Types of Policy Limits

-

Per Claim Limit: This is the maximum amount your insurance provider will pay for a single claim. For example, if your per claim limit is $1 million, this is the highest they will pay for any one claim against you.

-

Aggregate Limit: This refers to the total amount your insurer will pay for all claims during the policy period. If your aggregate limit is set at $3 million, that means it will cover all claims made within that timeframe, but not more than the specified limit.

Why Policy Limits Matter

Understanding your policy limits is essential for ensuring adequate coverage. If the claims against you exceed your policy limits, you’ll be responsible for paying the difference, which could significantly impact your finances. It’s crucial that you assess your exposure to claims in your field and choose limits that reflect this risk.

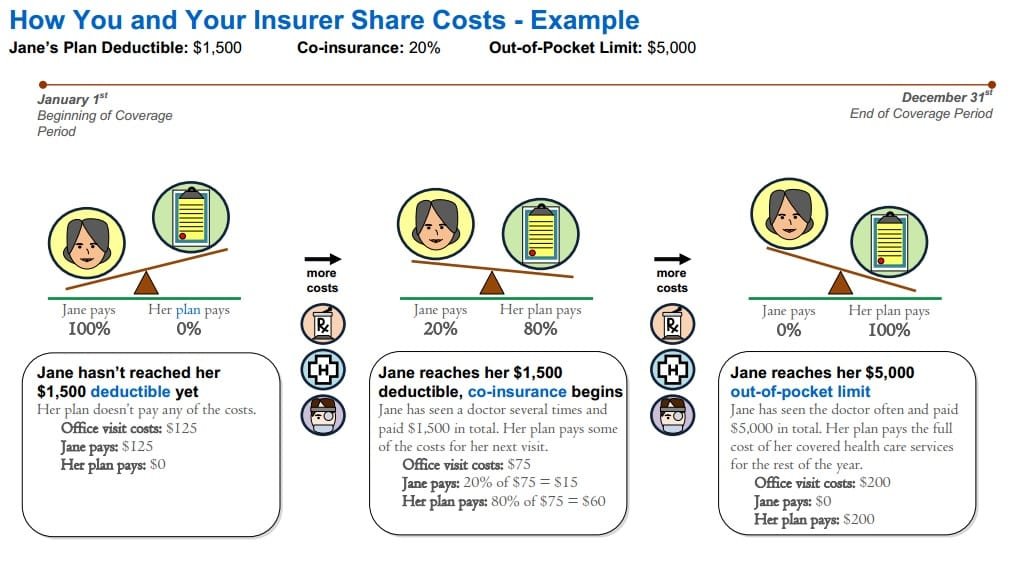

How Deductibles Work

Choosing the Right Deductible

The Importance of Adequate Coverage Limits

You might be wondering why it’s critical to have an adequate understanding of your coverage limits. Let’s explore this further.

Industry-Specific Risks

Different industries have different risk exposures. For instance, healthcare professionals may face larger settlements compared to, say, freelance graphic designers. Considering the potential risks that you could face in your profession is necessary when determining your coverage limits.

Legal Defense Costs

The legal defense can be costly, even if you ultimately win a case. If your policy limits are too low, you could end up paying considerable legal fees out of your own pocket. Choosing appropriate limits will help safeguard you from this financial burden.

Assess Your Risks

Evaluate the specific risks associated with your profession. Understanding the nature of your work and the potential for claims will guide you in selecting the correct limits.

Compare Policy Features

Consult an Insurance Professional

Don’t hesitate to seek advice from an insurance agent who specializes in professional liability coverage. They can help clarify your options and tailor a policy that suits your unique requirements.

The Impact of Prior Claims on Future Insurability

It’s important to recognize how previous claims can influence your ability to obtain insurance in the future.

Insurance Companies and Claims History

Insurance companies often evaluate your claims history when deciding to offer coverage and determining premiums. A history of frequent claims can make obtaining new coverage challenging or result in much higher premiums.

Mitigating Future Risks

Taking proactive steps to manage your risks can positively impact your insurability. Implement robust risk management practices and maintain a clean professional record. This approach not only enhances your reputation but also leads to better insurance options down the road.

Tips for Negotiating Better Terms with Your Insurer

Understand Your Needs

Before engaging with your insurer, have a clear understanding of your needs and what you hope to achieve through negotiations. This preparation will allow you to advocate more effectively for necessary terms.

Highlight Your Risk Management Practices

If you’ve implemented strong risk management practices, be ready to share this information with your insurer. Demonstrating how you’ve mitigated risks can potentially lead to lower premiums and better coverage terms.

Be Open to Multiple Quotes

Don’t settle for the first offer you receive. Reach out to several insurers and compare their quotes. This process gives you leverage during negotiations, as you can highlight competing offers to negotiate better terms.

The Importance of Educating Employees About Liability Risks

As a professional, educating your employees about liability risks can also be greatly beneficial.

Instilling a Culture of Awareness

Encouraging a culture of risk awareness among employees is vital. Ensure everyone understands the common risks associated with your profession and how to mitigate them. Regular training sessions can help reinforce this awareness.

Communication is Key

Make communication a priority when discussing risks. Encourage employees to report concerns or potential issues, creating an environment where everyone feels responsible for minimizing liability exposures.

Navigating Unique Insurance Considerations

Healthcare Providers

For healthcare professionals, malpractice lawsuits can be significantly high. Thus, understanding the boundaries of your policy limits is paramount. Choose policy limits that reflect the substantial potential settlement amounts in the healthcare industry.

Legal Professionals

Insights on Emerging Risks and Coverage Needs

The landscape of professional liability is constantly evolving, particularly with the introduction of emerging risks.

Cybersecurity Threats

Today, cybersecurity threats play a major role in professional liability considerations. If you aren’t adequately protected against cyber risks, you’re leaving yourself vulnerable. It’s prudent to consider insurance options that include cyber liability coverage, especially if you handle sensitive information.

Climate Change Impact

Beyond technology, climate change is reshaping liability risk assessments. Your business might face new exposures that can result from inadequate preparedness for natural disasters or extreme weather events. Consider these factors when assessing your coverage needs.