the cutting edge.

Create a series of “Day in the Life” articles showcasing different professions and their liability risks

Creating narratives showcasing daily experiences can illuminate overarching liability themes.

Engaging Your Audience

Share stories that resonate with professionals, detailing day-to-day challenges and potential liability exposures.

Building Connection